| « Back to article | Print this article |

Can the new IMF chief change its policies?

Since their formation, while the World Bank has always had an American nominee as the head, the International Monetary Fund (IMF) managing director has been from Europe. Within Europe, if French Finance Minister Christine Lagarde becomes the next managing director, as seems likely, this would be the fourth time a French citizen would occupy the position. The only other candidate is the Mexican Central Bank Head, and former deputy managing director of the IMF, Agustin Carstens. He, too, is from an Organisation for Economic Cooperation and Development (OECD) country, but one that has joined the rich men's club fairly recently.

Click NEXT to read on

Can the new IMF chief change its policies?

The far bigger question is to what extent he or she will be able to change IMF's policies, and particularly the market fundamentalist ideology that has been prevalent in Washington over the last three decades.

Click NEXT to read on

Can the new IMF chief change its policies?

For one thing, the Europeans in general and the French in particular have always been far more dirigiste than the Anglo-Saxons. (The last MD was actually the French Socialist Party's candidate for presidency, with every chance of being elected: to be sure, he was a "campaign socialist", very comfortable with the super-rich and Porsche cars than the man or woman on the streets, particularly in the developing world.) But it seems ideology changes with location in Washington.

Click NEXT to read on

Can the new IMF chief change its policies?

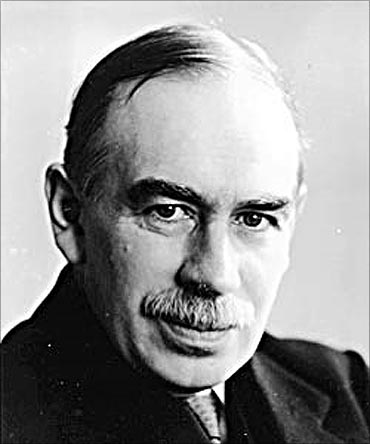

Keynes was also one of the two principal authors of the IMF Articles of Agreement (the other was Harry Dexter White, the American).

During the conference Keynes argued strongly for location of the IMF outside Washington.

Click NEXT to read on

Can the new IMF chief change its policies?

What Keynes feared has come to pass over the last three decades, in particular on the advocacy of unrestricted cross-border capital flows, and its corollary, market-determined exchange rates.

Click NEXT to read on

Can the new IMF chief change its policies?

East Asian economies were accused of crony capitalism after the crisis of 1997-98 - the prime example of crony capitalism is the nexus and revolving door between US Treasury and Wall Street. By the 1980s, with the arrival of president Reagan, market fundamentalism had become the ruling ideology in Washington.

Click NEXT to read on

Can the new IMF chief change its policies?

One wonders to what extent IMF economists, many of them trained in US universities and under the influence of the Chicago School, contributed to the change in stance on the capital account.

Click NEXT to read on

Can the new IMF chief change its policies?

Only the series of crises in the developing world in the 1990s led to an abandoning of the proposal.

Click NEXT to read on

Can the new IMF chief change its policies?

Of the impossible trinity - independent monetary policy, a managed exchange-rate and a liberal capital account - until the Second World War the accepted wisdom was to give up the first, allowing money supply to be determined by the reserves of gold; in the last three decades the IMF has advocated discarding the second, despite a series of crises from Mexico in 1994-95 to Iceland more recently, originating in it; it is high time it seriously looks at giving up the third - and looks at the real economy of growth and jobs a little more seriously.

Click NEXT to read on

Can the new IMF chief change its policies?

To end with the words of one of its founder economists, namely Keynes, "in future, the external value of (a currency) shall conform to its internal value, Secondly, we intend to retain control of our domestic rate of interest, so that we can keep it as low as suits our own purposes, without interference from the ebb and flow of the international capital movements, or flights of hot money."