| « Back to article | Print this article |

Telecom dreams bring Ambani close to rivals

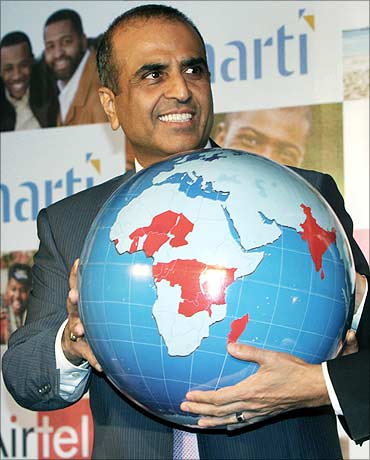

Six months after an infrastructure deal with brother Anil Ambani, Mukesh Ambani has now joined hands with Sunil Mittal. The tie-up has flummoxed many…

Till Mukesh Ambani’s Reliance Jio and Sunil Mittal’s Bharti Airtel announced on Tuesday that their companies would share telecom infrastructure in order to drive down costs, the two businessmen were known as bitter adversaries - at least in telecom.

They were on opposite sides in the early parts of the last decade when the GSM lobby, led by Mittal, tried hard to block limited mobility offered by fixed-line operators including Reliance Communications (then Reliance Infocomm) which was run by Ambani.

They still don’t see eye to eye on many key regulatory issues. And they are likely to slug it out in the near future as Reliance Jio plans to launch full-fledged fourth-generation, or 4G, mobile services - voice and data - across the country.

Like in any other market, its first target could be the market leader: Bharti Airtel. On its part, Bharti Airtel has already launched 4G services in some sectors in anticipation of its biggest fight ever, and claims to be the only company to offer services seamlessly across platforms: 2G, 3G and 4G.

Click NEXT to read more…

Telecom dreams bring Ambani close to rivals

That’s why the recent deal between the two has flummoxed many. Under the agreement, the telcos will share optic fibre, towers, submarine cable networks, and internet broadband services.

The aim is to avoid duplication of infrastructure.

This, mind you, will be only the first phase of the deal - they could at a later date also look at roaming services on each other’s network for 2G, 3G as well as 4G subscribers. Of course, both have made it clear that the pricing in these agreements will be at “arm’s length”.

This deal comes six months after Reliance Jio signed a series of similar agreements with Anil Ambani’s Reliance Communications. Many saw that deal as the first attempt by the Ambani brothers to work together after their bitter separation in 2005.

Some even saw it as a lifeline thrown at debt-laden RComm by Reliance Jio: Rs 12,000 crore (Rs 120 billion) for using 45,000 towers for 15 years plus Rs 1,200 crore for accessing the optic fibre network of over 120,000 kilometres.

Click NEXT to read more…

Telecom dreams bring Ambani close to rivals

Long-term plan

Reliance Jio’s deal with Bharti Airtel, which does not have any concrete financial numbers so far, is a long-term agreement meant to complement its earlier deal with RComm. And it is based on Reliance Jio’s business compulsions.

Those in the know say that Reliance Jio will require over 150,000 towers to have a pan-India 4G launch which will cover all key cities.

That is, of course, much more than what its rival telcos who offer 2G and 3G services require. That’s because Reliance Jio has got spectrum in the 2300 MHz band to host 4G services.

This band is not as efficient as 900 MHz and 1800 MHz. Experts say its efficiency falls dramatically within homes. This could impact consumer experience.

To get over this problem, Reliance Jio needs to install nearly three times more towers than an operator in the 900 MHz band and twice as many as in 1800 MHz.

Click NEXT to read more…

Telecom dreams bring Ambani close to rivals

Of course, Reliance Jio can start from scratch and build the towers on its own. But that could cost over Rs 45,000 crore and take three to five years to build, considering that the restrictions on installing new towers are becoming more and more stringent.

So Reliance Jio is following a twin strategy: build some towers, many of them low-cost, so that it is not completely dependent on competitors, and take on lease towers in bulk from existing players.

It is understood that such bulk deals will help Reliance Jio negotiate hard and bring down the prices.

There are about 400,000 telecom towers in the country, out of which about 150,000 are in the cities - the key area of focus for Reliance Jio in the initial years.

Click NEXT to read more…

Telecom dreams bring Ambani close to rivals

From these numbers, it is pretty clear that the deal with RComm (45,000 towers) will help Reliance Jio meet only a third of its requirement. That’s why in the long term, it needs to sign similar agreements with others.

The deal with Bharti Airtel (with around 35,000 towers) and maybe later with Indus Towers (120,000 towers; Bharti Airtel has a 42 per cent stake in it) will give Reliance Jio access to almost two-thirds of the towers in the country.

That’s a large enough footprint to start pan-India operations. With these three partners, Reliance Jio will have 75,000 to 80,000 towers to choose from in urban centres. But that means Ambani will have to depend on rivals to grow his telecom business.

To hedge the risks, Reliance Jio is building around 10,000 towers across the country in the first phase - the number could go up in the days to come.

Click NEXT to read more…

Telecom dreams bring Ambani close to rivals

Playing safe

In the fibre optic business too, Reliance Jio has decided not to depend on any one player to provide inter-circle as well as intra-circle connectivity. So it is laying 32,000 to 35,000 kilometres of fibre on its own including within cities, according to vendors.

But, of course, it will require much more as 4G services, which are largely data-driven, will need many times more bandwidth than voice.

As this is the core of the Reliance Jio plan, it knows it will be unwise to depend fully on shared infrastructure. However, with the RComm and Bharti Airtel tie-ups, Reliance Jio will have access to 300,000 kilometres of fibre optic network across the country.

There’s something in the deal for Bharti Airtel too. Bharti Infrastructure, its telecom infrastructure subsidiary, will see its tenancy go up sharply from about 1.85 now (the number of telcos who use the tower for putting up their equipment) to 2.85 once Reliance Jio checks in, making it a robust business (breakeven in this business happens at 2).

If the deal extends to Indus Towers, that company too will see its tenancy shoot pass 2. Bharti Airtel, which also has launched 4G services in the same band as Reliance Jio, can access some more towers which will improve its coverage. If that happens, and RComm also opts for it, Reliance Jio’s towers will start with a tenancy of 3!

Click NEXT to read more…

Telecom dreams bring Ambani close to rivals

The key is the price. Reliance Jio, according to analysts, has been able to leverage the long-term contract with RComm to get tower rentals down by half to around Rs 15,000 per month.

The question is whether Bharti Airtel or Indus Towers will offer such heavy discounts. If they don’t, the deal might not be as exciting as many think it is.

“Considering that Reliance Jio will not have much flexibility in choosing the towers as it needs one every 50 metres, I don’t see Bharti Airtel or Indus Towers reducing prices as then they have to do so for all their clients. So it might not be so easy,” argues a telecom industry veteran.

So, he argues, it is Reliance Jio’s deal with RComm which will help it keep costs low, especially in the initial phases.

There are some far-reaching possibilities that the recent agreement opens up. Bharti Airtel, which has launched 4G services in only eight of the country’s 22 telecom circles, could extend the service all over India by using Reliance Jio’s network. But that will depend on whether intra-circle agreements, which are currently illegal, will ever be allowed.

The two telcos could also get into an intra-circle network sharing agreement and reduce the cost of their 4G service. But all these possibilities require regulatory changes. Will Ambani and Mittal, with their legendary “environment management” skills, catalyse this change? That will be the billion-dollar question.

Click NEXT to read more...

Telecom dreams bring Ambani close to rivals

Mukesh Ambani’s telecom game plan

* Will start services in May or June next year. To become a pan-India 4G operator by the end of the year

* Will offer services in 22 circles, taking on Bharti Airtel, the only other telco which offers 4G services in eight circles

* Will offer dongles, fixed broadband at homes as well as mobile phones with voice and data

* Believed to have tied up with Samsung which will put up its network

* Could offer 4G mobile handsets at below Rs 5,000

* Has received permission from the government for 22 million numbers in the first phase

* Has tied up with Reliance Communications and Bharti Airtel for sharing infrastructure

* Will build its own low-cost towers (Rs 10 lakh for each tower), at one-third the cost of normal towers. Municipal corporations will use the towers as lamp posts.

* With 20 MHz of spectrum, is expected to offer low tariffs and increase data usage multiple times.

* Will also require a lot of bandwidth to support increased usage of data, which means a large fibre optic backbone

THE DEALS SO FAR

RELIANCE COMMUNICATIONS – RELIANCE JIO

April 2, 2013

Reliance Jio signs agreement with Reliance Communications to share its nationwide optic fibre network of 120,000 kms (intercity) for Rs 1,200 crore

June 7,2013

Reliance Jio and Reliance Communications sign agreement for sharing of towers infrastructure. Reliance Jio to utilise up to 45,000 sites of Reliance Communications. Deal valued at Rs 12,000 crore

BHARTI AIRTEL – RELIANCE JIO

April 23,2013

Reliance Jio to utilise Bharti’s dedicated fibre pair on i2i submarine cable that connects India and Singapore. The cable system would give Reliance Jio direct access and ultra-fast connectivity to major hubs across Asia Pacific

December 10,2013

Bharti and Reliance Jio enter into a telecom infrastructure sharing arrangement with both parties getting access to each other’s infrastructure