| « Back to article | Print this article |

Why Infosys is worried and TCS isn't

The results announced by both companies have been strongly affected by the rapid depreciation of the rupee during the reporting quarter, and show buoyancy in top-line -- gross revenue -- growth that would not otherwise have been possible.

The two leading information technology companies, Tata Consultancy Services and Infosys Technologies, reported their first-quarter results on the same day, thus dramatically juxtaposing them and offering valuable insights.

Although according to certain key parameters the companies belong to the same league, the signals they sent out could not be more different.

Infosys sees challenges in the global economic situation resulting in slower corporate expenditure on information technology.

On the other hand, TCS continues to see good demand ahead.

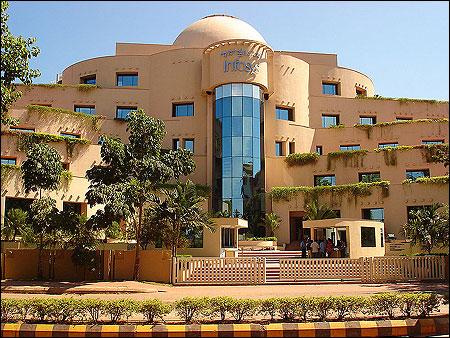

The image is used for representative purpose only

Click NEXT to read further. . .

Why Infosys is worried and TCS isn't

Thus, Infosys is worried about the future; TCS is not.

The markets absorbed this by pulling down Infosys shares by a massive eight per cent in post-results trading, whereas TCS gained one per cent after its own results.

This is not the first time the markets have treated Infosys' performance with scepticism, but what is relatively new is that the former star performer has missed its own guidance over successive quarters.

This indicates an inability to read the future correctly and, in a way, following the curve, not being ahead of it.

Click NEXT to read further. . .

Why Infosys is worried and TCS isn't

The results announced by both companies have been strongly affected by the rapid depreciation of the rupee during the reporting quarter, and show buoyancy in top-line -- gross revenue -- growth that would not otherwise have been possible.

Thus, both have recorded sequential (on the previous quarter) top-line growth of over 12 per cent.

On the other hand, the two companies have fared differently in terms of net margins.

TCS is slowly improving its net margin quarter by quarter, thus creeping up on Infosys. However, Infosys has lost ground with a fall of over two percentage points compared to the previous quarter.

Click NEXT to read further. . .

Why Infosys is worried and TCS isn't

Infosys, which has always commanded a pricing premium, sees that being threatened; TCS does not appear to be worried.

Perhaps, most significantly, TCS has improved margins even after carrying through pay hikes; whereas Infosys has postponed annual increments till now in the current year.

This is reflected in Infosys' attrition rate which, compared to its employee base, appears higher than TCS'.

What does all this signal for Indian IT? The US elections have made losing jobs overseas a major theme.

Click NEXT to read further. . .

Why Infosys is worried and TCS isn't

US visa rules, particularly the way they are applied, have already become tougher.

There is no knowing what the post-election scenario holds.

It is also not possible for IT majors to de-risk their business model by seeking more revenue from crisis-hit Europe.

There is no question that the global scenario is challenging but TCS, as also several mid-sized companies, is facing it quite vigorously.

Infosys seems to be facing more challenges than these.

Click NEXT to read further. . .

Why Infosys is worried and TCS isn't

The markets were particularly spooked by the substantial (three percentage points) downward revision of the company's dollar guidance for the whole year.

This puts a question mark over the industry's export growth of 11-14 per cent in dollar terms that the National Association of Software and Services Companies has projected.

Indian IT will need all the robustness that it has acquired over the years to put up even a moderately good performance in the present scenario.