| « Back to article | Print this article |

Pranab's parting gift disappoints markets

The hype over the weekend about Finance Minister Pranab Mukerjee's assurance of a package to revive the economy and stem the rupee slide didn't quite live up to its promise.

The Reserve Bank of India on Monday took a handful of measures to support the rupee, but disappointed market players hoping for bolder action.

Click NEXT to read further. . .

Pranab's parting gift disappoints markets

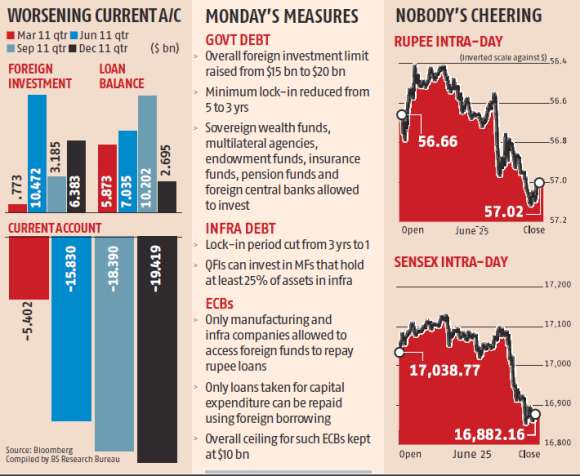

The central bank increased the limit on foreign investment in government bonds by $5 billion to $20 billion, increased the external commercial borrowing limit for manufacturing and infrastructure firms by $10 billion to $30 billion and allowed qualified institutional investment in mutual funds that hold 25 per cent of their assets in the infrastructure sector.

Further, it allowed FIIs to buy bonds with a residual maturity of three years compared to an earlier five, subject to a $10-billion ceiling.

Click NEXT to read further. . .

Pranab's parting gift disappoints markets

In a separate set of announcements later, the government decided to reduce the lock-in period for foreign investment in some long-term infrastructure bonds to one year from three.

This means companies in the manufacturing and infrastructure sectors can raise funds via ECBs to repay rupee debt within the ceiling of $10 billion.

Market participants said the measures were unlikely to spur major inflows into the bond market, as critical issues such as the rising subsidy burden and the introduction of the General Anti-Avoidance Rule in 2013 had been left unresolved.

Click NEXT to read further. . .

Pranab's parting gift disappoints markets

The rupee rallied in early trade on Monday but lost most of the gains and closed at 57.02, 14 paise or 0.2 per cent up from the previous close.

For stock markets, the day begun on a high note but the cheer was short-lived.

The finance ministry later held a briefing to calm the markets by saying the reduction in withholding tax on ECBs from 20 per cent to five for three years would be implemented soon.