| « Back to article | Print this article |

No terror funds in stock markets: Govt

The government on Tuesday ruled out any surreptitious entry of terrorist outfits into the stock market and said that sufficient caution has been administered to the stock exchanges to look out for any suspicious entry into their activity.

"The government, at present, does not have any reliable, credible information of any surreptitious entry of terrorist outfit into the stock market," the Department of Revenue said in a fresh affidavit to the Supreme Court which is hearing the issue relating to stashing away of black money by Indians in foreign banks.

"However, the Security and Exchange Board of India as well as stock exchanges have been administered sufficient caution to look out for any suspicious and irregular entrant into the stock market activity," said the affidavit filed in response to the PIL accusing the government of not taking action in bringing back black money stashed in foreign banks.

The PIL filed by eminent lawyer Ram Jethmalani and others had referred to the media reports alleging a link between money belonging to Indian citizens lying deposited in foreign banks and terrorist funding.

No terror funds in stock markets: Govt

"Upon enquiry, it has been confirmed by the Bombay Stock Exchange and the Chennai Stock Exchange that no fictitious or notional companies can be stated to be involved in stock market operations," the second affidavit filed in response to the PIL said.

The government elaborated on the mechanism for regulating the flow of money coming into the stock market through foreign institutional investors by Sebi and ruled out the possibility of banning participatory notes.

"In view of the fact that participatory notes are market instruments and when they are created and traded abroad it is not possible to ban the issue of the said instrument," the government said.

They are subjected to regulations and effectively being regulated by Sebi, it added.

No terror funds in stock markets: Govt

The Centre said all FIIs are mandated to report at the end of every month all the information relating to participatory notes issued by them including the names of the subscriber to the said participatory notes.

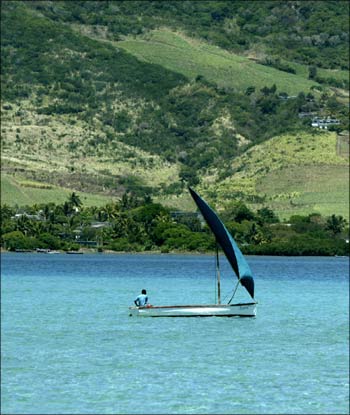

However, the Centre agreed that there is a possibility of misuse of double taxation treaty between India and Mauritius.

"The Centre is alive and conscious of the potentiality of misuse of double taxation treaty between India and Mauritius. In fact, further amendments to the treaty are being negotiated," the affidavit said.

The Department of Revenue brushed aside the allegation of inaction relating to stashing of black money in foreign banks by Pune-based businessman Hasan Ali Khan against whom Enforcement Directorate has lodged a complaint for violating Foreign Exchange Management Act.

It termed as baseless the allegation that the Centre was interested in protecting powerful individuals who may have been using Khan and his wife as their nominee/benamidar.

No terror funds in stock markets: Govt

The affidavit filed by the government has not dealt with the facts that there was a fake passport case against Khan and investigations into alleged money laundering were also being undertaken against him and he was involved in transactions with Saudi Arabian arms dealer Adnan Khashoggi, they had said.

Pointing out various alleged inactions against Khan, the petitioners in written submissions said, "Is it not unreasonable to infer that the government is interested in protecting powerful individuals who may be using Khan and his wife as their nominee/benamidar?"

Further, Diwan had said, "The most important factor is that not even a single individual has been apprehended or interrogated by the government in last five years in relation to money laundering and slush funds parked abroad."

The affidavit had said investigations against Khan and his alleged co-conspirator Kashinath Tapuria relating to suspected illegal deposits made by them in UBS Bank were underway.

No terror funds in stock markets: Govt

The petition has cited the alleged instance of ED detecting deposits made of around $8.04 billion with the UBS Bank in Zurich by Khan during a raid in Pune in January 2007.

The Income Tax Department had also served a demand notice to the tune of Rs 20,580 crore (Rs 205.80 billion) on Khan, besides Rs 40,000 crore (Rs 400 billion) on Tapuria and his wife Chandrika, the petition claimed.

The Centre said action has been undertaken against Khan by the ED in which his passport was revoked in 2007 and an FIR was registered agaisnt him in 2008.

The Apex Court had issued a notice to the ED and sought its response to a complaint lodged against Khan for accummulating wealth to the tune of over $8 billion in foreign banks.

No terror funds in stock markets: Govt

During the last hearing on July 20, senior advocate Anil Divan, appearing for the petitioners, had alleged the government did not inform about the complaint lodged by ED in December 2008 against Hasan when it had filed the affidavit on May 2.

It was pointed out the complaint filed on December 22, 2008, by an Assistant Director of ED against Khan, showed on December 8, 2006, Khan had an amount of over $8 billion in his account with UBS AG, Zurich.

This amount, Divan had said, was equivalent to Rs 36,000 crore (Rs 360 billion).

In a written submission in response to the first affidavit filed by the Centre, the petitioners had said vigorous investigations could have been undertaken into this aspect and action should have been taken against Khan on money laundering charges.

In the complaint, ED had also made a reference to Khan's account and money deposited in UBS Singapore.

Besides Jethmalani, five others, including former Punjab DGP K P S Gill and former Secretary General of Lok Sabha Subhash Kashyap who are petitioners, have alleged government was not taking action to bring back black money stashed in foreign banks.