| « Back to article | Print this article |

Why the RBI rate hike will NOT curb inflation

The Reserve Bank of India cannot much to address India's inflation woes. Solutions to the problem lie with Pranab Mukherjee and Sharad Pawar, who run the ministries of finance and agriculture, respectively, says Shonalee Biswas.

Duvvuri Subbarao, the current Governor of the Reserve Bank of India, must be a troubled man these days. Professionally, that is.

He has been on an interest rate-hiking spree since March 2010, having raised rates 11 times since. And on Friday again he has hiked the repo rate (the interest rate at which the RBI lends to the banks) by 25 basis points (one basis point is one hundredth of a percentage; 25 bps is thus 0.25 per cent) to 8.25 per cent.

The idea, of course, is to control inflation -- food as well overall inflation.

The food inflation for the week ending September 3, 2011, stood at a whopping 9.47 per cent. The wholesale price index (WPI), a representation for inflation, for the month of August 2011, stood at a 9.78 per cent, well above RBI's target of 7 per cent.

Click NEXT to read on . . .

Why the RBI rate hike will NOT curb inflation

But even this increase, like the other 11 before this one, is not really going to have an impact on food inflation.

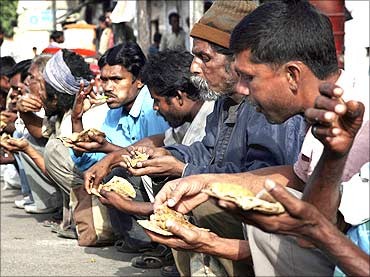

Food inflation has become a part of our lives. The sooner we accept it, the better it is. There is nothing that the RBI can do about it.

There are several reasons for the same. First, incomes in rural India have gone up significantly over the last few years. A report, titled This Time is Ripe, brought out by Kotak Institutional Equities points out that the income in rural India has risen by 138 per cent to Rs 681,400 crore (Rs 6,814 billion) over the five-year period ending 2009.

A major reason for this in the recent years has been the significant inflow of government money into rural India through the Mahatma Gandhi National Rural Employment Guarantee Scheme.

Click NEXT to read on . . .

Why the RBI rate hike will NOT curb inflation

Whenever incomes show such rapid increase, the first thing people do is switch to better food. Evidence shows that as the per capita income a country crosses $1,000 per annum, people move from cereal-based diets (rice, wheat, maize) to protein-based diets (non-vegetarian food, pulses). India has a lot of vegetarians which means increased consumption of dal (pulses) and milk.

So if you have been wondering why milk prices have been going up so often, increased consumption across rural India is the main reason. Of course, Mr Subbarao cannot do anything about this increase in prices.

What will make things even worse on the food inflation front is the proposed Food Security Bill. It is currently up for discussion on the Internet and is likely to drive food prices further up, if it becomes an Act.

The 27-page draft guarantees subsidised food to those who live below poverty line, calling them 'priority households' as well as other poor families classified as 'general households'.

Click NEXT to read on . . .

Why the RBI rate hike will NOT curb inflation

Now that brings us to the second point. The other intention in raising the interest rate was to arrest the fall of the rupee. Since the beginning of August 2011, the Indian rupee has lost value against the US dollar.

On August 1, 2011, one dollar was worth around Rs 44. Currently it is worth around Rs 47.5. It even touched Rs 48 for a brief while a few days back.

This sudden move of the rupee has made oil, which is India's biggest import, suddenly very expensive, leading to the price of petrol being raised by a little over Rs 3 per litre.

Oil is priced in dollars. So if India buys oil at the rate of $100 per barrel, we pay Rs 44,000 per barrel, when one dollar is worth Rs 44.

Click NEXT to read on . . .

Why the RBI rate hike will NOT curb inflation

When the same dollar fetches Rs 47.5, then India has to pay Rs 47,500 or Rs 3,500 more for the same amount of oil, assuming that the price of oil in dollars does not go up in the meanwhile. This means an increase in the oil import bill.

So the idea is if the interest rates are increased this might interest foreign investors. They can borrow money abroad and get it into India to invest and thus earn better returns due to higher interest rates.

To invest in India, they would have to convert their dollars into rupees. This will increase the demand for the rupee and the rupee will gain value against the dollar, which in turn will pull down India's oil import bill.

At least that is how it is supposed to work in theory. But what that does not take into account is the fact that the major reason for the rupee losing value against the dollar is the fact that foreign institutional investors (FIIs) are getting out of the Indian market by selling their equity holdings.

Click NEXT to read on . . .

Why the RBI rate hike will NOT curb inflation

Since August they have sold stocks worth over $2 billion. Interestingly, from the beginning of the year until July 2011, FIIs bought stocks worth around $2 billion.

Of course, when FIIs sell stocks, the money they get needs to be repatriated abroad. To do that FIIs have to sell rupees they earn by selling their stock market investments in India and buy dollars, which they repatriate abroad.

When they do that suddenly there is a surplus of rupees in the market, leading to the value of the rupee falling against the dollar.

Governor Subbarao cannot do much about this by increasing interest rates. In fact, increasing interest rates might lead to further selling by the FIIs because they might believe that the Indian economy may not do well in the days to come.

Click NEXT to read on . . .

Why the RBI rate hike will NOT curb inflation

Higher interest rates will mean that companies will not take on more debt to expand and thus shelve their expansion plans. It would also mean individuals taking on lower debt to buy homes, cars, motorcycles, etc and banks giving out lesser loans, which is not good news for the stock market.

Given this, FIIs may sell stocks and repatriate their money abroad and that will put further pressure on the rupee. So by increasing interest rates the RBI Governor may have only created a bigger problem.

Also a lot of recent events (Anna Hazare's anti-corruption movement and all the scams) have knocked the overall credibility of India, leading to a situation where foreign capital is likely to continue to leave India, and the RBI really cannot do anything about it by raising interest rates.

As mentioned earlier, WPI inflation stands at 9.78 per cent. Interestingly, food and fuel form nearly 22 per cent of this index. So the ability of the RBI to control the WPI inflation (which is a much broader representation of inflation than just food inflation) by raising interest rates is rather limited.

Click NEXT to read on . . .

Why the RBI rate hike will NOT curb inflation

But increasing interest rates will have some impact on controlling WPI inflation.

So that brings us to the other side of the argument. Should Subbarao have cut interest rates? Those who believe this, primarily talk about the slowdown in industrial growth.

The index of industrial production, which represents industrial growth, grew by just 3.3 per cent for the month of July 2011. In July 2010 it had grown by a robust 10.8 per cent.

The low number reflects the wavering confidence of capital goods companies producing or buying goods for that matter in the Indian economy. There was negative growth in sectors like apparels, chemicals as well as textiles.

Click NEXT to read on . . .

Why the RBI rate hike will NOT curb inflation

Car sales in the month of August also fell by 10.1 per cent in comparison to the same month last year.

Given this slackness in growth, people feel that a lower interest rate regime will encourage companies to take on more debt and go ahead with their expansion plans.

This, in turn, will encourage industrial activity and thus overall growth. Lower interest rates will encourage individuals to borrow more and buy homes, cars, motorcycles, white goods, etc.

Banks will benefit on two fronts. People are likely to borrow more and default less at lower interest rates.

Click NEXT to read on . . .

Why the RBI rate hike will NOT curb inflation

Other than this, real estate companies have been shouting from the rooftops for a lower interest rate regime.

But more than high interest rates it is the unwillingness of builders to cut prices that has been the major cause of the slowdown that has been impacting this sector.

Having said that, lower interest rates wpould definitely lead to some activity in this sector.

So Governor Subbarao would have had all these divergent points in his mind while making the decision that he took. . . Does he increase interest rates so that he can control WPI? But that would mean a sellout in the stock market, and the rupee depreciating even further.

Click NEXT to read on . . .

Why the RBI rate hike will NOT curb inflation

That, in turn, will push up the oil import bill, while the idea in the first place was to bring it down. It would also mean more increase in petrol prices, which does not go down well with politicians or the middle class voters for that matter.

It would also lead to negative corporate sentiment, leading to expansion plans either being shelved or postponed. That would mean fewer new jobs being created and so on.

It would also lead to increased insecurity levels among employees, who will spend less money and save more with the future looking increasingly uncertain.

The Governor would also have thought should he cut interest rates, so that industrial activity picks up, but run the risk of further WPI inflation in the economy? Or should he go for controlling inflation? Or should he go for creating growth?

Click NEXT to read on . . .

Why the RBI rate hike will NOT curb inflation

Does he become a hawk and raise interest rates or become a dove and cut interest rates? Or does he act independently, like the RBI should, and raise interest rates? Or should he listen to the mandarins at the Union ministry of finance, who have just given him an extension of nearly two years, and cut interest rates?

He has chosen to go with the former option and raise the interest rate. But will this 12th raise have any impact or will it go waste like the 11 before it?

Chances are there will be no impact. There is not much that the RBI can do to address India's inflation. Solutions to the problem lie with Pranab Mukherjee and Sharad Pawar, who run the ministries of finance and agriculture, respectively. But will they act? Well, your guess is as good as mine.

The author can be reached at shonalee.biswas@rediffmail.com