Foreign institutional investors (FIIs) have a reason to worry because the falling rupee is putting at risk the $100 billion they have pumped into Indian equities since 2009. Over the last two weeks, what has surprised everyone is the manner in which “quality stocks” have cracked.

In the worst of times, stocks such as ITC and HDFC Bank have held on because of their safe haven status. With the rupee’s fall, the dollar returns for foreign investors have declined meaningfully.

On August 22, CLSA’s celebrated strategist Chris Wood wrote in his weekly note ‘Greed and Fear’ that the rupee’s devastation meant that, in US dollar terms, the long-term investment returns for foreign holders of the likes of HDFC and ITC have declined dramatically.

The selling seen in the last couple of weeks seems to suggest that FIIs have been selling the so-called quality stocks to prevent a further erosion of capital values.

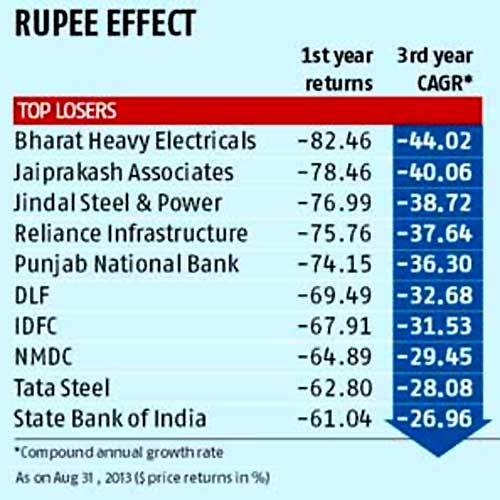

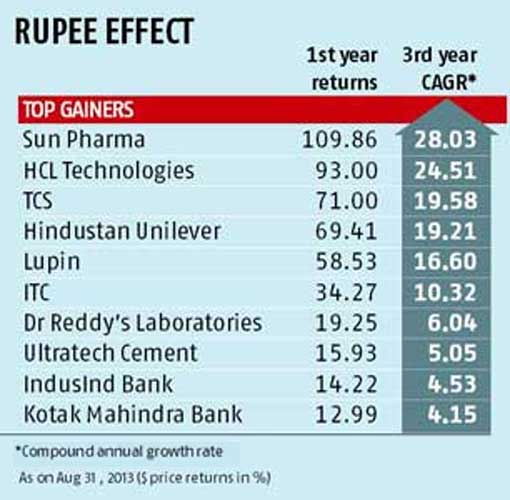

about the best and worst performing stocks...

Since August, ITC has fallen 12.18 per cent, Housing Development Finance Corp 11.36 per cent and HDFC Bank 7.13 per cent. These stocks have fallen between 23 and 30 per cent from their peaks.

CLSA’s strategy note, dated August 29, says with relatively safe stocks falling from their peaks, the risk of outflows has increased.

The Nifty 50 companies have delivered compounded annual returns, negative returns and over the five years, even the safe stocks have given single digit returns.

Compounded annual returns of the Nifty 50 companies over the three years are -10.42 per cent. In dollar terms, only 12 Nifty companies have given positive compounded returns over the three years, while 38 companies have given negative returns.

...

Dollar returns over the last one year are much worse. CLSA’s strategist Chris Wood says the compound annual average return over five years of an owner of these two stocks in dollars terms (HDFC and ITC) is now only four per cent and 20 per cent, respectively, compared with 13 per cent and 30 per cent in rupee terms.

Dhananjay Sinha, head of institutional equities at Emkay Global, believes the recent mayhem is indicative of the currency risk that foreign investors are facing. He adds India has become even more unattractive after the outperformance of developed markets.

The abysmal sales growth of three per cent during the first quarter of this year and a contraction in earnings imply that returns of Indian equities are unlikely to return to pre-crisis levels anytime soon. That’s a good enough reason to sell India.

...

The performance of blue chips also indicates the earnings stress. Only a handful of Nifty companies have consistently given positive returns over three years and most of them are either pharmaceutical or technology companies.

UltraTech Cement and Tata Motors are an exception to this rule as both these companies have generated positive returns over the last three years.

Since the Lehman crisis broke out in September 2008, FIIs have crowded into marquee stocks in the consumer, software services and banking sectors. Despite the premium that these stocks have commanded, FIIs have pumped in $100 billion into Indian equities since 2009, taking their overall stake in listed stocks to an all-time high of 22 per cent.

...

If this class of investors sees that the value of their investments is diminishing, they will want to cut their losses by selling these quality names. Also, with developed economies recovering from a prolonged slowdown, foreign investors may not be content with single digit returns from risky markets when they can earn risk-free returns from their home markets.

Rakesh Arora, managing director and head of research at Macquarie Capital Securities, says falling dollar returns is a big factor that determine foreign investments and if dollar returns are falling, then those stocks FIIs may want to sell can be sold easily.

Despite the risk, Arora is not overtly worried about a massive sell-off as Macquarie Capital expects the US Federal Reserve’s tapering programme to be only symbolic, if it starts in September. Also, interest rates are expected to remain low in the US till 2016, as recovery will be slow and tardy.