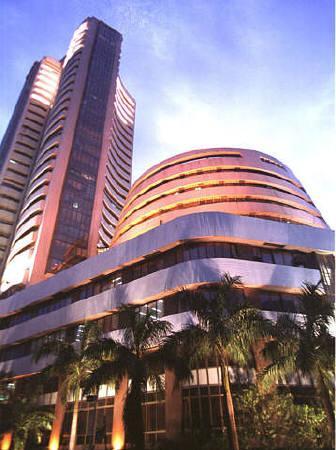

The Bombay Stock Exchange's benchmark Sensex crashed by 588 points to 15,479 at 1230 hours on Wednesday as operators succumbed to fresh selling pressure amid a rapid pullout of foreign capital as a poor manufacturing outlook for China and weaker-than-expected growth in the United States spurred fresh fears of a global slowdown.

Also, global factors like Eurozone debt crisis, rising oil prices, and weakening rupee in India are further wreaking havoc on investors.

The markets are witnessing heavy selling pressure. The S&P CNX Nifty slipped below crucial psychological level of 4,700 and has registered a fresh 52-week level. At 1230 hours the Nifty plunged 150 points at 4,657 levels.

However, towards the end of the trading day, Sensex recovered somewhat -- having first touched its lowest in two years -- to close at 15,699 -- down 365 points. Nifty ended down 105 points at 4,706.

. . .

Earlier in the day, the Nifty opened at 4,779 levels and touched the low of 4,653.

According to Somil Mehta, senior technical analyst with Sharekhan, "The stocks markets are in a downtrend and are likely to remain bearish in the short-to- medium. The immediate support for the Nifty would be 4,680 and any further weakness from there on could see the Nifty sliding to 4,600."

Meanwhile, all the Sensex stocks are under intense selling pressure. HDFC Bank is the top loser, the stock has shed nearly 6% to Rs 418. J P Associates is down nearly 5% to Rs 60.

. . .

Bharti Airtel, Jindal Steel, BHEL, ICICI Bank, Reliance Industries, Wipro, Infosys, Mahindra & Mahindra, TCS, Hindalco, SBI, Sterlite Industries and Tata Motors have fallen in the band of 3.1-4.4% each.

Among the individual stocks, Shares of Reliance Communication and Unitech are zooming in the trade after the Supreme Court granted bail to the corporate executives involved in the 2G spectrum case from these companies.

Shares of sugar companies are also trading higher, bucking the weak trend in the broader market, after the government allowed one million tonnes of sugar export.

. . .

Banking stocks are amongst the worst hit in trades thus far. BSE banking index- Bankex has slipped nearly 4% or 365 points to 9,521 levels. Oil & Gas index is also down 3.4% at 7,877 points. IT, Power, Metal, Capital Goods, Auto, PSU, FMCG and Healthcare and FMCG stocks are also under the pressure and these indices have shed 1-3% each.

From the banking space, HDFC Bank is the top loser, down 6.2% at Rs 416. ICICI Bank also lost 4% to Rs 714. IDBI Bank, Canara Bank, SBI, Axis Bank, Punjab National Bank, Bank of India, Yes Bank and IndusInd Bank were also trading lower by 2-4% each.

In the oil & gas space, Essar Oil is the top loser, down 5.3% at Rs 67. Index heavyweight Reliance Industries is also down 4.5% at Rs 759. BPCL, ONGC, Indian Oil, Cairn India, Oil India, HPCL and Petronet LNG have shed 1-4% each.

. . .

The broader markets have shed 2% each. The BSE mid-cap index is down 117 points at 5,512 and the small-cap index is down 121 points at 5,959.

The overall breadth is extremely poor as 2,023 stocks are advancing while a mere 525 stocks are advancing

All other Asian stock markets were also trading lower in early trade. The key benchmark indices in Singapore, Hong Kong, South Korea, China and Taiwan were down by between 0.46 per cent and 1.83 per cent.