| « Back to article | Print this article |

The 9 safest investments for you

Government-backed options give the highest security. A new gameplan with old warhorses.

It might seem ridiculous to talk about safe investments and sound returns at a time when the equity markets are down 34 per cent since last year and a tumbling real estate market is giving most of us sleepless nights.

One thing that the glum developments of the last 18 months have taught us is that when things go wrong, it's time to go back to the basics. When everything around us is crashing, the only comfort is in the simple and staid; like listening to an old song, or eating your mother's cooking.

For our money lives, this new reality of volatile markets indicates the need to go back to old options and invest in products that our parents relied on, the ones we turned our noses up at as too cumbersome, or even too boring.

These options, debt products with fixed returns mostly sold through post offices, are the safest possible as the government guarantees them.

Although, theoretically, it is possible that the government defaults, in reality, it has never happened in India and is unlikely to happen in the future.

Also, thanks to the lack of interest rate reforms, the returns on these products are higher than market determined rates. They also give tax benefits.

Text: Sunil Dhawan, Outlook Money

The 9 safest investments for you

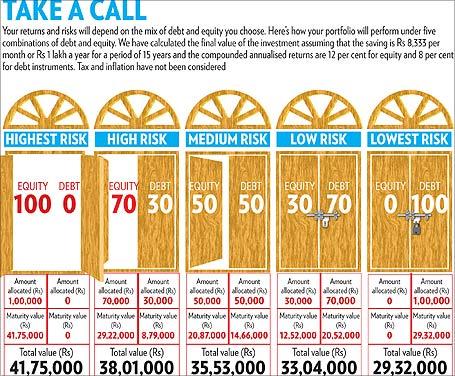

However, we are not suggesting that you move all your money into these products. If you are to meet your financial goals, you will need to have a decent mix of high-risk, high-growth options and assured return instruments.

If you want to set aside Rs 5 lakh (Rs 500,000) at today's cost for your child's higher education 15 years later, you will need Rs 10 lakh (Rs 1 million) then after accounting for an inflation of 5 per cent per annum.

If you invest only in debt products, you will have to save Rs 36,000 a year at 8 per cent interest per annum to build up that corpus in 15 years.

Using equities over the same period and assuming 12 per cent annualised returns, the savings required would be a more modest Rs 24,000 a year. So, what role can these embodiments of certainty and security play in your portfolio in a loss-ravaged year?

While investing in these products will not be your short cut to wealth, it will certainly ensure that your downside is protected and your accounts are still in the green even as the world around you turns red.

The 9 safest investments for you

The right one for you

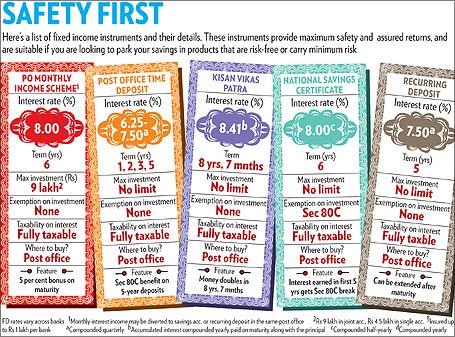

Assured return instruments have non-flexible features such as tenure, interest payment amounts and dates, taxability and liquidity. The basket of products with fixed and assured returns largely has nine instruments.

Except bank fixed deposits (FDs), all these products are fully government-backed. We have classified them as tax-savers, regular income providers and others.

Bank Deposits

The eight post office products described in the article carry a sovereign guarantee. Bank fixed deposits (FDs), too, offer fixed and assured returns, but they are not backed by any government guarantee beyond Rs 1 lakh (Rs 100,000) (principal and interest together) per bank per person.

This leaves any amount over this susceptible to risk in case of a bank default. It is better to spread your fixed deposits over banks rather than invest a big sum in a single bank. FDs' tenure varies from one month to 10 years.

The interest income can be had monthly, quarterly, half-yearly or even yearly and is fully taxable. Among the banks offering high interest rates currently, over a 1-year period, Development Credit Bank's rate is 9.25 per cent per annum and Tamil Nadu Mercantile Bank is paying 9.25 per cent for a 5-year tenure. Many banks offer senior citizens 0.5 percentage points more.

Investment in 5-year notified tax-saving bank FDs helps secure a regular income and save tax under Section 80C. The interest (fully taxable) on such deposits may be a shade lower than on non-tax deposits of the same duration.

ICICI Bank and State Bank of India currently offer 8.25 per cent per annum. For senior citizens with annual incomes less than Rs 2.25 lakh (Rs 225,000), this is a decent option.

The 9 safest investments for you

THE TAX-SAVERS

Public Provident Fund

Not only does PPF give tax exemption on deposits, but also gives you tax-free returns. Says Manish Jain, founder, Knowledgepartners.in, a financial planning portal: "For younger investors, especially those in the highest tax bracket, PPF is the best option. Being a 15-year product, it helps in achieving long-term goals."

New investors: You can open a PPF account either in your or your child's name. Combined contributions may vary between Rs 500 and Rs 70,000 each year. A separate minor account helps save funds earmarked for your child's needs.

Existing investors: Use the partial withdrawal facility (available after five years) only if needed. You can choose to close the account on maturity or continue in blocks of five years indefinitely, with or without making fresh deposits.

Taxpayers: Tax exemption is available on contribution and returns. A PPF's effective return currently works out to above 11.57 per cent for someone paying 30.9 per cent tax. Depending on your risk profile, PPF can be used judiciously with equity-linked savings schemes (ELSS) to bolster returns over the long term.

Retired: If you are retired and pay no or very low taxes, you could close your PPF account and move to products with higher yields, such as a bank FD, if available. Retired taxpayers may continue with or without fresh deposits.

National Savings Certificates (NSCs)

If you want to save tax and are not looking at a regular income, NSC can be a good option. It is suitable for investors of any age as long as they don't mind the long tenure. Taxpayers below 60 years of age can buy an NSC every month and build up a self-made pension plan.

The 9 safest investments for you

THE REGULAR INCOME PROVIDERS

Senior Citizens Savings Scheme (SCSS)

This can be availed from a post office or a bank by anyone over the age of 60 years. Early retirees can invest in SCSS, provided they do so within three months of receiving retirement funds. It offers the highest post-tax returns among taxable products. The upper investment limit is Rs 15 lakh (Rs 1.5 million) and the interest is payable quarterly.

Post Office Monthly Income Scheme (POMIS)

If you want a regular monthly flow of income, POMIS is ideal. You should go for it, especially if the amount is more than Rs 1 lakh as bank deposits per bank are insured only up to Rs 1 lakh.

In POMIS, one may deposit a maximum of Rs 9 lakh (Rs 900,000) under a joint account. If you exit before the term ends, you will have to forego 5 per cent bonus.

8 per cent Taxable Savings Bonds

The alternative to POMIS is the 8 per cent Taxable Savings Bonds issued by the Government of India. These pay half-yearly interest and also have a cumulative option. They have no upper limit of investment.

Retired: If you are retired and are looking for an enhanced regular income, start with SCSS. Then move on to POMIS. Over and above this, invest the remaining retirement corpus in 8 per cent Taxable Savings Bonds.

The 9 safest investments for you

OTHERS

Kisan Vikas Patra (KVP)

If you are not looking at a regular income, you could consider the post office KVP, which yields an annualised return of 8.41 per cent, the highest in this group.

But, if you are in the 30.9 per cent tax bracket, your post-tax annualised return will be 5.81 per cent as interest is fully taxable. KVPs are ideally suited to supplement funds to meet long-term expenses such as children's higher education.

Time deposit

Time deposits may be opened in a post office for 1-, 2-, 3- or 5-year periods. The interest is payable yearly and is fully taxable. You can claim a tax benefit under Section 80C on the amount invested in a 5-year deposit only. This is not a very attractive option since bank notified FDs that come with Section 80C breaks give higher rates.

Recurring deposits (RDs)

RDs in post offices provide an interest rate of 7.5 per cent per annum. These come for a period of five years, which can be extended. Investing Rs 1,000 a month into this scheme would yield Rs 72,890 on maturity. Avoid them as banks provide a better deal.

The 9 safest investments for you

The Roadblocks

The products mentioned above are simple and secure. But there's a hitch. In order to deposit funds, redeem investments, withdraw interest, or even to update your passbook, you need to visit a post office.

The notable exceptions are: PPF accounts in State Bank of India and bank RDs, both of which can be operated online, and interest payments from the 8 per cent Taxable Savings Bonds that can be routed electronically through banks. For people who are used to the air-conditioned confines of an advisor's office, or the three clicks and invest mode of electronic transacting, this can be an unpleasant and frustrating experience.

Also, since you will be tied to one particular post office, staying on top of these investments while changing residences or cities can turn out to be a nightmare.

Invest in these only if you either have a trusted and active agent or a friend who will do the running around for you, or if you have the time and patience to do it yourself.

Debt in your portfolio

These income-generating products are ideal for people who are close to achieving their goals. "For them, it makes sense to switch to such products (from equity) to preserve capital and reduce their risk weightage," says Jain.

The biggest drawback of these products with fixed returns is that they are not the best hedge against inflation. Says Kartik Varma, co-founder, iTrust Financial Advisors, a Delhi-based financial advisory company, "Debt products may be good at times of low inflation and for those who, as far as risk-taking is concerned, do not have age on their side."

But interest rates and inflation cannot be predicted easily. We suggest a balanced approach while investing across debt and equity assets. You need to devise your portfolio based on your age, income and financial liabilities, and consider both short- and long-term needs.

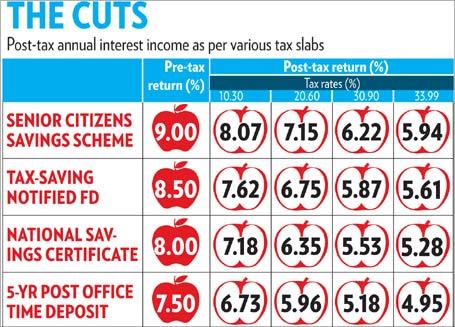

Real returns matter

For most investors, the return from these products is only nominal. The interest income is added to your income and taxed as per your slab. So, if you are paying tax at 30.9 per cent, an 8 per cent bank FD would give you a post-tax return of 5.28 per cent.

Building up a debt portfolio with fixed and assured return plans should be a carefully crafted process. A proper mix of products with varying maturities will help in maintaining liquidity and give higher returns. As with all things in life, even in your portfolio, balance is the keyword.

The 9 safest investments for you

The Stabilising Influences

Strategies for effectively using highly secure investments:

Public Provident Fund (PPF): If you don't have one, start a PPF account for yourself, your spouse and kids. Use it as a tax-saving investment, while maintaining your portfolio's debt-equity balance. If you are close to retirement, maximise your contribution. If you are retired, use tax-free money by way of partial withdrawals.

National Savings Certificate: Use it only for saving tax if there is room after EPF and PPF. If you are nearing retirement or retired, create a periodic income flow in the future.

Kisan Vikas Patra: Good for parking portions of lumpsums or windfalls such as bonuses, increments and refunds that might be earmarked for a goal, say, a gift on your kid's 18th birthday.

Senior Citizens Savings Scheme (SCSS): Best for a regular retirement income, thanks to the highest rate of 9 per cent per annum.

Post Office Monthly Income Scheme (POMIS): SCSS investment can't exceed Rs 15 lakh (Rs 1.5 million). Invest any amount in excess in POMIS, the next best option after SCSS for secure retirement income.

8 per cent Taxable Savings Bond: If more regular income is needed after an SCSS and POMIS combination, opt for half-yearly option of this scheme with no upper investment limit.

5-year Time Deposit (with Section 80C): Avoid this post office offering since banks offer higher interest rates.

Other Time Deposits: Avoid post office time deposits. You will get a better interest rate from banks.

Recurring Deposits (RDs): Avoid post office RDs as bank RDs offer better interest rates.

The 9 safest investments for you

3 Get-More Tricks

Besides secure returns, the safest investment options can be cleverly tailored to suit various requirements. Here are strategies that have been used for ages and can work wonders in these harsh times.

Reinvest Monthly Income Scheme (MIS) Interest

Take a 6-year, 8 per cent per annum Mis. reinvest the monthly interest in a savings account (3.5 per cent interest per annum), which will give you an annualised return of 7.53 per cent after six years. reinvesting in a recurring deposit (7.5 per cent per annum) will give you an annualised return of 7.76 per cent.

Ladder National Savings Certificates (NSCS)

NSC is a 6-year instrument. assume that you buy nscs worth 24,000 in one financial year. instead, buy worth 2,000 every month till your retirement. renew every investment after six years and continue doing so until your retirement. finally, the matured will give regular income, which can be used as pension.

Use your Public Provident Fund (PPF)

PPf is a 15-year account in which you can put up to 70,000 every year. After the fifth year, make partial withdrawals for tax-free funds and contribute 70,000 as before from current income to get tax benefits.

The 9 safest investments for you

Some myths and realities

Myth: Returns from Public Provident Fund (PPF) are fixed.

Reality: Every year in April, the government fixes the returns from post office products, including PPF. Any change in the interest rate will be applicable on PPF balances made after the announcement.

-----

Myth: Bank fixed deposits are absolutely safe.

Reality: The Deposit Insurance and Credit Guarantee Corporation insures bank deposits up to Rs 1 lakh (Rs 00,000) per bank per person. This includes the principal and the interest in all branches.

-----

Myth: Life insurance endowment plans give assured returns.

Reality: Returns in the form of bonus are not assured and depend on the insurer's profitability. However, once attached to a policy, they become assured.

-----

Myth: Post office investments are absolutely safe.

Reality: Post office instruments are backed by the government. This makes them highly secure, but not infallible. Although it has never happened in India, governments of other countries have defaulted in the past.

-----

Myth: Assured return instruments give double tax benefit.

Reality: Apart from PPF, in which the contribution, returns and the final amount are all tax-free, all other post office products are variously taxed.