| « Back to article | Print this article |

Public sector banks declare war on corporate defaulters

Fed up with a profitable textile company's failure to repay its loan, UCO Bank has taken its grievance public, placing newspaper ads last month that brand the industrialist owner of S. Kumar's Nationwide Ltd a defaulter.

State Bank of India (SBI), Bank of India Ltd and Bank of Baroda are also preparing to name and shame corporate borrowers which are not paying them back, bank executives told Reuters.

This aggressive tactic for dealing with bad debt marks a major departure from the traditional laid-back approach of Indian state lenders.

Weighed down by stressed loans of nearly $150 billion - equivalent to more than 10 per cent of bank assets in the country - and against a backdrop of the slowest economic growth in a decade, Indian banks are bringing an unprecedented intensity to their recovery efforts.

"We are going hammer and tongs to recover loans," said M.S. Raghavan, executive director at Bank of India, which last year began opening debt recovery branches to pursue defaulting borrowers.

Click NEXT to read more...

Public sector banks declare war on corporate defaulters

In the banks' arsenal of debt recovery tools are the power to seize and sell assets, take deadbeat borrowers to court, sell loans to investors, and beef up debt recovery teams, although a slow-moving legal system and the lack of a bankruptcy process limit their effectiveness.

Officials at state banks, which account for about three-quarters of lending in India, expect the push will cut bad loan ratios by at least 1 percentage point.

Bank of India's non-performing loan (NPL) ratio improved slightly to 2.99 per cent of total assets at end-March from 3.08 per cent at end-December.

"If we don't intensify, nothing is going to come to us," Raghavan said.

Traditionally, Indian lenders, especially those controlled by the government, have tried to nurse customers through tough times by easing terms or "evergreening" loans - giving new loans to pay old ones - an unlawful practice that many in the industry say is common.

Click NEXT to read more...

Public sector banks declare war on corporate defaulters

In a country where businesses thrive on personal relationships, Indian banks have typically avoided involving the courts or liquidating assets - time-consuming efforts which often yield only minor results.

Even the so-called "fast-track courts" for banks, formed in the last decade, can take more than two years to resolve a case.

The central bank has called for better management of bad debts, and wants to strengthen oversight by lenders.

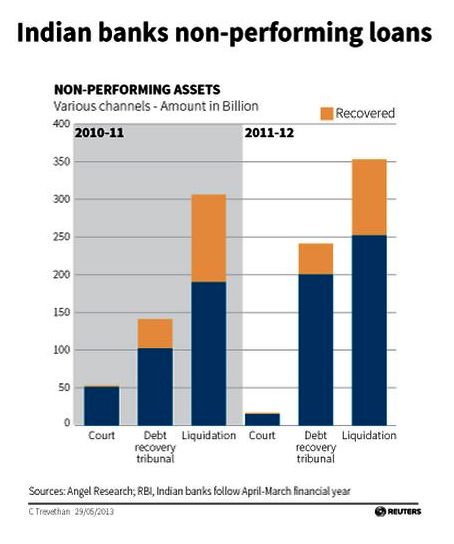

Banks tried to recover on $10.9 billion in bad loans but managed just a quarter of that through liquidation and lawsuits in the year ended March 2012, the latest data from the central bank shows.

Banks are particularly needled by business chiefs who sit on huge personal fortunes, but whose companies fail to repay loans.

Click NEXT to read more...

Public sector banks declare war on corporate defaulters

In March, Finance Minister P. Chidambaram asked state banks to move against rich "promoters" to recover loans from failing companies after a $1.4 billion default by Kingfisher Airlines Ltd, controlled by liquor baron Vijay Mallya.

Targets and Texts

S. Kumars and its Reid & Taylor clothing brand, well-known in the country thanks to its endorsement by Bollywood superstar Amitabh Bachchan, owes $19 million to UCO Bank, according to the Kolkata-based lender's newspaper ad.

Another lender, SBI, in May sent a liquidation notice to S. Kumars and Reid & Taylor, said Soundara Kumar, head of the bank's stressed assets management division.

S. Kumars and Reid & Taylor founder Nitin Kasliwal did not respond to several phone calls from Reuters.

S. Kumars earned net profit of 865 million rupees in the nine months to December, according to a stock exchange filing.

Click NEXT to read more...

Public sector banks declare war on corporate defaulters

"What we are now beginning to see is incidents of such prosperous promoters and sick companies are increasing. What we have tried to do is simply send a message across," said a senior executive at UCO in Mumbai, speaking on condition of anonymity because they were not permitted to talk to the media.

There is some evidence that public outing as debt dodgers can goad a company into action.

United Bank of India took out a newspaper ad in April to say pharmaceutical packaging firm Bilcare Ltd's outstanding Rs 51 crore (Rs 515 million) loan was in default.

Bilcare later said in a stock exchange statement that it was in touch with lenders and was trying to restructure its loan.

Such methods are likely to become more popular, given the absence of a formal bankruptcy law, and the great time and cost of pursuing collection in court.

Click NEXT to read more...

Public sector banks declare war on corporate defaulters

"Our legal systems move very slowly. We have such a huge number of pending cases in the courts that we are unable to lay our hands on assets that we can recover from," said Shubhalakshmi Panse, chairwoman of state-run Allahabad Bank.

Bankers say errant borrowers often manage to get stay orders from various courts, slowing down the recovery process, and most cases take over two years to be resolved.

Panse said she has given daily loan recovery targets to bank officers and branch managers across India. They send her a text message each day apprising her of the status of those targets.

If borrowers want to stay out of court, they can try the Corporate Debt Restructuring (CDR) Cell, where banks sought to restructure a record $16.6 billion in loans in the year that ended in March 2013, an increase of 38 percent year-on-year.

Click NEXT to read more...

Public sector banks declare war on corporate defaulters

Worried that CDR enables both borrowers and banks to escape from bad loans too lightly, the central bank has asked lenders to set aside more money in reserve against restructured loans and begin classifying them as bad, starting in 2015.

In a rare case, lenders recently rejected a proposal by outsourcing firm Spanco Ltd to restructure a Rs 1,300 crore (Rs 13 billion) loan through CDR.

Even the powerful Vijay Mallya could not hold Kingfisher's creditors at bay forever. After threatening to do so for months, banks began liquidating collateral for the airline's loans in March, more than a year after its initial default.

"Trying to be tough is a good step given that whatever they have been doing in the past has not been working," said Ismael Pili, banking analyst at Macquarie Securities in Hong Kong.

© Copyright 2024 Reuters Limited. All rights reserved. Republication or redistribution of Reuters content, including by framing or similar means, is expressly prohibited without the prior written consent of Reuters. Reuters shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.