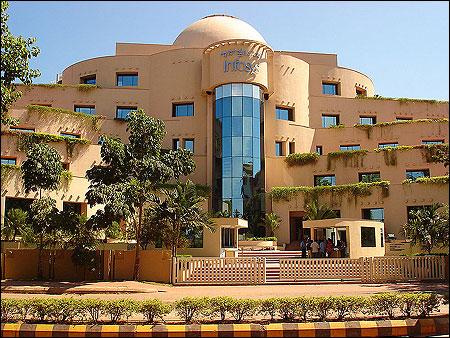

Photographs: Amrith Anandan/Wikimedia Common BS Reporter in Mumbai

The whispers surrounding Infosys performance are getting louder. Institutional investors, who have invested over $15 billion in the company, are concerned over the deteriorating financial performance of the company.

Questions are also being raised over Infosys rational to maintain high margins, especially in a difficult macro environment when competition is focused on gaining market share. Infosys has close to 600 investors.

The company, which announced its fourth quarter number earlier this week, missed its March 2012 guidance by 1.9-2.2 per cent.

More importantly it's guidance of 8-10 per cent growth in FY13 shocked the street, as it was lower than IT industry body Nasscom's estimate of 11-13 per cent.

Click on NEXT for more...

Infosys investors concerned over company

Image: Infosys Chennai main block at Mahindra World City, New Chennai.Photographs: Simply CVR/Wikimedia Commons

In an open letter to chief executive officer S Shibulal, brokerage firm CLSA Asia Pacific markets raised a few questions on the firms rational to maintain margins at higher level, the roadmap for use of $4.1 billion cash and Infosys ability to predict its own business.

The brokerage house said that these are questions that more than 100 investors that it spoke to had on mind.

"I hope that this letter is not construed as anything other than an attempt by a long-time Infosys well-wisher to try and understand why have shareholder returns trailed sector peers across time periods over the last 4 years, something that is quite unprecedented in your history as a public company," said Nimish Joshi in his letter to Shibulal.

He also asked, the key question on every shareholder's mind is what is troubling the company, which has been the flag-bearer of the Indian IT industry globally and single-handedly raised the profile of Indian equities among foreign institutional investors.

Click on NEXT for more...

Infosys investors concerned over company's performance

Image: Swimming pool, Infy's Mysore campus.Photographs: Indianhilbilly/Wikimedia Commons

The letter also points out how the changing macro economic environment has changed business realities and competitors have been taking market share.

"While the last decade of hyper-growth in offshore IT Services meant Infosys could pick and choose its business and still manage to grow in-line to better than peers, you will appreciate that times have been much different post the 2008 slowdown.

Client focus remains excessively on cost-cutting and Infosys may not find enough deals which satisfy its threshold pricing criteria. Combine that with the new found aggression among Infosys' peers and greater hunger for acquisitions, reasons for the loss of revenue market share become clearer," Joshi said.

Click on NEXT for more...

Infosys investors concerned over company's performance

Image: Movie Theatre, Infy's Mysore campus.Photographs: Mahendra M/Wikimedia Commons

According to analyst, if Infosys continues to show these problems, then it risks being overtaken by Nasdaq-listed Congnizant, which has guided for a 23 per cent growth for CY2012. Though the difference between both the firms guidance is around $1.5 billion.

The CLSA report also talks about the cash that the company has. Infosys' business model is neither capex nor working capital heavy and my belief is that is unlikely to change anytime soon. Infosys has no doubt been disciplined in usage of cash for potential acquisitions.

Given the low capex/working capital needs in IT Services, I do not think a higher dividend pay-out or buy-back will be construed by investors as a precursor to lower growth prospects ahead.

article