| « Back to article | Print this article |

Orient-Express to be a value buy for Tatas

Indian Hotels' ambitious bid to acquire Orient-Express Hotels (OEH) has disappointed the Street. However, this might be a knee-jerk reaction.

Analysts say Indian Hotels is acquiring OEH at prices that are at the bottom of the Bermuda-based company's valuation cycle.

Though the acquisition price is 40 per cent higher than OEH's trading price, it is less than a fifth of the OEH stock's peak price of $60 per share in November 2007.

In 2007, Indian Hotels had paid about $42 a share for a stake of 11.5 per cent in OEH in two tranches.

Analysts also say the deal might prove to be a strategic fit for the company in the long term, as OEH operates in the leisure and adventure segments, while Indian Hotels primarily operates business hotels.

Therefore, the deal might lead to cross selling and joint promotions. In the short term, however, it might pinch Indian Hotels shareholders, owing to higher debt and additional equity dilution.

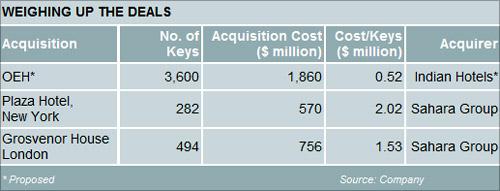

Tata group-promoted Indian Hotels has made an unsolicited buy-out offer to the OEH board for $1.86 billion (about Rs 9,600 crore).

The deal also includes OEH's debt of about $530 million (Rs 2,800 crore). Indian Hotels' proposal could be one of the last bold acts by Tata group patriarch Ratan Tata before he retires in about 10 weeks.

Indian Hotels has agreed to make cash payment of up to $650 million (about Rs 3,500 crore), while $100 million (about Rs 534 crore) would be pumped in by its Italian partner Montezemolo & Partners SGR SpA. To finance the deal, Indian Hotels is relying heavily on debt.

"Generally, acquisitions for Indian Hotels have not been rewarding for the company," said Niraj Mansingka, an analyst with Edelweiss Capital in Mumbai told Reuters. The company's international portfolios, especially that of the US, are recording losses.

On Friday, the Indian Hotels stock closed 5.48 per cent lower at Rs 66.35 on the BSE.

"While no strategic rationale is currently presented by Indian Hotels, it seems clear to us (it) wants to position itself as a global hospitality chain. Past international acquisitions/tie-ups of management contracts have been steps in that direction," an analyst said in a JP Morgan report.

In the last five years, OEH shares have fallen about 80 per cent. At their current market prices, they are trading at just above the book value of OEH's original investments in various properties.

Their current market value would, however, be many times their book value, as recent acquisitions by Sahara Group show.

At its offer price, the Tata group would pay about 1.5 times the net depreciated value of OEH properties and the par-value of its total assets, including cash on books and goodwill. Currently, Indian Hotels is valued on a par with the depreciated value of its assets (properties) and a 30 per cent discount to its assets.

"OEH's acquisition, if it happens, may give Indian Hotels ready access to a high-end customer base, which could have synergies with its international and domestic portfolio," the JP Morgan report said.

"Considering the large quantum of the deal, the slowdown in the US and Europe and the higher leverage of the company, we believe this deal, if it materialises, would put more strain on the profitability and valuations of the company on a combined basis. However, due to a slowdown in the US and Europe, the asset value of OEH has come down to below its intrinsic value. In that sense, it may take this proposal viable from a very long-term (five-seven years) perspective," said a ICICI Securities report.