Ajay Piramal's strategy of acquiring cheap assets and selling at high valuations may not have impressed shareholders, but after the mega deal with Vodafone peers are quick to compare him with the Oracle of Omaha.

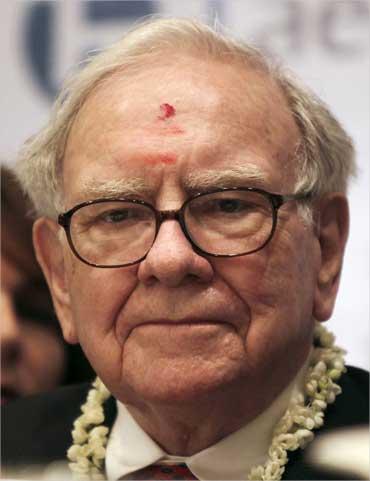

'Buy cheap and sell high' is a simple investment principle first taught by Ben Graham and David Dodd at Columbia School way back in 1928, but few have followed it with the discipline of Warren Buffett.

The world's second-richest man - the chairman of Berkshire Hathaway - has built his empire by putting the principle at the centre of all his investments.

Few others have met with similar success. But, of late, the corporate world is abuzz with the rise of India's own value investor: Ajay Piramal, chairman of the Piramal group.

He too has made a career out of buying cheap assets and selling them at a high value.

Many would say it is audacious to call Piramal the Buffett of India because he's just been in the right place at the right time.

That might be true, but there's no denying that his business strategy has been driven by value and not vanity.

…

Several Indian businessmen, including some very distinguished ones, are paying a price for their extravagant acquisitions made during the boom years. Piramal stayed away from those even if he was tempted for a while.

If nothing else, then just for sticking to the principle of value investing Piramal deserves credit.

If taking contrarian bets defines value investing, then Piramal has done it all his life. He bought a string of pharmaceutical companies when large multinationals were selling them cheap in the 1980s.

He made acquisitions abroad when the Indian currency was at its strongest and stayed away from popular sectors that other Indian businesses were chasing mindlessly (infrastructure and real estate) between 2007 and 2010.

He risked his credibility by selling a successful business to Abbott when the world was queuing up to get a foothold in India.

The jury may still be out on Piramal's new businesses and where they are headed, but he has demonstrated that he can generate superior returns even in these market conditions.

…

Merchant banker Vallabh Bhansali says Piramal is unique because he can acquire businesses, build businesses from scratch and sell them when the time is right.

"Over the years, he has often asked me why investors have not given a fair value to his businesses, but today I don't think he is waiting for India to understand him," says Bhansali.

On the other hand, Amit Tandon of Institutional Advisory Services maintains that investors of Piramal Enterprises, the group flagship, had put their money in a healthcare company - if the company is not choosing to remain in that business, it should return the cash.

Indeed, the investors of Piramal Enterprises are not amused as the company's consolidated earnings per share (EPS) went into negative territory: Rs 13.2 in 2012-13 from Rs 21.4 in 2009-10 (this was prior to the sale of its domestic formulations business to Abbott for $3.72 billion).

The company had a market capitalisation of Rs 10,107 crore on Tuesday, up 16 per cent from Rs 8,668 crore on May 21, 2010, a day before it sold the domestic formulation business.

Sensex, the benchmark index of BSE closed at 22,461 on Tuesday, up 36.5 per cent from 16,445 on 21 May.

…

Sitting on a pile of cash

By selling the domestic formulations business, the company divested its most profitable operational business, but did not distribute the money earned as it believed in building new businesses.

While that takes time, high amount of cash on the books has dragged the return on capital employed (RoCE) to 2.51 per cent in 2012-13 from 24.23 per cent in 2009-10.

Hence, Piramal Enterprises needs to look for investment opportunities till its operational businesses gain scale and requires cash to give better return.

"The board has identified four broad businesses that it will have a presence in - pharmaceuticals (both domestic and international), infrastructure, financial services and the information business (Decision Resources Group) - which will not give results overnight," says Deepak Satwalekar, an independent director on the board of Piramal Enterprises.

"We resisted the pressure to invest in haste. The Vodafone deal came up at that time. We knew it was a short-term deal and yet would yield good returns. Investment and operational business strategies can both co-exist. but as operational businesses grow, the pool of funds for short-term deployment will shrink."

…

What makes Piramal unique as an entrepreneur is possibly his ability to spot a trend early and his ability to cash in at the right time without bringing emotion into it.

It's for this reason that many in the corporate world have begun to refer to him as the Buffett of India.

His critics may not have forgiven him for selling a highly successful business back in 2010, but the valuation he got suggests that the decision wasn't a losing proposition. Piramal sold the branded generics business to Abbott in 2010 for $3.7 billion (Rs 18,000 crore), which was nine times the sale and 30 times the Ebitda (earnings before income tax depreciation and amortisation).

Had he not sold, he would have had to grow the business at 20 per cent year-on-year with an operating margin of 35 per cent for the next 20 years to break-even at similar levels.

Narayanan Vaghul, former chairman of ICICI Bank and an independent director on the board of Piramal Enterprises, describes Piramal as a successful acquisitionist who uses his ability to manage organisations and talent to his advantage.

"I would not call him Buffett. I don't see him emerging as a private equity player, but as someone who will be focused on four or five businesses. What he does next will be driven by what happens in the country."

…

The other big criticism Piramal faced back then was the utilisation of the money he got from Abbott.

Three years on, Piramal is laughing all the way to the bank and making headlines for the windfall gains he made by selling his stake in the telecom company to Vodafone and earned 52 per cent on his investment of Rs 5,894 crore made two years ago.

While some of his peers are beginning to see sense in his style of investing, analysts aren't just yet buying into his philosophy.

Questions are still being raised on whether the company should be investing or building businesses. Piramal's answer never changes, as he says in jest: "I am always consistent as I have said that these opportunities will come but our goal is to create long-term shareholder value by building operational businesses."

Despite his protestations, his style of value investing is getting talked about and compared with that of Buffett.

…

Over the last three years, he has demonstrated his ability to generate superior returns - be it by building a business, selling it or by deploying capital - in a dispassionate manner.

He started building the pharmaceutical business in 1988 when multinationals were leaving the country as they saw no value in staying on.

Piramal recalls that at that time, these companies had great brands and were sitting on valuable physical assets like land. He joined the fire sale and built a pharmaceutical business, straddling different segments.

"We don't see investments the way others do. We take contrarian bets because we see opportunities where others don't."

Similarly, he sold the business when he felt that competing with Big Pharma would be tough in the generics space. "We try to take little more of a contrarian approach, not because of the sake of being contrarian but because we see the opportunity. Yet none of this is a result of a set pattern", he says. "If everyone is doing the same then you cannot make abnormal returns - that is the rule of economics."

…

The common thread

Though there is a vast difference in the scale of operations of Piramal Enterprises and that of Berkshire Hathaway, both the companies have significant amount of cash to invest.

Piramal does not deny that his style of investments is driven by the same principle that drives Buffett. Both champion the strategy of contrarian bets and believe in having operational companies as well as pure investment plays.

At the height of the sub-prime crisis following the collapse of Lehman Brothers in 2008, Berkshire Hathaway invested $5 billion in Goldman Sachs Group. For Buffett, it generated a return of $3.1 billion in 2013.

Then in November 2010, Buffett surprised the markets by buying the remaining 77.4 per cent stake in Burlington Northern Santa Fe Railway for $26 billion.

He bought at a time when the industry was seeing one of its toughest times and had a low valuation.

…

He is now reaping the benefit as the US economy revives. Similarly, in spite of the slowdown in commercial vehicles, Piramal Enterprises bought a 9.9 per cent stake in commercial vehicle financier Shriram Transport Finance for Rs 1,652 crore in May 2013.

It was a strategic bet as the company has huge cash reserves which can be used by Piramal to invest in promising businesses. Piramal is certainly waiting for the revival of commercial vehicle demand to benefit from this investment.

Deepak Parekh, chairman at mortgage lender HDFC, says: "Piramal has a sharp nose to smell the deal first and then has the ability to decide fast on both buying and selling."

Piramal Enterprises has focused on three business verticals which have garnered revenue of Rs 3,400 crore in the first nine months of 2013-14 with Ebitda of Rs 800 crore.

More than a third of this revenue - about Rs 1,200 crore - came from its contract manufacturing business of the pharmaceutical vertical.

This vertical contributed another Rs 790 crore of revenue with its generic anaesthetic products and over-the-counter products.

The last piece of this vertical, the drug discovery business, is still in trial phase with a pipeline of 13 compounds and no revenue.

The company may see its biggest growth in the near future coming from the other two verticals: information management and financial services.

In May 2012, Piramal had bought US-based Decision Resources Group which does data analytics for the healthcare industry. This contributed revenue of Rs 730 crore in the nine-month period.

The financial services business comprises a non-banking finance company and real estate fund. This brought the company revenue of Rs 560 crore in the nine-month period.

While the company is in the process of building these businesses, Piramal doesn't want to let go of short-term opportunities like Vodafone to make money.

Investments done by Piramal Enterprises

Aug 2011

5.5 % in Vodafone India

Rs 2,856 crore

Feb 2012

5.5 % in Vodafone India

Rs 3,000 crore

Feb 2012

10 % in Shriram Transport Finance

Rs 1,652 crore

April 2013: Structured investment of Rs 550 crore in Navyuga Engineering Company through Strategic Investment Group

April 2013: Structured investment of Rs 500 crore via convertible debentures in Green Infra, a wind energy company backed by IDFC Private Equity