| « Back to article | Print this article |

RBI downplays money laundering charges

The Reserve Bank of India on Thursday sought to downplay the money-laundering allegations against three private sector banks, saying the country has a 'perfect' system to prevent such offences and that not a single such transaction took place in the sting operation.

The country's three largest private banks -- ICICI bank, HDFC Bank and Axis Bank -- were last week accused of indulging in money laundering both within and outside with an online portal, Cobrapost, claiming that the sting operation conducted by it had revealed a scam.

Click NEXT to read further. . .

RBI downplays money laundering charges

"Allegations do not mean flouting norms.

"There is not a single transaction which has taken place. KYC violations will happen in any system.

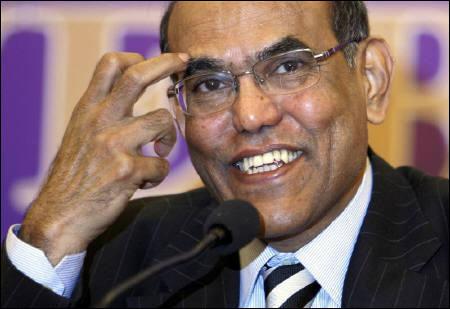

"These are all transactional issues and have nothing to do with money laundering," Deputy Governor KC Chakrabarty told reporters after a meeting with bankers in Mumbai.

He was responding to a question on the issue.

The senior most Deputy Governor further said, "there is no scam (that) has happened...as no transaction has taken place."

"Let us not unnecessarily downgrade ourself.

"Our system to prevent money laundering is perfect, absolutely nothing (wrong with it)," he said.

Click NEXT to read further. . .

RBI downplays money laundering charges

Chakrabarty also said RBI will further tighten the anti-money laundering norms if needed.

"If we find there is a need to further tighten any guidelines, we'll do that."

The comments come even as the RBI, Finance Ministry and the banks concerned are probing the allegations that some officials of these banks offered to facilitate money laundering.

On March 14, Cobrapost had released the contents of purported video recording of officials of HDFC, ICICI and Axis Bank allegedly agreeing to receive unverified sums of cash and put them in their investment schemes and benami accounts in violation of anti-money laundering laws.

Click NEXT to read further. . .

RBI downplays money laundering charges

Following the allegations, the banks had also suspended some employees in question.

RBI has also initiated scrutiny of the three banks for alleged violation of KYC guidelines. It has said final reports will be completed by March 31 and thereafter further course of action as necessary will be initiated.

The footage, taken in 'Operation Red Spider', purportedly showed some executives of the three banks verbally agreeing to take huge amounts of cash from the undercover reporter and putting them into a variety of long-term investment plans so that the black money ultimately is converted into white.

Click NEXT to read further. . .

RBI downplays money laundering charges

Meanwhile, Chakrabarty admitted that some people may not be paying taxes and some such money flows into the system.

"We have given sufficient instructions to banks (about) how to avoid this. Our people have gone for scrutinising, not only these three banks, but we do it for all other banks," he said.

He also sought to distinguish between money laundering and black money, saying they were two different things.

On the likelihood of other irregularities like flouting of KYC norms and suspicious transactions, he said there are sufficient guidelines to prevent them and banks are following them.

Click NEXT to read further. . .

RBI downplays money laundering charges

"All our successive FSR (financial stability report) are highlighting that we have serious concern over bank branches selling gold coins, mutual fund products, insurance. . .it involves multiple regulators, it involves KYC (Know Your Customer) requirements.

"We are going for a large scale financial inclusion drive, if we make KYC too stringent, then banks will not open the accounts," Chakrabarty said.

"You don't need a sting operation to show that in this country, people have black money. Some black money remains in bank accounts, for that do you require to have a sting operation?" he said.

Stating that the country has good rules and regulations, he said some stray incidents or allegations don't make India's system bad. "We don't make it as a systemic issue," he added.