Photographs: Punit Paranjpe/Reuters Palak Shah in Mumbai

Fact that RIL will get the much required support from another segment like shale gas is a big positive for the stock.

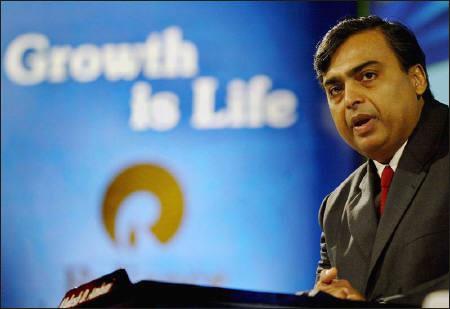

Stock market analysts believe worst may be over for Reliance Industries Ltd. (RIL). The share price of Mukesh Ambani company will get re-rated after it reported better than expected gross refining margins (GRMs), which resulted in increase in profits from core business of refining, higher contribution of profits from shale gas and gave early signals of stability in retail business, said market experts.

"The stock has limited down side but may close this calender year at around its annual high levels of Rs 900," said Deven Choksey, managing director of Mumbai based K R Choksey Shares and Securities.

Click on NEXT for more...

Analysts turn bullish on Reliance

Photographs: Reuters

RIL's share on Monday closed at Rs 823 on the Bombay Stock Exchange (BSE). It had touched a 52-week low of Rs 671 on May 8 this year. Under performance of RIL share price has had a major impact on the overall market sentiment in the country, as the company has a near 10 per cent weight age in the key benchmark equity indices. Analysts had down graded RIL on falling gas out put from KG-D6 basin after several controversies.

The company reported a profit after tax of Rs 5,376 crore (Rs 53.76 billion) for the second quarter of the financial year, which was in line with market expectations.

Though, the profit fell 5.7 per cent in second quarter, analysts said, the company has given positive outlook in business in several fronts.

Click on NEXT for more...

Analysts turn bullish on Reliance

Photographs: Reuters

Choksey says, the fact that RIL will get the much required support from another segment like shale gas is a big politive for the stock. "Profits from shale gas has contributed more from KG-D6.

The shale gas bet of the company seems to be promising.

In US it is one of the fastest growing business since 30 per cent of domestic gas production in US comes from shale. If RIL develops this segment along with its other core areas, the stock will be a fine fundamental play. Also, the company has said that the retail business which is in losses, is likely to break-even by next year."

Click on NEXT for more...

Analysts turn bullish on Reliance

Photographs: Punit Paranjpe/Reuters

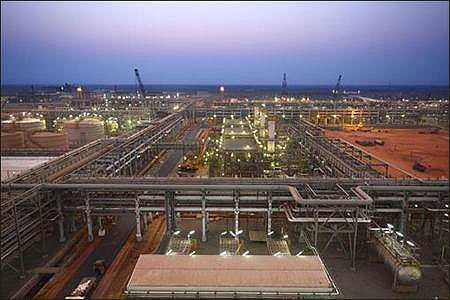

For RIL the US H1 shale gas output tripled for the quarter. The segment contributed profit of around Rs 1,000 crore (Rs 10 billion) in earnings before interest tax on a consolidated basis, which is more than earnings coming from KG-D6 that contributed around Rs 800 crore (Rs 8 billion).

RIL's revenue from oil and gas business was down 36.7 per cent to Rs 2,254 crore (Rs 22.54 billion) on back of fall in natural gas output from KG-DG, which was largely believed to be on the back of government's decision to not review the gas price in country.

Click on NEXT for more...

Analysts turn bullish on Reliance

Photographs: Suzanne Plunkett/Reuters

Shale gas is natural gas formed from being trapped within shale (rock) formations. It has become an increasingly important source of natural gas in the United States over the past decade, and interest has spread to potential gas shales in the rest of the world.

Another RIL analyst S P Tulsian said, "Improvement in the company's core business itself is a major positive for the stock. Going ahead, the petro chemicals business too is expected to improve, which could be a direct boost to the company's bottom line."

Click on NEXT for more...

Analysts turn bullish on Reliance

Photographs: Claudia Daut/Reuters

GRMs for the second quarter were reported at $9.5/bbl versus $7.6/bbl by RIL. "Before looking to anything else, analyst would see that RIL's GMR is better than Singapore GMR, which is the standard benchmark for the industry.

Don't be surprised if foreign brokerages revise their outlook on the stock based on this,' said Kishor Ostwal, managing director of CNI Global Research.

GMR is a way to represent the economics of a refinery. It is the difference between crude oil price and total value of petroleum products produced by the refinery.

Click on NEXT for more...

Analysts turn bullish on Reliance

Photographs: Reuters

However, Tulsian believes that controversy of KG D6 may not take a back seat. Media reports have suggested that RIL and its partner British Petroleum (BP) have not been successful in finding gas in 9 out of 22 wells approved by the government for their exploration in Andhra Pradesh based Krishna-Govaderi basin.

Also, the government has not agreed to RIL's demand to revise upwards the gas price. BP had invested $ 7.5 billion to buy a 30 per cent stake in RIL's KG-D6 venture.

Now, it is believed both the companies will together work for importing LNG gas in India, which has been yet another grey area for other companies due to controversy on several issues, said experts.

article