| « Back to article | Print this article |

The amazing story of Godrej's growth

More than a century ago, Ardeshir Godrej gave up law and decided to make surgical equipment. He took a loan from a friend of his father, and with that money he made scalpels, forceps, scissors and pincers.

He then showed these to the owner of the company he was working with. The owner was impressed with what he saw but when Godrej requested the product be tagged 'Made in India', the deal fell through.

Today, the Rs 10,000-crore (Rs 100 billion) group named after him wants to straddle the emerging markets in Asia, Europe, Africa and South America with its hair colours, household insecticides, soaps and so on.

A quarter of its business comes from abroad, and it wants to scale up the contribution in the days to come. It has become the second-largest player in insecticides in Asia (Japan excluded).

Much of this growth has come through acquisitions. So far, Godrej Consumer Products has spent almost Rs 2,000 crore (Rs 20 billion) to buy companies, brands and distribution networks abroad. The company's board last year authorised it to raise Rs 3,000 crore (Rs 30 billion) for expansion.

So, the war chest still has considerable ammunition left, though some of this money, around Rs 800 crore (Rs 8 billion), may go in the purchase of Sara Lee's 51 per cent stake in Godrej Sara Lee.

Click NEXT to read on. . .

The amazing story of Godrej's growth

"Over the last few years, we have followed a very disciplined and focused approach to identifying acquisitions that represent a strong fit with our business, both strategically and operationally," Godrej Consumer Products chairman Adi Godrej recently said in a statement.

The acquisitions, fast and furious that they have been, appear fragmented across geographies and product lines. For the company, there is method in the madness.

"It's our '3 by 3' matrix strategy," says Godrej Consumer Products managing director Dalip Sehgal. The company will operate in three continents (Asia, Africa and South America) in three categories: Hair care, home care (including insecticides) and personal wash.

The three continents have now begun to grow fast, which has opened a huge market for consumer products. These are also markets where multinationals like Unilever, Procter & Gamble and L'Oreal don't have an overbearing presence; this leaves ample scope for smaller companies and regional brands to grow.

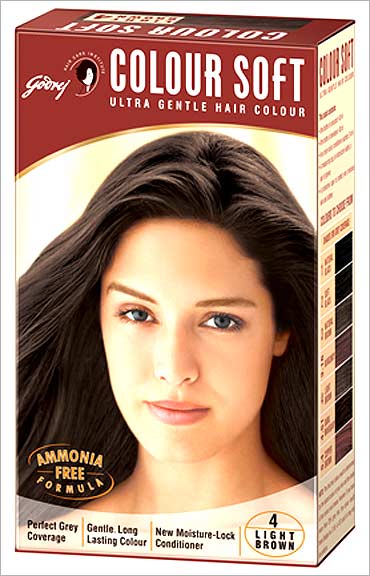

And the three product categories are those in which the Godrej group has done well in its domestic market. Godrej Consumer Products is the leader in hair colours and dyes with brands like Godrej Expert, Renew and Colour Soft.

Its Godrej No. 1 is the third-largest brand in the soap market after Hindustan Unilever's Lifebuoy and Lux. And Godrej Sara Lee leads the pack in household insecticides with brands like Goodknight, Hit and Jet.

Click NEXT to read on. . .

The amazing story of Godrej's growth

"These emerging markets are not very different from Indian consumers, and hence we will build on what we already know," says Sehgal.

Investment analysts say that Indian companies like Godrej Consumer Products have realised the worth of emerging market and are thus in a hurry to expand there.

"The company's strategy is similar to other Indian FMCG companies like Marico, which are trying to garner 24 to 30 per cent of their business from their international business," says Anand Shah of Angel Broking.

Apart from Marico, Dabur and Wirpo too have begun to push hard in East Asia and West Asia, respectively. So, Godrej Consumer Products may not be the only one to think of emerging markets; but it is certainly the most aggressive of the lot.

A close scrutiny of the acquisitions shows that Godrej Consumer Products has brought products, brands as well as distribution networks. This gives it the opportunity to move products across geographies. Trade channels can be used to sell multiple products.

Its regional brands can thus become multinational in nature. "It's all about cross-synergies," says Sehgal.

Click NEXT to read on. . .

The amazing story of Godrej's growth

African safari

The focus on emerging markets is new. The first overseas acquisition that Godrej Consumer Products had done way back in 2005 was Keyline Brands in the United Kingdom.

This company owned brands that once belonged to large companies like Unilever and Henkel but had become too small for their attention -- Erasmic, Aapri, Nulon and Cuticura.

These brands were retailed through large chains like Sainsbury's, Tesco and Boots, and Godrej Consumer Products thought it could use the acquisition to place its own brands in the network. But growth in this business has been lacklustre, around 7 per cent per annum.

Some of these brands have been taken to West Asia (the rights for the best-known of these, Cuticura, are held by Chennai-based Cholayil Pharma) and Sehgal says the sales force will be strengthened to sell more through groceries.

Godrej Consumer Products has done a course-correction since then. Its energies are now focused on the emerging markets. Africa is the most densely populated continent in the world and houses 13 per cent of the population.

Further, its economy is anticipated to grow at 4.3 per cent this year. Godrej Consumer Products started out with South Africa where it has acquired two hair care companies -- Rapidol and Kinky. Rapidol is into hair colours, Kinky into extensions, braids and so on. Rapidol has grown 49 per cent in the last one year and Kinky has grown 39 per cent.

Click NEXT to read on. . .

The amazing story of Godrej's growth

The South African market for hair care is huge. Godrej Africa Director & Chief Executive Officer Keith Harrison puts it at $2 billion.

Analysts say Godrej Consumer Products has bought smart. Rapidol's competition is restricted to L'Oreal's Dark n lovely, and its Inecto sells at a discount in the price-sensitive market. Rapidol therefore lords it over 90 per cent of the market. And Kinky, it is estimated, sits on approximately 12 per cent market share, although this category is not read by Nielsen or any other market tracker.

At present, it has 24 stores across three provinces in South Africa and is in the process of expanding to rest of the country.

Rapidol and Kinky export to 15 African countries. But Godrej Consumer Products has bigger plans. It is on a mission to set up four hubs across the entire continent that will cover South Africa, West Africa, East Africa and Central Africa. This is a part of the company's 'One Africa' strategy, which looks at opportunities across the continent.

Apart from hair care, Godrej Consumer Products also has an eye on the personal wash market in Africa. "Personal wash is a huge opportunity in the continent," Godrej executive vice president (international operations) Jimmy Anklesaria says. "Recent reports suggest that the African continent is vulnerable to the swine flu epidemic; so personal wash becomes critical for us."

This is where its acquisition of Tura from Lornamead fits in with its soaps, moisturising lotions and skin creams, all sold under the Tura brand. It gives Godrej Consumer Products inroads into West Africa, particularly Nigeria which has a population of 140 million and economic growth of about 6 per cent per annum.

Click NEXT to read on. . .

The amazing story of Godrej's growth

Tura reaches about 70 per cent of total outlets in Nigeria. Once the deal is through, Godrej Consumer Products will be able to mount its hair care products on this network.

In addition, this gives Godrej Consumer Products an opportunity to sell its Indian brands like Renew, Godrej No. 1 and Cinthol in the oil-rich country. In fact, Godrej No. 1 has already begun to sell in certain pockets of Africa. Cuticura too is being tested in the region. Over time, Godrej plans to take its household insecticides also to Africa.

Asian ride

While Africa is a virgin market, Asia has strong regional brands. Sector experts predict a scramble for these brands and markets in the near future. Several of these brands have already changed hands.

Godrej Consumer Products joined the bandwagon recently when it bought Indonesian maker of household insecticides Megasari Makmur along with its distribution company.

Megasari Makmur is a young company -- it was formed in 1996. But its acquisition gives Godrej Consumer Products a strong foothold in Indonesia which is one of the largest markets in the region. At $345 million, it is the fourth-largest market for household insecticides in the world after China, Brazil and India.

Megasari Makmur has 35 per cent of this market. As much as 72 per cent of Megasari Makmur's business comes from insecticides with brands like Hit, Stella and Mitu, though it is also Indonesia's biggest maker of air-care products and wipes. The acquisition comes with six factories, 11 branches and 74 regional distributors.

Click NEXT to read on. . .

The amazing story of Godrej's growth

The deal is expected to be closed in a couple of months. It will catapult Godrej as the second-largest household insecticide company in Asia (ex-Japan).

Godrej Sara Lee has been active in Asia for a while. Its products are sold in 51 countries, most of it in the Indian sub-continent. It has full-fledged operations in Sri Lanka and Bangladesh and now wants to set up a plant in Nepal.

In India, of course, it straddles the whole spectrum of household insecticides with mats, coils, lotions and aerosols. Goodknight, a mosquito repellant in all the four forms, is a category leader. Jet is smaller but has a market share of around 80 per cent in anti-mosquito coils in the state of Andhra Pradesh. Hit, which is for use against flying and crawling insects like cockroaches, has built the category from scratch in the last 15 or so years.

Sara Lee, it is an open secret, has decided to exit its consumer products business of around $2 billion per annum to focus on foods. Godrej has the right to buy it out of the joint venture, Godrej Sara Lee (it did a profit after tax of Rs 104 crore (Rs 1.04 billion) on a turnover of Rs 755 crore (Rs 7.55 billion) in 2008-09), in such a case and the right to sell brands like Ambipur, Kiwi and Brylcreem in the country. It is certain that it will exercise this right.

There have also been reports that Godrej could be in the race to acquire Sara Lee's consumer products business.

This still leaves the third pillar of the strategy, South America, unclear. Some announcements in this regard could come in the future. Still, it has been a long journey for Godrej since the days of its founder.