| « Back to article | Print this article |

EMIs likely to go up as RBI raises repo rate by 25 bps

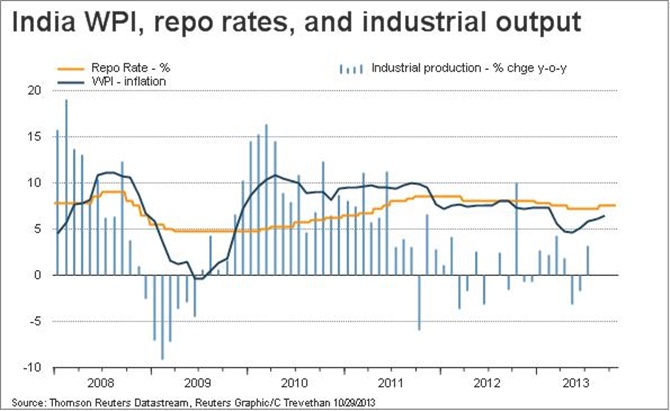

The Reserve Bank of India (RBI) raised its policy interest rate for the second time in as many months on Tuesday, warning that inflation is likely to remain elevated for the rest of the fiscal year, and rolled back an emergency measure put in place in July to support the slumping rupee.

The central bank lifted its policy repo rate by 25 basis points (bps) to 7.75 percent, in line with the expectations of most analysts in a recent Reuters poll, despite the risks to an economy beset by sluggish growth.

"Overall WPI (wholesale price index) inflation is expected to remain higher than current levels through most of the remaining part of the year, warranting an appropriate policy response," RBI Governor Raghuram Rajan said in his review.

Click here for details of Second Quarter Review of Monetary Policy...

Click NEXT to read more...

EMIs likely to go up as RBI raises repo rate by 25 bps

With the rupee having stabilised, the RBI lowered its Marginal Standing Facility (MSF) rate a further 25 bps to 8.75 percent, which eases liquidity in the banking system by lowering the cost of borrowing for lenders.

Rajan, a high-profile former chief economist at the International Monetary Fund, took office in early September and stunned markets in his first policy review just weeks later by raising interest rates to combat fierce price pressures dogging Asia's third-largest economy.

"Today's move was a follow-through of the hawkish September policy guidance as high and persistent inflation is seen as an impediment to the medium-term growth outlook," said Radhika Rao, economist at DBS in Singapore.

Click NEXT to read more...

EMIs likely to go up as RBI raises repo rate by 25 bps

"The new policy approach is a single-minded focus to contain inflationary expectations, with or without support from fiscal policy," she said.

India's benchmark 10-year bond yield dropped as much as 6 basis points from before the policy statement to 8.58 percent. The rupee trimmed earlier losses to trade flat on the day.

The BSE Sensex extended gains while the banking share index rose nearly 2 percent.

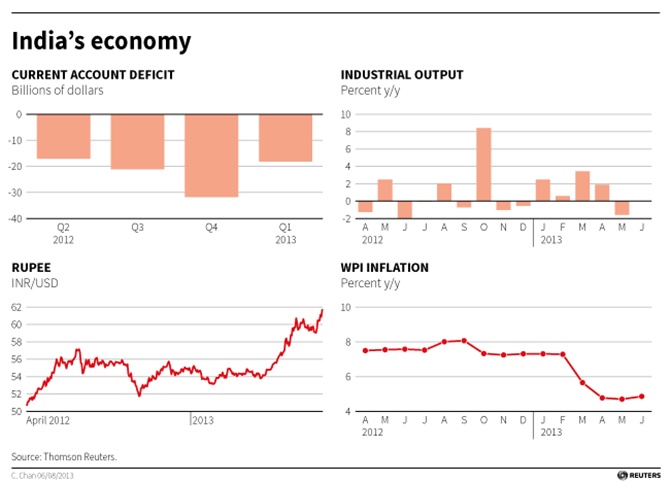

Annual food inflation accelerated to 18.4 percent in September, its highest since mid-2010, pushed up by prices of vegetables including onions and stirring public discontent ahead of national elections which must be held by next May.

Click NEXT to read more...

EMIs likely to go up as RBI raises repo rate by 25 bps

India's economy grew at 4.4 percent in the June quarter, the slowest since early 2009. The 5 percent growth rate recorded in the last fiscal year through March was the weakest in a decade.

The RBI expects the economy again to grow at 5 percent in the current fiscal year that ends in March.

The headline wholesale price index (WPI) unexpectedly hit a seven-month high in September of 6.46 percent as food prices surged, while the consumer price index jumped an annual 9.84 percent.

The RBI said on Tuesday it would remain above 9 percent in the coming months "absent policy action."

Annual food inflation accelerated to 18.4 percent in September, its highest since mid-2010, pushed up by prices of vegetables including onions and stirring public discontent ahead of national elections which must be held by next May.

Click NEXT to read more...

EMIs likely to go up as RBI raises repo rate by 25 bps

The rupee slumped to record lows in August, at one point sliding some 20 percent for the year, on concerns about the country's gaping current account and fiscal deficits, and as global investors dumped emerging market assets for fear the U.S. Federal Reserve was set to start tapering its massive stimulus programme.

To halt the slide, the RBI had jacked up the MSF by 200 bps in July.

It rolled back 75 bps of that at its September 20 review and another 50 bps earlier this month. Tuesday's MSF rate cut returns the gap between the repo and MSF rates to the usual 100 basis points.

© Copyright 2024 Reuters Limited. All rights reserved. Republication or redistribution of Reuters content, including by framing or similar means, is expressly prohibited without the prior written consent of Reuters. Reuters shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.