| « Back to article | Print this article |

Pre-election markets are likely to stay positive

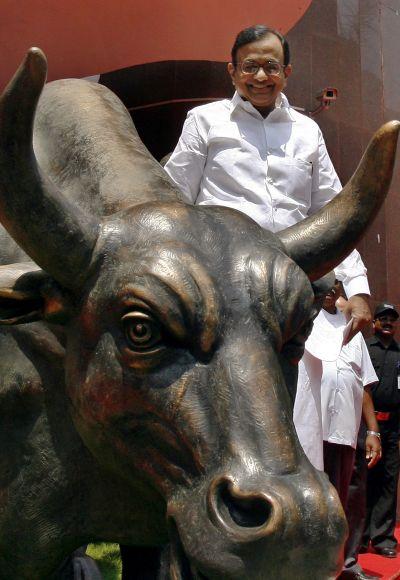

Many market participants subscribe to a version of Pascal’s Wager, where they substitute ‘bull market’ for ‘God’.

If there’s a bull market, those who believe in it, profit.

The difference is that, if there’s no bull market, those who believe in it could lose.

This is unlike the classic Pascal Wager, where the believer loses nothing if there’s no God.

The election schedules have turbocharged the expectations of foreign institutional investors, who believe in Indian bull markets.

There will be nine phases of voting through five weeks of April-May.

There could be a new government in charge by May-end.

Click NEXT to read further. . .

Pre-election markets are likely to stay positive

In the four sessions since the elections were announced, the major market indices have zoomed five per cent, hitting new all-time highs.

The FIIs have pushed nearly Rs 5,000 crore (Rs 50 billion) into Indian equities.

The dollar has dipped to three-month lows, falling below the Rs 61-mark for a while, due to the flood of dollars coming into Indian equity.

This wave of optimism may last until the election results.

At that stage, the bullishness might intensify if a Bharatiya Janata Party-led government does come to power with a stable majority.

Or, there may be massive outflows if expectations are belied and the 16th Lok Sabha is hung, or a less ‘growth-friendly’ political formation comes to power.

Click NEXT to read further. . .

Pre-election markets are likely to stay positive

There are a few interesting points.

Domestic institutions are moderate net-sellers in March -- domestic institutional investors don’t seem to be as optimistic as the foreign institutional investors.

Second, domestic retail seems to be cautious as well since the bull run is less pronounced in smallcaps.

If DIIs and retail turn optimistic, then that would add more firepower to the bull run.

There is also some rotation across sectors.

Money has been pulled out of information technology and pharma.

Both sectors tend to do well when the dollar is strong and, of course, that is not the case at the moment.

Click NEXT to read further. . .

Pre-election markets are likely to stay positive

Speculators have entered banking, capital goods, realty and oil and gas.

The Bank Nifty is high-beta and it has a large weight in the Nifty and Sensex.

It climbed almost 12 per cent in the last week, despite non-performing assets in the banking system rising to record levels.

Capital goods majors, cash-strapped realty firms, and oil and gas players have also benefited from speculative investments.

At least part of the logic for entering these depressed sectors is an assumption of the rupee strengthening on the basis of FII inflows.

This is a reflexive situation.

There are FIIs targeting sectors, which benefit from a rising rupee, on the assumption that the bullish FII focus on India equity will lead to a stronger rupee.

Click NEXT to read further. . .

Pre-election markets are likely to stay positive

The news on the fundamentals front is more mixed.

The current account deficit will come down to less than half of the 2012-13 levels.

The latest estimate for 2013-14 is that the CAD will roll in at below $40 billion compared to $88 billion in 2012-13.

Despite that, the finance minister shows no signs of easing gold import controls.

The latest HSBC Purchasing Manager Index for February 2014 also suggests manufacturing has started a sustainable rebound.

That’s the good news.

The bad new is that Q3 gross domestic product growth numbers were missed, with GDP growth coming in at 4.7 per cent, 20 basis points below the consensus expectations of 4.9 per cent.

Click NEXT to read further. . .

Pre-election markets are likely to stay positive

This means the full-year GDP estimates will be missed since Q4 GDP growth would have to rise to an unlikely 5.7 per cent to meet the full-year estimates of 4.9 per cent.

The fiscal deficit is also likely to be higher if GDP growth is lower.

Globally, the dollar index, which compares the dollar to a basket of six major currencies, was down slightly before strong US payroll data came in for February.

American non-farm employment data beat consensus estimates, suggesting that the US economic recovery remained on track. Dollar treasury yields rose on that prospect.

This could also mean the tapering process is accelerated, with the US Federal Reserve cutting back its balance sheet expansion more sharply.

Click NEXT to read further. . .

Pre-election markets are likely to stay positive

Meanwhile, China recorded an unexpected trade deficit of $23 billion in February.

Exports fell 18.1 per cent to $114 billion, while imports rose 10 per cent to $137 billion.

February included the Chinese New Year holidays, which could have skewed consumption and domestic production patterns.

However, if this isn’t purely a seasonal effect, it could mean that the Chinese economy is shifting focus with more emphasis on domestic consumption.

Anxiety about the Ukraine crisis seemed to have receded, with global crude and gas markets settling down.

There is still a chance that this situation could flare up again, however.

Click NEXT to read further. . .

Pre-election markets are likely to stay positive

Traders looking at the Indian situation could reasonably expect a positive trend until the elections end and the results come in.

At that stage, there will be some volatility and there could be a violent trend reversal if the results don’t favour a BJP-led government.

Technically speaking, the major market indices are in historic new zones, so there are no benchmarks for judging likely resistance/support levels.

Stock market valuations are close to long-term historical averages.

The Nifty has traded at a median 18.2 PE and a mean 18.3 PE over the past 15 years.

It’s held at 18.4 PE now.

But market valuations can run up very quickly and sentiments can also change quickly.

Click NEXT to read further. . .

Pre-election markets are likely to stay positive

Analysts of reflexivity such as George Soros assert that valuations can move far beyond the rational once reflexivity is in play.

Changing the direction of fundamental trends takes much longer than changing asset valuations.

Even if a decisive government takes charge in June, it may take two or three quarters before GDP growth picks up appreciably.

A disconnect between valuations and fundamentals over that period is liable to be dangerous.

Bear that in mind as the market rallies.