| « Back to article | Print this article |

7 safe stocks for the volatile market condition

In a worsening macroeconomic situation and volatile markets, there has been a flight to safety, with investors parking their funds in stocks perceived to be safe havens with a reasonable amount of growth visibility.

With a lower risk appetite, investors have parked a larger share of their funds in large caps.

Not surprisingly, the broader markets have outperformed, with the Sensex gaining 11.3 per cent over the last one year, while the BSE Midcap index has lost 9.5 per cent in the same period.

Consequently, pockets of value have emerged within the mid cap space defined here as stocks with a market cap less than Rs 25,000 crore (Rs 250 billion).

And, experts say, given the environment, if investors follow a bottom-up approach, it should work well and deliver better results.

G Chokkalingam, chief investment officer & executive director, Centrum Broking & Wealth Management, sees the bottom-up approach to invest in stocks that have seen valuations become cheap as a good strategy.

Click NEXT to read on how the stocks were selected…

7 safe stocks for the volatile market condition

While advising to avoid the infrastructure sector, he says investors should consider companies with a sound business model, export-oriented or companies with no debt, sustainable profit growth and good corporate governance.

In a bid to select investment-worthy stocks, we looked at BSE 200 companies. Based on Bloomberg earnings estimates, there are companies with pretty healthy earnings visibility - wherein average annual EPS growth for FY14 and FY15 is over well 15 per cent.

However, given the higher risk, investors have to be cautious, keeping in mind parameters such as a strong balance sheet and healthy cash flows from operations, relatively higher resilience to economic slowdowns and reasonable valuations.

The seven stocks listed here not only meet these parameters but are either market leaders or have carved out a niche for themselves in their respective sectors with strong brand equity.

Click NEXT to see the seven stocks…

7 safe stocks for the volatile market condition

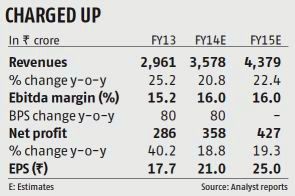

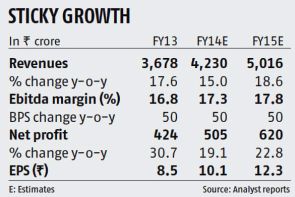

Amara Raja Batteries

With pricing power returning, strong replacement demand and softening lead prices, most analysts have turned positive on battery makers such as Amara Raja.

Higher revenue growth and margins are expected to reflect in the record strong earnings growth of about 15 per cent annually over the next two financial years for the company.

While replacement demand in the automobile space (60 per cent of revenues) is expected to grow about 14 per cent, the same for the industrial segment, where Amara Raja is the market leader, is expected to grow just above 10 per cent.

Given the improving industry structure, while most analysts have a buy on both, Exide Industries and Amara Raja, IIFL’s Joseph George and Kevin Mehta prefer the latter due to superior cost structure, higher margins, better capital efficiency, and greater growth potential compared with market leader Exide.

Analysts believe the valuation discount between the two at about 15 per cent (Exide trades at a premium) is likely to shrink due to these factors. This should help Amara Raja outperform.

Analysts believe the valuation discount between the two at about 15 per cent (Exide trades at a premium) is likely to shrink due to these factors. This should help Amara Raja outperform.

Most analysts have price targets of Rs 320-340, which translates into potential upside of 16-24 per cent.

Click NEXT to read more…

7 safe stocks for the volatile market condition

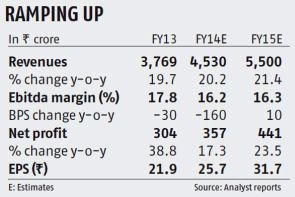

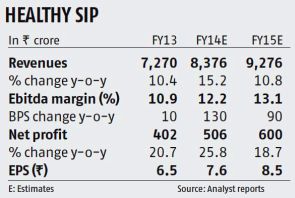

Apollo Hospitals

The country’s largest listed healthcare provider is expected to grow its revenues by about 25 per cent annually over the FY13-FY15 period, driven by rising demand and increasing presence across key markets.

Of the two main divisions, hospitals and pharmacy, it is the latter, accounting for a third of revenues, that has witnessed a faster growth rate and improvement in profitability in the June quarter.

CRISIL Research expects the pharmacy segment to grow upwards of 22 per cent annually till FY15, driven by the addition of 200 stores and growth in revenues per store.

While the hospital business growth was muted in the June quarter at 11.5 per cent (the stock is down 13 per cent over the month because of this), Sriram Rathi of Anand Rathi Research believes the division will ramp up from the next quarter, driven by recent commercialisation of new beds (these had reported lower than expected contribution in the June quarter).

Notably, this division accounts for nearly 90 per cent of the company’s profits, and the improving revenues will drive overall growth.

Notably, this division accounts for nearly 90 per cent of the company’s profits, and the improving revenues will drive overall growth.

This will be aided by the addition of 1,000 beds in FY14 and another 1,235 in FY15; the tally stood at 8,420 at end-FY13. At Rs 850, the stock is trading at 28 times its FY15 earnings estimates, with target prices between Rs 950-1,015.

Click NEXT to read more…

7 safe stocks for the volatile market condition

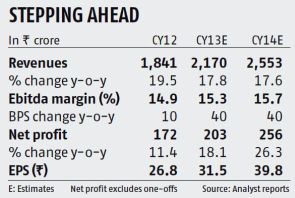

Bata India

Bata India has undergone a significant transition from a lower-range men’s footwear retailer and now offers footwear for women and children across different price points. It has also added modern designs to its offerings.

The company has reaped the benefits of this restructuring via a huge Ebitda margin expansion (up 700 basis points to 14.9 per cent in the past four years ending CY12), while revenues have almost doubled and net profit (excluding extraordinary items) almost tripled.

Bata plans to increase the proportion of high-margin women’s and children’s footwear to drive growth. While it has a total of about 1,400 stores, its plan to add 100 stores every year (capex of Rs 100 crore or Rs 1 billion per annum via internal accruals) should aid growth.

Bata’s net cash position, strong store network and brand loyalty are key strengths. It has bagged a large order from the Indian Air Force and expects strong traction from the defence sector.

Bata’s net cash position, strong store network and brand loyalty are key strengths. It has bagged a large order from the Indian Air Force and expects strong traction from the defence sector.

The management is confident of delivering doubledigit growth over the next three-five years and increase its market share. A sharp unforeseen economic downturn and a significant surge in crucial inputs, leather and rubber, are key risks.

Click NEXT to read more…

7 safe stocks for the volatile market condition

Glenmark Pharmaceuticals

With a third of overall revenues from the US, new launches, especially in the dermatology space, will be the critical trigger for the company.

The success of the dermatology portfolio, according to Kotak Institutional Equities, is important given that the US base business has suffered price erosion and the oral contraceptive space is seeing intense competition.

In addition to traditional sources of growth, what sets the company apart from peers is its ability to monetise its research portfolio. It is looking to consolidate its presence in existing markets, improve profitability and generate cash flows.

This should help it enhance its return ratios. Analysts estimate the company’s earnings to grow at 23 per cent annually in FY14 and FY15.

They have a buy call on the stock, which has corrected about seven per cent over the last month on debt issues. While net debt is high at Rs 1,787 crore or Rs 17.87 billion at end-March 2013, a large part of the repayment is long-term (starting 2015).

Nevertheless, the net debt-equity ratio is still comfortable at 0.65 times; the company’s cash flows from operating activities have been positive for four years and stood at Rs 554 crore or Rsw 5.54 billion in FY13.

Nevertheless, the net debt-equity ratio is still comfortable at 0.65 times; the company’s cash flows from operating activities have been positive for four years and stood at Rs 554 crore or Rsw 5.54 billion in FY13.

The stock trades at 15.6 times its FY15 earnings, with target prices in the range of Rs 570-633, implying upsides of 7-20 per cent. Investors could consider it on dips.

Click NEXT to read more…

7 safe stocks for the volatile market condition

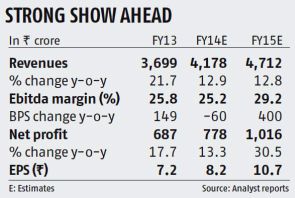

Pidilite Industries

Pidilite Industries, the largest branded adhesives player, enjoys strong pricing power due to its flagship brand Fevicol besides others like Fevi Kwik and m-seal.

Strong positions in various segments have resulted in a sound financial track record with higher return ratios (return on capital employed of 27-37 per cent in the last four years) and a robust balance sheet.

Pidilite has also expanded into waterproofing (Dr Fixit and Roff), automotive care, flooring and modular furniture, some of which are pretty nascent segments in India but offer high growth potential.

On the flip side, a slowing economy is the key risk, reflected in lower volume growth in the June 2013 quarter. Here, industrial products saw volumes plunge to one per cent and margins also slipped.

However, though volume growth also slipped to 8 per cent in the consumer and bazaar segment, it accounts for 80 per cent of sales and reported its highest margin of 28.7 per cent in over eight quarters.

Strong pricing power has helped this segment sustain average margins of 23 per cent historically. Thus, despite cutting estimates, analysts expect Pidilite to post healthy profit growth of 17-19 per cent in FY14.

Strong pricing power has helped this segment sustain average margins of 23 per cent historically. Thus, despite cutting estimates, analysts expect Pidilite to post healthy profit growth of 17-19 per cent in FY14.

The concerns are largely priced-in in the valuations, which are 10 per cent below the three year average PE of 27.4 times.

Click NEXT to read more…

7 safe stocks for the volatile market condition

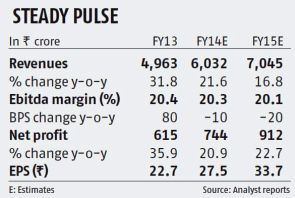

Tata Global Beverages

Tata Global Beverages (TGBL), the second largest branded tea player in the world and the leader in India, has seen its core business profits grow at an average 26 per cent annually in the past two years, on the back of strong brands like Tetley and Tata Tea, increasing premiumisation of products and rising volumes.

Dominant brands in the coffee (Eight O’ Clock Coffee, Grand Coffee) and water (Himalayan, Tata Water Plus) businesses have aided overall growth. Its tie-ups with Starbucks to set up stores in India and PepsiCo to distribute water brands are among key growth drivers.

While a debt/equity ratio of 0.1 times and healthy margin profile provides comfort, given its international business, TGBL also benefits from rupee depreciation.

Strong brands, both in tea and coffee, provide flexibility to sustain margins during times of adverse movements in prices of tea and coffee. However, since the prices of tea and coffee have been soft recently and both are expected to remain benign in the medium term, these should support margins.

Strong brands, both in tea and coffee, provide flexibility to sustain margins during times of adverse movements in prices of tea and coffee. However, since the prices of tea and coffee have been soft recently and both are expected to remain benign in the medium term, these should support margins.

But, increasing competitive intensity across segments could take some of these gains. The company is also scouting for attractive inorganic opportunities and its strong balance sheet should lend support.

Click NEXT to read more…

7 safe stocks for the volatile market condition

Zee Entertainment

Increase in subscription revenue brought on by mandatory digitisation should help India’s largest media company by market capitalisation to post 13 per cent annual growth in overall revenue over the next three years.

Given a muted macroeconomy, a large part of the company’s growth is expected to come from subscription, which accounts for over half of the revenues rather than advertising.

However, it is not that advertising revenues will not grow, but the growth is expected to be muted at eight-nine per cent in the current financial year.

While Zee’s prospects look good, there could be some margin pressures in FY14, as the company invests in new properties and its sports channel.

The stock has corrected about 10 per cent over the last month on higher sports content as well as the launch of new channels.

These negatives, however, are reflecting in the share price and analysts believe that at 14.5 times the FY15 enterprise value/Ebitda, the stock is reasonably valued.

Morgan Stanley analysts, who have a price target of Rs 278, believe the stock is a safe haven in the current scenario, given its strong balance sheet, healthy free cash flows and a formidable position in the broadcasting space.

Morgan Stanley analysts, who have a price target of Rs 278, believe the stock is a safe haven in the current scenario, given its strong balance sheet, healthy free cash flows and a formidable position in the broadcasting space.

Given the current price of Rs 222, the target price translates into an upside of 25 per cent.

Click NEXT to read more…

7 safe stocks for the volatile market condition

Among the picks, while Apollo Healthcare is the largest player in the private healthcare space, Zee Entertainment is the largest in the entertainment sector.

The same is the case with Tata Global, Bata and Pidilite. Others such as Amara Raja is a strong number-two player in the organised battery segment, which is almost a duopoly.

Given that a few of these picks have seen corrections in the recent past and others are reasonably valued, investors with a holding period of a year can expect good returns.