| « Back to article | Print this article |

RBI shifts inflation goalpost to Jan 2016

Reserve Bank of India Governor Raghuram Rajan has managed to divide economists yet again.

While nobody was expecting RBI to cut rates on Tuesday, the stance was expected to be more accommodative. RBI's 'balanced' commentary has left enough room for interpretation.

The two key takeaways from the current policy statement would be: RBI's attempt to anchor inflation expectations; and, to nudge the government towards fiscal consolidation by further cutting the government's captive borrowing base.

RBI has now shifted the inflation goalpost to January 2016 by setting a target of six per cent for the headline inflation print.

This has confused the market.

Please click NEXT to read further. . .

RBI shifts inflation goalpost to Jan 2016

While many believe RBI has kept the door open for rate cuts later this year, others believe it is in for a prolonged pause.

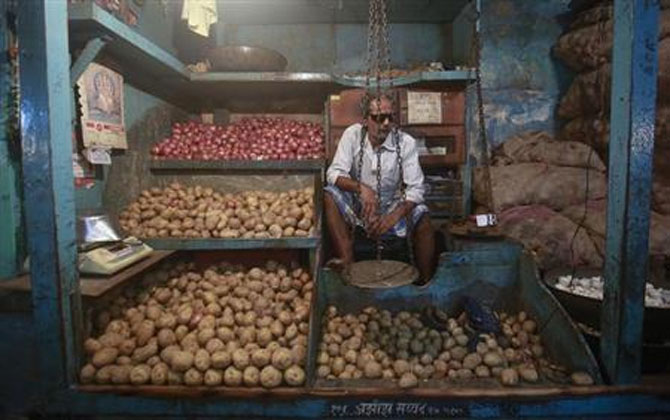

While RBI is on track to meet its inflation target of eight per cent in January 2015, there are plenty of upside risks to prices, especially if growth picks up and supply-side responses are not adequate.

If the revival in monsoon continues and crude prices trend lower, Fredric Neumann of HSBC Global Research believes RBI can easily meet its January 2015 consumer price index target of eight per cent.

Please click NEXT to read further. . .

RBI shifts inflation goalpost to Jan 2016

In contrast, Sonal Varma of Nomura believes RBI might remain on a prolonged pause, even if inflation undershoots the central bank's first milestone of eight per cent by January 2015.

In contrast, Sonal Varma of Nomura believes RBI might remain on a prolonged pause, even if inflation undershoots the central bank's first milestone of eight per cent by January 2015.

RBI is unlikely to ease unless there is visibility of attaining and sustaining the next target of six per cent by January 2016, she adds.

Please click NEXT to read further. . .

RBI shifts inflation goalpost to Jan 2016

Others believe the government's expansionary Budget statement is unlikely to help inflation.

The 50-basis point cut in statutory liquidity ratio net demand and term liabilities has to be read in that context.

Given that holdings of public-sector banks under SLR is higher at 25 per cent of NDTL and held-to-maturity securities at 22 per cent are well below new limit, this gesture may seem symbolic, but the RBI is expected to persist with this move in the coming quarters, too, such that it brings the government's borrowing costs closer to market rates.

Please click NEXT to read further. . .

RBI shifts inflation goalpost to Jan 2016

Dhananjay Sinha, economist and strategist at Emkay Global, believes SLR requirements have created an artificial demand for government securities and, hence, acted as artificial softening impact on the yields.

"As RBI curtails this artificial demand for bonds, it will not only help build a market-determined yield curve for G-Sec, but consequently also impact pricing of the products, which are priced based on G-Sec yields but also work as a check on the fiscal deficit given there will be no pre-emptive funding of the same available."