| « Back to article | Print this article |

It's time to log into infrastructure funds

One category of funds launched with huge fanfare and optimism back in 2007 and 2008 was infrastructure funds.

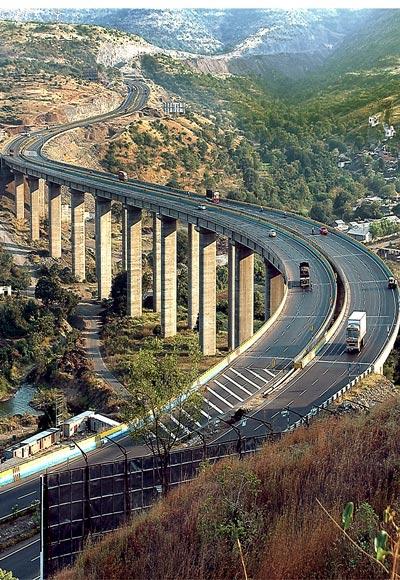

The Indian economy needs huge investments in roads and power and infrastructure funds were well positioned to channelise investments into these companies and thus make money for investors.

But so far, the story just hasn’t played out as per expectations. Infrastructure funds have been languishing for years.

This category of funds hugely underperformed the broader market in the last one as well as three years.

In 2013, infrastructure funds were in the bottom heap of fund categories, losing 7.9 per cent just ahead banking funds which lost 14 per cent, according to data from Value Research Online.

Click NEXT to read further. . .

It's time to log into infrastructure funds

By contrast, the BSE Sensex gained 7.97 per cent the past year. In the past three years, infrastructure funds lost 7.31 per cent.

All infrastructure funds posted losses last year from around four per cent to 15 per cent, with the exception of one fund, Franklin Build India Fund, which posted gains of 6.49 per cent, according to data from Value Research. 2014, however, could prove to be different.

Sure enough, infrastructure companies have no shortage of concerns hanging over their heads with order books still not growing fast and projects not managing to take off.

Over the past few months, infrastructure companies have been undertaking restructuring exercises, reducing their debt, and hiving off non-core operations and focusing on improving their cash flows.

Click NEXT to read further. . .

It's time to log into infrastructure funds

Experts reckon that infrastructure is expected to pick up post the general elections in 2014. Says Sanjay Sinha, ceo, Citrus Advisors: “This should be the beginning of the infrastructure cycle as we have hit the bottom.

“The order books of infrastructure companies should start building in the next six months, which will be a big trigger for companies and that could see these companies do well.”

At current market valuations, the sector is trading at five-six times next year’s earnings and around one time its book value.

Even a slightest improvement in the outlook will have a huge impact on share prices. As liquidity improves, many companies have been able to reduce their debt and working capital requirements.

Click NEXT to read further. . .

It's time to log into infrastructure funds

In 2014, favourable results of the general elections and possible interest rate cuts could have a positive impact, which could lead to a re-rating of the sector.

The capex cycle, both in the public and private sector, is expected to be better next year.

For now, if you are among the older investors in infrastructure funds, and are sitting on low returns or losses, hold on as the infrastructure revival will see these funds recover lost ground, say experts.

However, don’t build fresh allocations in this sector if you already have a decent exposure.

Click NEXT to read further. . .

It's time to log into infrastructure funds

For those who don’t have an allocation to infrastructure, now might be a good time to get into these funds as many of these companies are now available at beaten-down valuations.

Says Sinha: “Investors who don’t have an exposure could add some fresh investments in this sector.

“Once the order books start to improve, these funds will do well.”

However, as infrastructure funds are sectoral funds, experts say that investors should first make their basic allocation to diversified large- and mid-cap funds.

And as infrastructure projects take time to execute, investors should give some time till the end of 2014 for these funds to deliver.