| « Back to article | Print this article |

Why buying a home has nothing to do with high EMIs

The Reserve Bank of India raised interest rates on Tuesday. In response, banks have started raising interest rates and as a result EMIs (equated monthly installments) on various kinds of loans, including home loans, have started to go up.

As a result of this, since the RBI announcement the stock prices of real estate companies have been on their way down.

When asked about the falling stock price by a business news channel, a senior functionary working for one of India's biggest real estate companies, held banks responsible for it.

He said banks should not charge high interest rates to make more money and the RBI should look at the kind of margins (the difference between the rate at which a bank borrows and then lends) that banks are making.

Click NEXT to read on . . .

Why buying a home has nothing to do with high EMIs

He further said that banks should be allowed to launch teaser home loans (like SBI did and was followed by HDFC, and other banks) at lower interest rates so that more and more people could go out and buy their 'dream' house.

Who are we kidding?

First and foremost, a bank can't be borrowing money at the rate of 8-9 per cent and then give out a home loan at 6-7 per cent. It is more than fair to allow them to make a margin of 2-3 per cent, by charging an interest of 10-11 per cent on home loans, given the risk of giving out a home loan to be repaid over a period of 15-20 years.

While higher interest rates do mean a higher EMI, does a marginally higher EMI because of a higher interest rate really impact the decision of buying a dream home? Not really.

Click NEXT to read on . . .

Why buying a home has nothing to do with high EMIs

Let us say the interest being charged on a home loan is at 10.5 per cent and that increases to 11 per cent after the RBI move.

The EMI would increase from around Rs 998 to Rs 1,032 per lakh (per 100,000) of home loan. An increase of Rs 34 per lakh.

So if an individual takes a loan of Rs 50 lakh (Rs 5 million), the EMI would increase by around Rs 1,700 (Rs 34 x 50). A person who can afford to take a loan of Rs 50 lakh and pay an EMI of around Rs 50,000 per month on it can surely afford to pay Rs 1,700 more.

Given this logic of higher EMIs being responsible for lower home sales does not make any sense. The basic reason for the lack of buying that prevails currently is not the high interest rate environment, but the really high prices that real estate builders have been demanding on the homes they sell.

Click NEXT to read on . . .

Why buying a home has nothing to do with high EMIs

The law of demand

For anyone who understands basic economics, the law of demand states that 'high prices lead to a lower demand' and vice versa. Given this how do you create demand when things are not selling? The answer is simple: you cut prices.

But despite 'low' demand no builder worth his salt is willing to cut prices. And why is that? Well, to know the answer to that question we need to dwell a little deeper into the issue.

Black money

Builders are currently not willing to cut prices because they have made a lot of money over the last few years. So they are flush with cash.

More than that, with most of them demanding a certain portion of the total cost of the house in 'black', they are in a really comfortable situation (at least personally, the companies they run might be in a mess).

Click NEXT to read on . . .

Why buying a home has nothing to do with high EMIs

In fact, over the years the 'black' portion demanded by builders for selling a new house has only gone up. In some cases, the black money portion can even constitute 50 per cent of the total cost of the house.

This is the major reason which makes it more and more difficult for the middle class Indian to go out there and buy a house. Where does he get black money from?

The builder-politician nexus

As is well known, most of India's biggest real estate companies also act as fronts for politicians. Behind almost every big real estate company is a politician.

Being a politician in India is now very expensive business. Fighting an election costs a lot of money.

Click NEXT to read on . . .

Why buying a home has nothing to do with high EMIs

And with more and more fractured mandates becoming the order of the day, situations where elected representatives (read MPs and MLAs) need to be bought out are becoming more and more common.

And where does all this money come from?

Given this situation it is not in the interest of the builder or the politician backing that builder that prices fall.

The benami wealth of the politicians needs to be preserved and that is precisely what is being done. We invest our hard earned money in fixed deposits, stocks, mutual funds, life insurance policies, public provident fund and so on. The politician simply buys land.

Professor R Vaidyanathan who is with the Indian Institute of Management-Bangalore estimates that around $1.4 trillion of Indian money has been stashed away in Swiss banks since the country gained Independence. And where does that money come from?

Click NEXT to read on . . .

Why buying a home has nothing to do with high EMIs

With a little help from banks

Even real estate companies that have loans to pay off do not cut prices so that they can sell more and earn more. In such cases, the politician backing them ensures that they get new loans from banks (could be a co-operative bank or even a big nationalised bank for that matter).

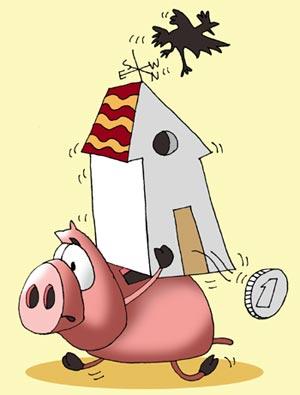

These new loans can, in turn, be used to pay off the old loans and the builder need not cut prices so as to earn more and pay off his old loans. And so the cycle continues.

Hence, at the end of the day the reason why people are not buying real estate is because real estate, especially in the larger cities, is terribly expensive.

Take a city like Mumbai where even for those who are comfortable in taking on a home loan of Rs 1 crore (Rs 10 million) -- which would mean paying an EMI of around Rs 1 lakh (Rs 100,000), buying a reasonably decent place is very difficult. The situation is not very different in other big cities.

So if anyone is to be blamed for the lack of buying in real estate, it is the builders themselves and not the higher EMIs on home loans.

The author can be reached at shonalee.biswas@gmail.com