| « Back to article | Print this article |

High on Modi but will the stocks deliver?

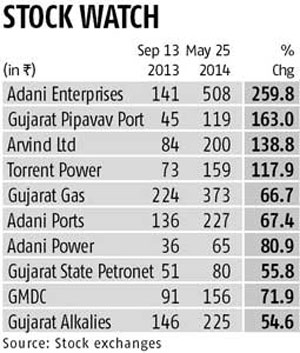

Stocks of Gujarat-based companies have spurted over the past nine months, some touching their 52-week highs, on expectations that a Narendra Modi-led government would be beneficial. While the broader markets have risen 23 per cent in this period, most Gujarat-based stocks have risen upwards of 50 per cent.

Stocks of Gujarat-based companies have spurted over the past nine months, some touching their 52-week highs, on expectations that a Narendra Modi-led government would be beneficial. While the broader markets have risen 23 per cent in this period, most Gujarat-based stocks have risen upwards of 50 per cent.

One reason for the spurt, especially in infrastructure-related stocks, has been the expectation of moves to resolve issues such as coal and gas availability, faster approvals and boosting of overall economic growth.

If this happens, Gujarat-based power or gas units will benefit, as well as other companies, led by improved utilisation and profitability.

For example, Adani Group stocks such as Adani Power could benefit if coal availability improves and some of their court cases get resolved. The fortunes of Adani Ports and Adani Enterprises will improve if trade volumes jump on the back of economic growth.

Click on NEXT for more...

High on Modi but will the stocks deliver?

While the perceived business-friendly environment will benefit all companies, analysts say the next up-move in Gujarat-based public sector units (PSUs) is likely to come with an improvement in fundamentals, rather than an association with Modi's home state.

Says Gautam Trivedi, managing director and head of equities, Religare Capital Markets, "The prime minister believes in restructuring of PSUs. There is no logical reason for Gujarat-based PSUs to run up just because Modi is the next PM. Though I think the bull market is here to stay, Gujarat-based PSU stocks will have to go up on their own merit from here on."

Arvind Ltd's stock has been on an uptrend as the company started to gain from the transition it took from a cyclical/commodity business (denims) to a brand, retail and textile play. Since September last year, it has more than doubled to around Rs 200.

While the branded segment is likely to grow 25-30 per cent in FY15, better operational performance of the textiles business will boost Arvind's financials.

Textiles account for 70 per cent of revenue and 90 per cent of profits. The stock trades at 5.5 times its FY15 ratio of enterprise value to operating earnings (EV/Ebitda). Sharekhan analysts say the business transition is not fully captured and there could be a further re-rating, by unlocking the value of the brands.

Click on NEXT for more...

High on Modi but will the stocks deliver?

Gujarat Gas has been struggling with weak volumes over the past year, due to higher price of spot LNG (liquefied natural gas) and falling gas production at the KG-D6 basin. Analysts expect a weakness in volumes to continue, given the subdued industrial demand and high LNG prices.

This has restricted pricing power, leading to pressure on the company's margins. Analysts remain cautious on the stock, though they could review earnings and target prices as its merger with GSPC gets completed in the next six to nine months.

The potential cap on marketing margins by the Petroleum and Natural Gas Regulatory Board could hit margins further and is a key overhang on the stock, which trades at rich valuations of 14.3 times the estimated earnings for 2014.

Click on NEXT for more...

High on Modi but will the stocks deliver?

Lignite mining major Gujarat Mineral Development Corporation's stock price surge has been on the back of improving prospects and sentiment. Revenues and profits were at multi-quarter lows in the September 2013 quarter, with mining getting affected by unprecedented rain.

Volumes have rebounded since, though demand remains muted. While lignite mining contributes about 80 per cent to revenue, 16 per cent comes from the power segment, also expected to see better plant load factors.

Expect volumes to improve further and this, coupled with price increases, could be a trigger. However, after the recent run-up, a further upside from current levels of Rs 156 remains limited. The FY16 price target is about 4.5 times the EV/Ebitda range of Rs 139-150.

Click on NEXT for more...

High on Modi but will the stocks deliver?

Falling gas transmission volumes have impacted Gujarat State Petronet's performance in recent quarters. Lower availability of domestic gas and lower demand for expensive spot LNG have hit volumes. This is likely to continue in the near term, say analysts.

They expect GSPL to post volumes of 21-22 million standard cubic metres a day (mscmd) each in FY14 and FY15, down from 27 mscmd in FY13.

Additionally, GSPL is making huge investments (Rs 400-500 crore annually) in setting up new pipelines.

This could dilute return ratios, given the poor visibility on utilisation of pipelines. The stock trades at 1.2 times the FY15 estimated book value, lower than its historical average of a one-year forward price/book value of about two times. However, weak visibility on both revenue and earnings are concerns, partly reflecting in valuations.

Click on NEXT for more...

High on Modi but will the stocks deliver?

Torrent Power had limited options in the past because of non-availability of gas, which meant 74 per cent of its power generation capacities were idle. Investors are worried about its transmission business and high dues with state utilities in the past.

Also, if gas availability does not improve, the huge equity investments made in existing and upcoming power plants might get eroded. However, the worries are partly resolving, as Torrent has started to get its dues after a court verdict.

The Street also believes higher gas output and its availability, earlier limited to fertiliser companies, could actually reach power plants, benefiting companies like Torrent which has operational generation capacity of 1,698 Mw (1,250 Mw fuelled by gas and 400 Mw by coal).