| « Back to article | Print this article |

7 great growth stock bargains

That picking stocks is a combination of both art and science is not a secret anymore, but picking value in the stockmarket remains as difficult as ever.

In fact, since the beginning of 2008, things have become a little more complicated for investors. First, the markets went into a tailspin, cutting value of a normal portfolio by at least half.

In 2009, markets doubled, leaving the most cautious investors waiting on the proverbial fence. The common theme, both on the downturn and the up move, was uncertainty and fear, and it still is, though the focus has now shifted from the United States to Europe.

Greece, for example, was saved from the brink of defaulting on its debt. Similarly, market confidence in countries like Spain, Italy and Portugal has also deteriorated. Although a rescue plan by the European Union, along with the International Monetary Fund (IMF), has been put in place, high debt in the region will continue to haunt the markets for a while.

So, having seen the full 360 degree view of the market in just two years, should you be in or out of the market?

Click NEXT to find out. . .

7 great growth stock bargains

Markets are mostly uncertain in the near term, but given the kind of resilience the Indian economy showed during the global financial crisis and with the robust medium to long-term outlook, Indian equities are expected to continue to perform well.

However, this confidence does not mean that there will be no volatility in the short term. In fact, Outlook Money has always advised investors to enter stockmarkets with at least a three-year horizon, and the longer the better.

Now, based on a combination of art and science, highlighted here are seven growth stocks for a long-term portfolio.

Past and Future

In the stockmarket, past performance is no guarantee of future results, but it does not take away the relevance of history. It helps you cut away the hype around a stock or sector. Investors following this principle avoided the tech bubble a decade ago, and are in a much better position in the upswing, as stocks backed by strong numbers are reaching new highs.

But investors do get carried away by future earnings projections and want to catch the next hot stock. Interestingly, according to a study, analysts making earnings projection two years in advance are wrong over 90 per cent of the time.

So the idea here is not to suggest the next multibagger, but to highlight stocks with proven track records which will most likely keep delivering in the medium-to-long term. History is full of examples of what exciting ideas and exotic investing have done to the world of finance, from the seventeenth century Tulip Mania to the latest property bubble.

Click NEXT to find out. . .

7 great growth stock bargains

On the other hand, legendary investors like Warren Buffett and Benjamin Graham created wealth by sticking to the basics.

Simple parameters. The first thing that we looked at while selecting stocks was growth. We looked at three-year compounded annual growth rate (CAGR) in both topline and bottomline for all the companies listed on the Bombay Stock Exchange.

To avoid small companies, we removed those with market caps under Rs 1,000 crore (Rs 10 billion). Although it's a good idea to find value in smaller companies as it is easier for them to grow faster because of their lower base, in markets where safety is an issue with investors, it makes more sense to hold relatively big and known names.

Also, smaller companies are often not researched well by analysts and it becomes difficult to take a call when something goes wrong.

Valuation. Finding a good company with a decent track record is only half the job. It is equally important to figure what kind of price you are paying for it.

Here price is not the absolute price of the stock, but in relation to earnings per share. We removed all the companies trading in excess of 20 times past twelve month's earnings. Also, to qualify in our list of finalists, the growth in profits had to be significantly higher than the price earnings multiple (PE).

The benefit of having such stocks is that as the market discovers the earnings momentum, the PE expands to match the earnings growth. But if there is a broader selloff in the markets, growth-valuation mismatch will restrict the fall.

Click NEXT to find out. . .

7 great growth stock bargains

Margins. Healthy profit margins are important for businesses. They not only indicate the ability of the company to price its products or services, but also shows how well a company is placed through phases in the business cycle.

A very low profit margin also means that the business is excessively competitive and can restrict future growth.

Other factors that went into picking companies include return on the capital employed, net worth and historical record of price multiples. We also ensured that returns on investment do not rely too heavily on income from "other sources" that are not part of its core operations, and so on.

Even after all these criteria, we were left with a fairly big list. Interestingly, a large number of banks and financial institutions qualified and many of them made the final cut but we left the banks out as we featured five of them in our last issue.

Click NEXT to find out. . .

Margins. Healthy profit margins are important for businesses. They not only indicate the ability of

Living dreams

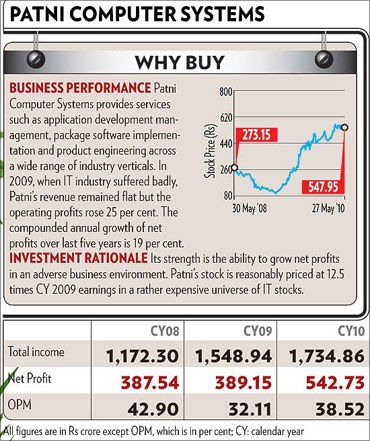

These seven stocks do not necessarily share any underlying theme, but some of them do have similar stories in a very different kind of way. If people like N.R. Narayana Murthy and Nandan Nilekani left Patni Computer Systems in early eighties to live their dream with Infosys Technologies, following in their footsteps, the stars of Wipro went on to found MindTree in the late nineties.

Patni Computer Systems did suffer the loss of, perhaps, it's most valuable assets and it remains less than one-tenth of size of Infosys in terms of market cap. But with change in management, it looks like it is getting ready to do the catch-up. The net profit for Patni has grown in excess of 38 per cent CAGR in last three years.

The company has developed a strong ability to protect profits, as it is constantly increasing the share of fixed price projects. Also, better relations with clients is paying off, as it now earns 90 per cent of its revenue from existing clients.

Although Infosys continues to be the darling of the markets, maintaining momentum with its size can be problem.

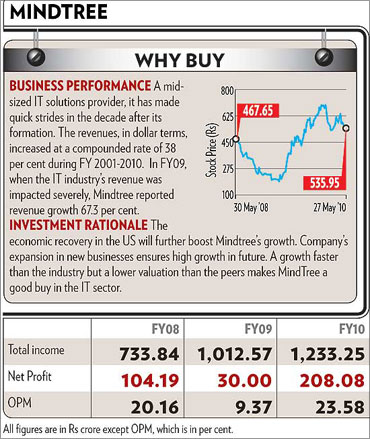

Over a decade after Infosys became a million-dollar idea, Ashok Soota, Subroto Bagchi and a few of their friends from Wipro came together to form MindTree.

The idea was simple -- everything in the 21st century will either be software enabled or constrained. The idea was put to work, a few other like-minded professionals joined hands, funding was arranged and today, MindTree is a well-respected midsized information technology (IT) company, though still significantly smaller then Wipro.

But with over 30 per cent CAGR growth in past three years, the idea called MindTree holds promise.

Click NEXT to find out. . .

7 great growth stock bargains

Financing dreams

While in the IT business people went on to live their dreams, three other companies which made our list are helping other people fulfil theirs.

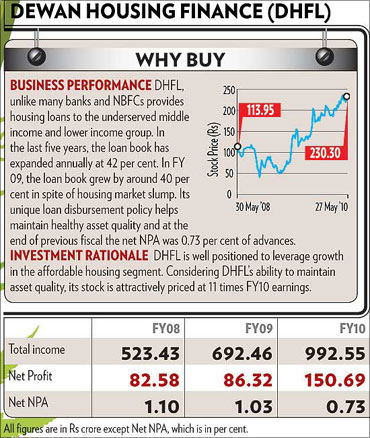

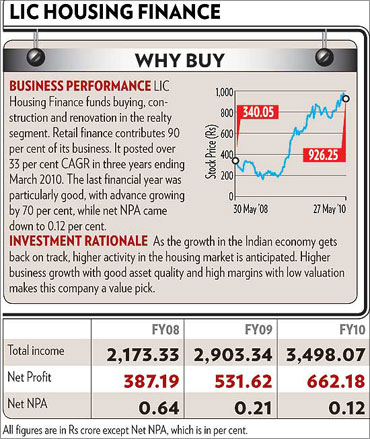

LIC Housing Finance and Dewan Housing Finance Corporation are financing homes for Indians, while Shriram Transport Finance Company is helping small entrepreneurs buy commercial vehicles, largely pre-owned. Interestingly, despite being in the financing business, none of them suffered any major setback in the recent downturn.

Dewan Housing saw the benefit of being in the affordable housing segment long back. Its focus on the tier-II and tier-III cites helped it grow even in bad times. Asset quality was maintained as loan ticket sizes were small. LIC Housing Finance, promoted by the Life Insurance Company of India, also maintained a robust loan disbursal rate without compromising on asset quality.

Non-performing assets have come down significantly, while the net interest margin improved by over 3 per cent in the last quarter. Although the company has interests in the commercial space, its focus is on retail, which has worked well for the company.

Click NEXT to find out. . .

7 great growth stock bargains

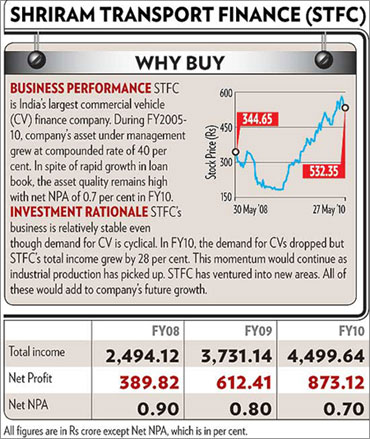

With the economy improving, both areas look poised to reap benefits. Shriram Transport Finance Company is similar to housing finance companies in more than one way. Apart from maintaining good growth and asset quality, the focus is on small borrowers.

The company is primarily engaged in financing pre-owned commercial vehicles. That means smaller loan sizes and better repayment track records. The focus area helped the company to overcome the downturn. While sales went down significantly for new commercial vehicles, the second-hand market did not suffer as these vehicles are used in the shorter routes and largely by traders carrying essential commodities, which was not affected by the slowdown.

In order to maintain better quality of lending, the company has devised a formula. Fifty per cent of the salary of field officers is linked to the receivables, which automatically means better lending practices.

Click NEXT to find out. . .

7 great growth stock bargains

However, these non-banking financial companies have major disadvantage compare to banks as they do not have access to low cost saving and current account deposits.

On the other hand, unlike banks, their advantage is that they do not have to put a quarter of their assets in low-yielding government bonds.

Infrastructure plays

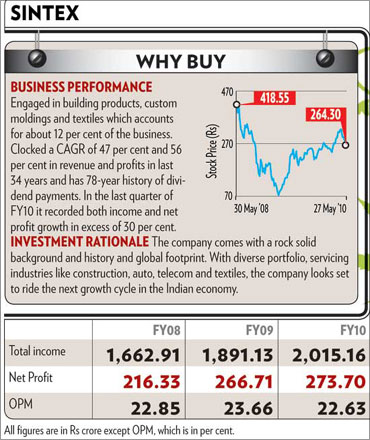

The last two companies come from the infrastructure sector. Sintex Industries' legacy dates back to 1931. Power Finance Corporation is a state-owned company established in 1986 to finance the growth of the power sector.

Sintex has exposure to building products, custom moldings and textiles. While in plastics the company's growth comes from automotives and electrical accessories, in textiles it supplies brands like Armani, Diesel, Van Heusen and Arrow. The company has an impressive track record of creating value for its shareholders.

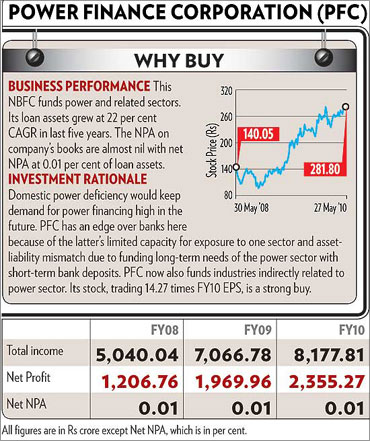

If Sintex is tapping manufacturing for ever-rising needs of the Indian economy, Power Finance Corporation is financing power companies to deal with the power deficit in the country and has now diversified into financing raw material and equipment makers in the segment.

The company faces competition from banks, but the asset-liability mismatch in funding long-term power projects by banks is an advantage for PFC. Also, the liabilities for the company is at fixed cost and its assets are at floating cost, which helps maintain margins.

Given the kind of power shortage the country is facing currently, there will be much higher level of activity in the near future, and most of the power projects are financed by a combination of debt and equity, with debt being the major portion, PFC will be the preferred choice.

These stocks have been selected on past performance and medium-term future growth prospects. This doesn't mean they will not be subject to wider market volatility, but their strong credentials will help them deal with short-term ups and downs and deliver reasonably good returns in the medium-to-long term.