| « Back to article | Print this article |

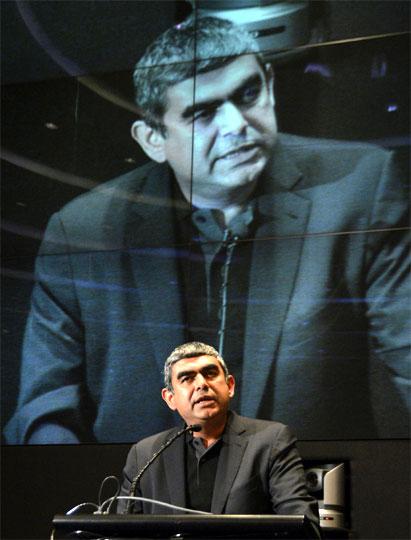

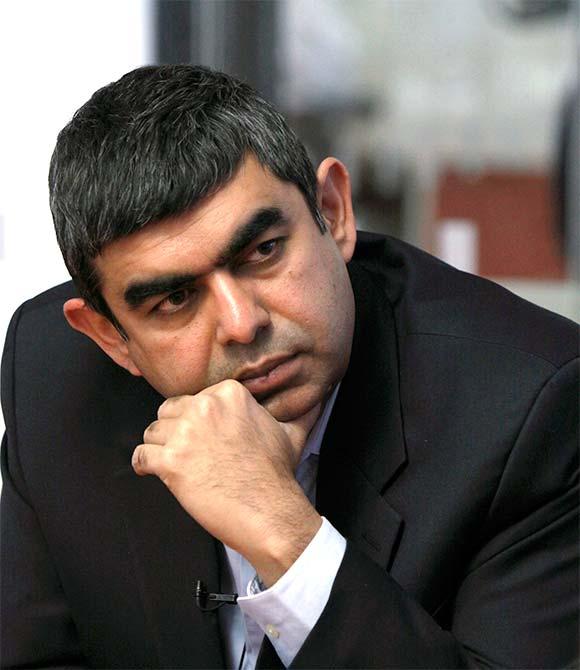

Sikka effect: Infosys gains weight at the bourses

Last week’s announcement of Vishal Sikka as the chief executive officer helped the stock reverse a four-month weightloss streak.

And, put it back among the top five heavyweights in the BSE exchange’s bellwether Sensex (behind ITC, Reliance Industries, ICICI Bank and HDFC Bank); these five account for 40 per cent of the index.

The fall in Infy’s Sensex weightage was sharp in the past few months and had hastened after the general election results and the exit of president and board member B G Srinivas.

Click NEXT to read further. . .

Sikka effect: Infosys gains weight at the bourses

In the fortnight before Sikka’s appointment, three stocks -- HDFC Bank, Larsen and Toubro and HDFC -- had overtaken the Bengaluru tiger on the index.

In the past week, Infy has pushed L&T and HDFC behind; it still trails HDFC Bank, with a weightage of 6.76 per cent.

An Infosys spokesperson said the company did not comment on stock movements.

Infosys’ weightage in the index had fallen to a low of 6.2 per cent from February highs of 9.68 per cent, on the uncertainties surrounding its leadership and resurgence of the broader market, led by Reliance Industries’ rally.

Falling weightage means the stock is sitting out of a broader rally or significantly underperforming it.

Click NEXT to read further. . .

Sikka effect: Infosys gains weight at the bourses

If the lower weightage sustains long enough, it could trigger a vicious circle where the funds which align their portfolio to the index prune their holdings accordingly, putting further pressure on the stock, leading to underperformance.

Thus, in a way, the index weight of a stock is similar to market share of a company, which gives it a pricing power.

Lower the share, lesser the power.

In December 2011, Infosys overtook RIL to become the most weighted stock in the BSE Sensex, with a weightage of 10.25 per cent.

The market darling looked poised to ride on the strengthening dollar and improved outlook for the US economy.

It was trading around Rs 2,700, much below the current levels.

Click NEXT to read further. . .

Sikka effect: Infosys gains weight at the bourses

A year of setbacks

The first big attack on Infosys came within months.

In April 2012, soon after its second quarter results, CLSA analyst Nimish Joshi wrote an unusal open letter to then Infosys chief S D Shibulal.

The letter was triggered by poorer than expected results and subdued dollar guidance.

It raised concerns about Infy’s declining market share, affecting its pricing power and its cash chest.

Several analysts then downgraded the stock.

Unprecedently, even governance issues were raised in what was generally seen as one of the better governed companies in the country.

Proxy advisory firms raised concerns about audit partners not being rotated for several years and pay of independent directors.

Click NEXT to read further. . .

Sikka effect: Infosys gains weight at the bourses

Former Infosys employee, Shriram Subramanian of Ingovern Research, now a proxy advisor, was particularly vocal.

In October 2012, CLSA again bashed the company, saying the stock could lose 40 per cent over the next 12 months.

It was trading at Rs 2,578 when the report came out.

Reprieve

However, the return of founder N R Narayana Murthy, coinciding with a rupee sliding past 65 to a dollar, made analysts eat their words.

By the end of 2013, Infosys was up there at Number 2 on the Sensex, just below ITC. CLSA and others revised their targets.

By the latest data, ITC has the highest weightage in the index at 11.54 per cent, with a market capitalisation of Rs 2.86 lakh crore (Rs 2.86 trillion).

Click NEXT to read further. . .

Sikka effect: Infosys gains weight at the bourses

Riding on recent gains, RIL has the second highest weightage at 8.32 per cent.

In January this year, RIL had a weightage of 8.27 per cent, behind Infy’s 8.76 per cent.

Infy gained weight after the first-quarter results and touched a high of 9.68 per cent on February 25.

However, it has since seen a remarkable fall, before the Sikka boost (see chart).

The weightage in the index is calculated by a measure called free float market capitalisation.

This is the proportion of a company’s market capitalisation held by non-promoter shareholders.

Companies like Infosys which have low promoter holdings have traditionally dominated the Sensex weightages.

Click NEXT to read further. . .

Sikka effect: Infosys gains weight at the bourses

It has a free float factor of 0.84, which means 84 per cent of its total market capitalisation is considered freefloat market cap.

ITC, L&T, ICICI Bank and HDFC have 100 per cent free float market cap, as these do not have any identifiable promoter.

RIL, on the other hand, has a high promoter holding and a free-float factor of 0.55 but its substantially higher total market capitalisation helps it remain high on the weightage chart.

Changing fortunes

- Dec 2011: Overtakes Reliance Industries to become most weighted stock with 10.25 per cent; market cap at Rs 1.3 lakh cr

- Apr 2012: Trails expectations in Q4; CLSA open letter to Shibulal slams strategy, questions ability to retain margins

- Apr-Oct 2012: Other analysts, proxy firms raise concerns

- Oct 2012: CLSA predicts 40 per cent fall in price from Rs 2,570-levels

- Jun-Jul 2013: NRN returns; Rupee slide begins

- Aug 2013: CLSA revises targets upwards

- Dec 2013: In an interview after AAP victory in Delhi, NRN says 'Arvind has defined what is possible'

- Jan 2014: Infy second heaviest on Sensex at 8.76 per cent

- Feb 25, 2014: Hits 9.68 per cent, its highest Sensex weight this year

Click NEXT to read further. . .

Sikka effect: Infosys gains weight at the bourses

- Mar 10, 2014: Falls below 9 per cent

- Mar 19, 2014: RIL overtakes for the first time; after a week of flip flops, infy loses no.2 spot

- May 8: ICICI Bank overtakes infy

- May 16: Election Results day, Infy weight dips below 7 per cent

- May 19: Loses 4th place to HDFC Bank; wrests it back a week later

- May 29: HDFC Bank and L&T overtake pushing Infy to 6th place with 6.4 per cent

- Jun 6: Infy loses to HDFC, down to seventh position on index with 6.27 per cent

- Jun 12: Infy announces appointment of Vishal Sikka as CEO

- Jun 13: Surge lifts stock back to Top 5