| « Back to article | Print this article |

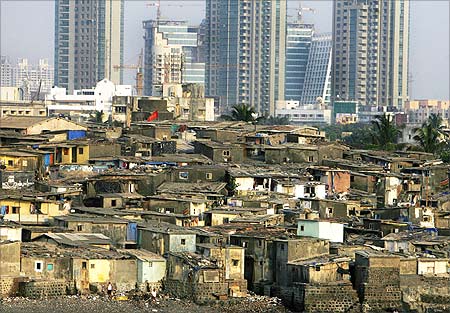

Rate rise may hurt demand for office, retail space

Realtors are in for a double whammy.

The rise in interest rates is not only making homes and equated monthly instalments dearer for buyers, coupled with an anticipated slowdown in the economy, it would hurt demand for commercial real estate as well.

Also, the rising interest rates will push up project costs, making them less attractive for developers.

Akash Deep Jyoti, analyst with credit-rating agency Crisil, feels higher interest rates could slow down the economy, which would reduce the requirement of office space.

Click NEXT to read further. . .

Rate rise may hurt demand for office, retail space

"Since companies would be under pressure to cut costs, they would move away from high-cost central business districts to areas with lower rents."

He feels the trend will accentuate in a slowdown and companies could move from Noida to Greater Noida, Gurgaon to Greater Gurgaon (Manesar, new Gurgaon).

"You can't do anything about commodity prices or power costs, but real estate is an easy focus area," he said.

The movements away from CBDs happened when the economy does not do well.

Rate rise may hurt demand for office, retail space

Higher interest rates will push up project costs and hurt their valuation, which could make these less attractive to developers.

Unlike a residential project, which is funded largely through customer advances, commercial projects have to be funded through a mix of debt and equity.

An investor buying into such a project would value it based on its discounted cash flows and expected yields.

"When interest rates go up, the discounting will take place at a higher rate. The overall expectation of the yield goes up and valuation comes down," said another analyst.

Click NEXT to read further. . .Rate rise may hurt demand for office, retail space

With rentals still under pressure, as there's an over-supply across micro-markets, developers could go slow on new commercial projects in hand, which could hurt supply in the future.

Anshuman Magazine, chairman and managing director of CB Richard Ellis, South Asia region said, "The rate rise would have a medium to long-term impact on the supply side in commercial real estate, resulting in project delays. The impact will be felt after a time lag, maybe in another 12 to 14 months or so," he said.

Click NEXT to read further. . .

Rate rise may hurt demand for office, retail space

"This is because there's an over-supply in the IT side. A lot of that supply has to be absorbed before there's a crunch," he said.

"Developers will face some pressures in terms of fund cost.

"They would be inclined to pass on some of the cost to the end user.

"But given the current supply situation, which in most markets is higher than demand, this may not be possible. Thus, rental values are expected to remain stable," said Kaustuv Roy, executive director, India Cushman & Wakefield.

Anshul Jain, CEO, DTZ India feels the rising interest rates will impact both demand and supply, and new product launches will slow down.

Click NEXT to read further. . .

Rate rise may hurt demand for office, retail space

"This is not necessarily a bad thing as it would help resolve over-supply issues that India has been facing in the commercial sector," he said.

Rising rates may slow down economic activity and hurt demand for commercial realty.

Many developers bet on the commercial segment to cushion them against a fall in home sales.

After facing input-led cost pressures and poor sentiment in the residential segment, builders had clearly not budgeted for the blues on commercial segment.