| « Back to article | Print this article |

Decoding Flipkart: The real picture on investors, earnings

Sachin and Binny Bansal are faces of the e-commerce sensation but other investors dominate the board.

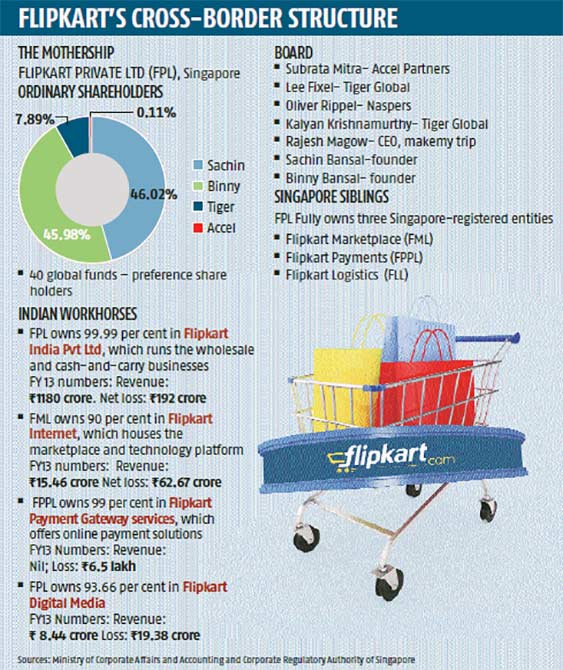

Representatives of private equity firms outnumber the founders of e-commerce poster boy Flipkart.com on the board of its Singapore-based parent, Flipkart Private Ltd (FPL).

FPL is the ultimate holding company of several legal entities based in Singapore and India that work seamlessly to convert an online shopper's click or touch into a neatly wrapped bestseller or the latest smartphone delivered at his doorstep.

FPL is also the primary recipient of the millions of dollars private equity money that has been flooding the company of late. As many as 40 global entities own preference shares worth a billion dollars in the company.

While FPL, which is described as an investment holdings firm in official filings, is said to be worth several billion dollars, its main operational arms in India have recently received funds from the parent valuing these at a fraction.

Please click NEXT to read more…

Decoding Flipkart: The real picture on investors, earnings

Flipkart India (FIPL), the Indian entity that runs its cash-and-carry and wholesale businesses was valued at Rs 2,246.45 crore whereas Flipkart Internet, the marketplace arm, was valued at Rs 1,426.65 crore (Rs 14.26 billion).

That barely adds up to half a billion dollars. Where are the other billions?

Business Standard studied the business profiles and corporate filings of 10 legal entities with the 'Flipkart' name in India and Singapore to bring to you the first ever look into the board composition, capital structure and earnings numbers of the group, which according to its cheerleaders are worth several billion dollars.

In response to an email questionnaire sent by Business Standard, Flipkart spokesperson Camille Gonsalves said, "Your questions are interesting. But, we cannot answer even one of these."

The 10-point questionnaire sought details about the role of founders, investors, group entities and holding structures.

Please click NEXT to read more…

Decoding Flipkart: The real picture on investors, earnings

A month before the high-profile $1-billion funding was announced, FIPL allotted 401,296 shares to its parent FPL, according to a filing with the ministry of corporate affairs (MCA).

FIPL received a capital infusion of Rs 300 crore valuing these shares of Rs 1 each at premium of Rs 7,499 each. After the latest issue, FIPL had 2.99 million shares outstanding. At the valuation of Rs 7,500 a share, the company was worth Rs 2,246.45 crore (Rs 22.46 billion).

On the same day, another local arm Flipkart Internet, which is owned by FPL through its Singapore subsidiary Flipkart Marketplace Ltd (FML), received Rs 421crore for 337,089 shares each priced at a premium of Rs 12,499.

At this price, Flipkart Internet, which houses the technology platform and the marketplace business, was valued at Rs 1,426.65 crore (Rs 14.26 billion).

Apart from these two, FPL, directly and through Singapore subsidiaries, controls Flipkart Payments Gateway Services Ltd and Flipkart Digital Media Ltd. These two were much smaller with paid-up capital of Rs 1 lakh and Rs 6.5 crore, respectively.

Please click NEXT to read more…

Decoding Flipkart: The real picture on investors, earnings

Devendra Nevgi, CEO, ZyFin Advisors, said, "The money that chases newer economy business models are usually the higher-risk capital, especially when the business model has very little history of benchmark valuations. What we understand is the valuations based on sustainability of the earnings and cash flows. These numbers matter more than just the hope of it. Valuation models driven more by liquidity and better short-term business sentiment and the hope of finding a higher buyer, than real earnings run the risk of breakdown."

What do these firms earn?

The real earnings numbers of the India-registered operational entities are not very flattering. FIPL posted a net loss of Rs 192 crore (Rs 1.92 billion) for the year ended March 2013, taking the total accumulated losses to Rs 281.73 crore (Rs 2.81 billion).

However, total revenues for FY13 stood at Rs 1,180 crore (Rs 11.80 billion). In the annual report FIPL said, "In its wholesale and cash-and-carry business, your company has achieved success and trades in 20 categories including Books, Consumer Electronics, where it has consolidated leadership position, and launched new categories as office supplies, watches, toys, various health and beauty products, etc., and maintain over 2,000 supplier relationships."

It was optimistic that the wholesale cash-and-carry (WH C&C) business has huge potential from corporates/SMEs/ institutions, which would like to leverage "our bulk buying competency and we continue to invest in our WH C&C operations across various categories, including newer categories in lifestyle, consumables and electronic accessories."

Please click NEXT to read more…

Decoding Flipkart: The real picture on investors, earnings

It was confident that the expansion of private label "Digiflip" would help derive better margins and expected it to "help company to turn profitable in coming years".

It added, "The wholesale cash and carry business is a long-term play and your company shall be able to turn profitable with scale." It promised that "your directors shall endeavour to reduce the expenditure to the extent possible and shall build strategies to attain the set goals".

As part of the restructuring in 2012, the technology platform and the marketplace business was hived off into a separate unit. This hiving created Flipkart Internet Ltd. This company, which is held through Singapore-registered Flipkart MarketPlace, made losses of Rs 62 crore (Rs 620 million) in FY13, its first year of operation.

"The marketplace business is in the investment phase and your company is investing in developing the marketplace technology platform and hence incurring losses," the firm said in its directors' report dated September 30, 2013. It added, "Your directors believe the marketplace model has huge growth potential and investing in growth shall allow your company to reap reach (sic) dividends upon achieving scale."

Please click NEXT to read more…

Decoding Flipkart: The real picture on investors, earnings

Delhi-registered Flipkart Digital Media made a net loss of Rs 19.38 crore for FY13, while Flipkart Payments gateway, which has launched Payzippy, an online payment solution, posted a Rs 6.5-lakh loss. Flipkart Digital Services, a Bangalore-based entity, was in the process of being struck off, according to MCA records.

Nevgi of ZyFin points out higher valuations are often justified by "spinning a story around it".

One recent spin that has helped Flipkart justify its valuation is the comparison to American giant Amazon.com. Nevgi said, "Comparisons with Amazon would be inappropriate given the different nature and scale of markets in which both the companies function." Nevgi also said the company can do much more on transparency and corporate governance standards.

Please click NEXT to read more…

Decoding Flipkart: The real picture on investors, earnings

The board composition they don't talk about

Flipkart's famously unrelated founders Sachin Bansal and Binny Bansal have not been very forthcoming on granular details on earnings and have often ducked questions about their actual stakes in the companies and board composition.

As late as last week, Sachin Bansal, in an interview, said, "We don't talk about our board composition."

Filings with Singapore regulators showed FPL's seven member board has two representatives from Tiger Global, the US-based PE fund, namely Lee Fixel and Kalyan Krishnamurthy. Fixel is designated as managing partner of Tiger Global and co-runs the fund known for its smart tech investments.

Krishnamurthy is director-finance portfolio companies, Tiger Global Management and had briefly served as the interim chief financial officer of Flipkart. Subrata Mitra of Accel Partners and Oliver Rippel of Naspers are the other investor nominees on the FPL board. While Fixel and Mitra are American citizens, Krishnamurthy is a Singapore citizen and Rippel is a permanent resident of Singapore.

Please click NEXT to read more…

Decoding Flipkart: The real picture on investors, earnings

There are three Indians on board, including the Bansals. The third is Rajesh Magow, co-founder of makemytrip.com.

The business profile of Flipkart as on July 31 with Singapore regulators did not show any equity holding for Magow, suggesting that he could be on the board as an independent director. An email sent to Magow seeking details about his role in Flipkart remained unanswered.

Thus, the three investors - Tiger Global, Accel and Naspers have twice the firepower of the founders in the FPL boardroom. The founders though still controlled substantial portion of the ordinary shareholding.

According to the data with Singapore regulators, Sachin Bansal owns 7.65 million ordinary shares or 46 per cent, while Binny has 7.64 million shares or 45.98 per cent. Tiger Global is the third largest shareholder with 1.31 million shares or 7.89 per cent. Accel has 17,000 or 0.1 per cent equity stake in the company. Total value of ordinary shares stood at $ 774,305 (Rs 4.87 crore).

Please click NEXT to read more…

Decoding Flipkart: The real picture on investors, earnings

This structure resembles the shareholding of the original Flipkart vehicle - Flipkart Online Services ltd (FOSL). The annual return of FOSL dated September 30, 2013, showed the Bansals owned 92.35 per cent of equity.

Tiger Holdings (7.55 per cent) and Accel (0.1) held the rest. FOSL was the original operating company founded by the Bansals and had received three rounds of funding in the form of preference shares before the company decided to move to a Singapore-based structure in 2012 following so-called regulatory complications.

Apart from Tiger and Accel, three individuals Shekar Kirani, a partner in Accel, and Arushi Gupta and Ishir Gupta had also participated in the funding rounds and subscribed to preference shares.

The Guptas are minors and are children of a Bangalore-based Ashish Gupta. Business Standard could not confirm if this is the same Ashish Gupta of PE fund Helion Venture Partners.

Please click NEXT to read more…

Decoding Flipkart: The real picture on investors, earnings

According to its last balance sheet, FOSL made a loss of Rs 116 crore (Rs 1.16 billion) on sales of Rs 217 crore (Rs 2.17 billion) for the year ended FY 12.

In its annual report for FY13, FOSL said, "Your company has sold the entire business to Flipkart India Private Limited effective on December 31, 2011, by way of a business transfer agreement, wherein all assets, liabilities, brand, technology platforms and systems, employees and business contracts were transferred to FIPL for an agreed consideration. Your company is evaluating various going forward options including the voluntary liquidation."

Guptas, Kirani, Tiger and Accel are part of a group of 40 entities that owned some 56.37 million preference shares in Singapore-based mothership FPL. These preference shares were worth $1.017 billion according to the FPL filings.

Top investors in the preference shares of FPL include Tiger Global, Intervision Holdings, IDG Ventures, Accel, Sofina, Vulcan Capital, DST Asia, DGF Bravo, Erasmic Ventures, Iconiq Strategic Partners, Helion Ventures and several funds of Morgan Stanley and Fidelity.

Private equity experts said the preference shares used by private equity investors come with several clauses and milestones. It was not clear from the public documents what was the price at which these different investors subscribed to these preference shares and the ratio at which these could be converted into equity shares.

Even as the turn of the sentiment has pushed up valuations, Nevgi of Zyfin said, "The key question is whether similar valuations would have been in place back in May-June last year, when sentiments in India were strongly negative. Similar stories of galloping valuations had come up globally in 2000 during the dot com boom and inflicted painful wounds on investors. For investors who have lost money in 2000, it is important to reassess the risk this time more in detail-once bitten twice shy."

Disclaimer: Rediff.com also has an e-commerce business which competes in some areas with Flipkart.