| « Back to article | Print this article |

How realtors have profited from rising India, China

In the days of the Raj, the British and the maharajas used to retreat from the hot and humid capitals of Calcutta, Delhi, Bombay, Bangalore, and Madras and head for the hills.

They created a network of beautiful hill stations (high-altitude towns) famed for their cool air.

Among them were Darjeeling and Simla in the foothills of the Himalayas, and Ooty in the Nilgiri Hills.

Nearly seventy years after the end of the empire, the new elite are once again being lured by the magic of the mountains - but this time, the mountains are artificial and located in the middle of the same steamy cities: the super-tall skyscrapers.

Click NEXT to read more...

How realtors have profited from rising India, China

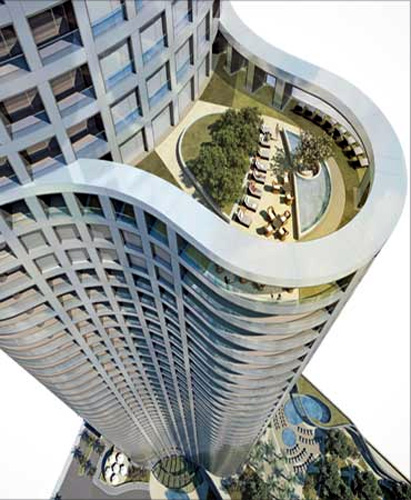

One of these, World One, is making its way up to 1,450 feet above the Mumbai skyline. It is expected to reach this vertiginous height -117 floors - by 2014, and would be among the world's tallest residential towers.

At such a height, life becomes very different - at least according to the Lodha Group, the skyscraper's property developer.

Preaching the benefits of living in a super-high-rise building, it starts by saying that "it is like living in a hill station": in particular, the temperature drops by as much as 4.5 degrees Celsius. In addition, for every thirty floors, there is a dramatic reduction in air and noise pollution, with the amount of noise falling by 30 percent.

Click NEXT to read more...

How realtors have profited from rising India, China

With these kinds of advantages, the property developer is planning to charge $ 1.5 million or more for the homes, which will be furnished with the finest European brands: interiors designed by Giorgio Armani's design studio Armani/Casa, kitchens by Bulthaup, and bathroom fittings by Antonio Lupi, Dornbracht, Gessi, and Villeroy & Boch.

Competition is stiff. Other Indian companies are erecting similarly ambitious skyscrapers.

But Lodha Group, founded by Mangal Prabhat Lodha in 1980, is not resting on its laurels.

Toward the end of 2011, it was conducting twenty-seven projects, involving thirty million square feet of prime real estate in Mumbai.

Click NEXT to read more...

How realtors have profited from rising India, China

The most ambitious was New Cuffe Parade, announced in October 2011- which was India's biggest land deal and which has developed into a multibillion-dollar complex.

These projects serve as symbols of the vaulting ambitions of India's commercial elite - and the consumers who come to buy the apartments.

Abhishek Lodha, the thirty-one-year-old son of the group's founder, who joined the family firm after completing engineering degrees at Georgia Institute of Technology in the United States, says, "Every global city is made memorable by its architectural landmarks. Be it the Eiffel Tower in Paris, the Opera House in Sydney, or the Empire State Building in New York, these vibrant forms reflect the passion and culture of the city they are located in."

Click NEXT to read more...

How realtors have profited from rising India, China

Describing World One, he goes on to say, "In partnership with the globe's finest architects, designers, and engineers, we seek to bring to Mumbai a landmark that will exemplify the spirit of Mumbai -to always soar higher through hard work and passion."

This same sentiment exists in China, where a similar group of property developers has been transforming the country's skyline.

China Vanke, the country's biggest real estate company, has seen its fortunes rise dramatically over the past twenty years, with the growing demand for middle-class housing.

Click NEXT to read more...

How realtors have profited from rising India, China

The company was founded in the 1980s by Wang Shi, a flamboyant former Red Guard member who - very appropriately, given the skyward trajectory of his company and construction work - has climbed to the top of Mount Everest. In 1990, the company focused on just four tier 1 cities.

Fifteen years later, it was covering thirty-four cities, even some tier 4 cities with under one million people, and was selling 2.5 million square meters of property annually.

By 2010, the numbers had jumped again: forty-six cities and a staggering 9 million square meters of sold property. Revenues exceeded $15 billion.

Click NEXT to read more...

How realtors have profited from rising India, China

"Live in Your Dreams" is a China Vanke slogan. But in China and in India, dreams come at a price. To afford them, the new consumers have turned to banks and specialist mortgage lenders, breaking a generational reluctance to go into debt. In India, Housing Development Finance Corporation (HDFC) has been leading the way, led by Deepak Parekh.

Parekh's uncle founded the company in 1977. Parekh joined the firm a year later, taking a salary cut after a stint with The Chase Manhattan Bank. The Indian company saw its loan book rise from $10 billion in 2005 to $22 billion in 2010.

Yet despite the doubling of its loans, conservatism has been Parekh's watchword. "There are many qualities of a leader," he told us. "One is vision, and in a lending organization, another is conservatism."

Click NEXT to read more...

How realtors have profited from rising India, China

Typically, HDFC makes more than 90 percent of its individual loans to salaried householders. Some of its rivals have been forced to give loans to higher-risk customers.

Also, most of its focus has been on the major tier 1 and 2 cities, with around 50 percent of its 300-plus branches based in these wealthier metropolises. Loan-to-value ratios average 68 percent, with a thirteen-year term. Cumulative loan write-offs amount to 4 basis points.

"We serve the middle class," says Renu Karnad, managing director of HDFC. "They have the same needs as the middle class around the world. They want a better home, they want modern appliances, and they want space. We estimate that there is a national housing shortage in India of more than twenty-five million units."

Click NEXT to read more...

How realtors have profited from rising India, China

Since its launch, HDFC has financed 3.9 million houses. It has grown from eighty-seven outlets in 2001 to offering deposit and loan products in more than twenty-four hundred towns and cities.

Today, it has $25 billion in loans outstanding in India. Yet there is room to grow even further.

In India, mortgages amount to 9 percent of GDP versus 81 percent in the United States, 88 percent in the United Kingdom, and 48 percent in Germany. HDFC wants to capture the growing power of the Indian consumer.

Click NEXT to read more...

How realtors have profited from rising India, China

Just as property developers and mortgage lenders have profited from the property boom sweeping through China and India, so too have the home furnishings and household appliance companies.

In India, one company that has been excelling is LG, the South Korean multinational. Its story is one of persistence, and it is a role model for companies wanting to enter the Indian market.

As Lucky Goldstar, it first entered India in the early 1990s, establishing a joint venture with Bestavision, an Indian consumer electronics company. But this failed. It tried again in the mid-1990s, this time with another domestic partner, the CK Birla group. This failed, too.

THE $10 TRILLION PRIZE

AUTHOR: Michael J Silverstein, Abheek Singhi, Carol Liao, David Michael

PUBLISHER: Harvard Business Review Press

PRICE: Rs 995

ISBN: 9781422187050

Reprinted with the permission of Boston Consulting Group. Copyright 2012 Michael J Silverstein, Abheek Singhi, Carol Liao, David Michael. All rights reserved