"One for everyone. Pick the card that suits you the best! It's good to have a credit card that's like you!" reads a promotional mailer from Standard Chartered Bank.

It further reads, "5 per cent cash back on all fuel spends, all phone bills, all utility bills on Titanium Card." Platinum card offers five times rewards on dining, hotels and fuel and so on.

If you see such an offer, will you apply for the cards? Likely; who does not like discounts and freebies?

This is why many own multiple credit cards, with multiple benefits. Some go to the extent of saying these benefits help counter the high prices to some extent.

If you pay, for instance, an electricity bill of Rs 1,000 using a cash-back card, the card will offer you five per cent of your bill amount, that is Rs 50. You pay only Rs 950 on your card.

Reward offers on credit cards work differently. You get cash benefits in the form of coupons or vouchers for a certain number of points collected on purchase through the credit card.

...

For instance, for every purchase through Standard Chartered's Platinum Rewards Card, you collect 3,000 points, which earn you Big Bazaar coupons worth Rs 1,000.

Which of these works better for a cardholder? "Collecting and redeeming reward points for lifestyle or other expenses works out better for card holders. Once a customer has collected enough points, s/he can use those for specified expenses at their will." says a senior official of HDFC Bank.

It might not always be different cards that offer cash back and rewards benefits. Sometimes, the same card offers both these.

According to an SBI official, banks discourage customers from cash back cards, as banks as banks have to pay in cash to the customer. With rewards points, banks have nothing to lose.

Also, those who really take advantage of such offers are high spenders, making it an expensive proposition for banks.

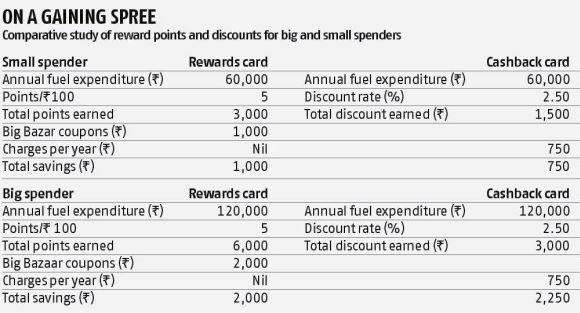

Let's see which option works out better for cardholders. We take the example of Standard Chartered's Super Value Titanium (cashback card) and Platinum Rewards card.

...

You spend, say, Rs 60,000 a year on fuel for your car. With the cashback card, you will get a five per cent cashback, according to the Standard Chartered bank's mailer. However, the actual cashback works out to be 2.5 per cent.

Reason: The five per cent cashback offered by Standard Chartered's Super Value Titanium is in fact 2.50 per cent cashback and 2.50 per cent fuel waiver surcharge.

This means by spending Rs 60,000, you will get back Rs 1,500 in a year. The fuel surcharge is offered by the rewards card as well.

In contrast, the rewards card will give you 3,000 points, which means Rs 1,000 worth of Big Bazaar coupons for spending. This means the cashback card offers a better deal. However, the reward card does not levy any joining or annual charges on the cardholder.

However, the cashback card levies an annual fee of Rs 750, which brings down the saving on the card to Rs 750. This makes the total earning on reward cards higher by Rs 250.

...

"For small spenders, both these cards offer almost the same deal. However, for big spenders, the cashback card is a better deal between the two," says certified financial planner Malhar Majumder, executive director of Kolkata-based Fine Advice.

If the annual fuel spend is doubled to Rs 120,000, then the cashback would be Rs 3,000 and rewards would be worth Rs 2,000.

Even if you take into account the annual fee levied by the cashback card, you would get a total cashback of Rs 2,250, higher than the offer on rewards card.

"Rewards tend to be more when you are opting for lifestyle and related expenses, less when you are looking at regular needs, like Big Bazaar coupons. Also, money is spent first and rewards come later. In the case of cash back cards, you get direct discounts on items you have to buy regularly like fuel or electricity. A 2.50 per cent discount saves on immediate cash outflow. Cash discount frees up cash. Reward points are connected to spending programmes, usually lifestyle-related, which you may not need immediately," adds Majumder.

...

A cash back card helps you in two ways. One, it brings home the direct benefit of discounts. Two, it saves you the pain of choosing an item to buy from the reward catalogues, which might not be really worth the price shown.

Of course, the benefits of both cashback and rewards are available at select merchant outlets with which the card manufacturer has a tie-up.

Hence, you might not have too many options to shop. Many times, discounts/rewards for fuel purchase are available only when you swipe your card on the card issuer's machine.

Finally, credit cards should be used judiciously. Keep a record of your estimated monthly expenses that may get cash back. Calculate how much you save if you go with the card.

Remember to check on joining if there are any annual fees. Go for it only if you save a decent amount after paying for fees.

Do not spend just because there is a cash back offer, as you have to pay the outstanding amount lest you'll land in a debt trap.