| « Back to article | Print this article |

What is negative inflation? Is it good?

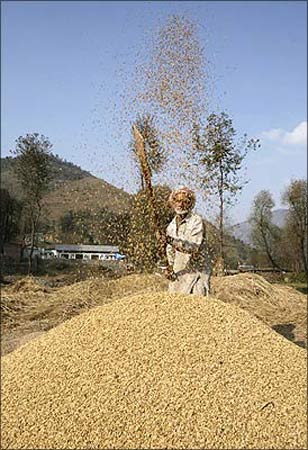

Inflation in India turned negative 1.61 for the first time in 32 years but the prices of food items like fruit and vegetables, cereals and oil were still higher than last year.

India possibly is the only major economy moving into a deflationary zone though the European region is near zero level due to recessionary pressures. The stock markets immediately welcomed the development and jumped by about 200 points as analysts expect this to help ease the monetary policy restrictions and pave the way for cut in banks' lending rates.

However, food articles were costlier by 8.7 per cent from the comparable week last year as pulses moved up 17 per cent, cereals 13.5 per cent, and fruit and vegetables 10 per cent. The dip was on account of a fall in fuel prices as international crude oil is now ruling around $70 a barrel against over $140 a barrel during the year-ago period.

So what is negative inflation and how does it impact the economy? Will if hurt India? Read on

Negative inflation: Is it good for India?

What is negative inflation?

Low inflation does not mean that prices will remain low: it means that prices are rising at a slower pace than before.

Negative inflation can also be termed as deflation. Deflation is a fall in the price of goods and services. Deflation occurs when the inflation rate falls below zero per cent. This is the opposite of inflation.

When the inflation rate is negative, the economy is in said to be in a deflationary period. This is when there is less money (supply of money) chasing the same amount of goods and services, leading to the increase in the value of the money.

Disinflation is when there is a slowdown of inflation but there is still inflation.

So why does deflation take place?

Negative inflation: Is it good for India?

Why does deflation happen?

A fall in spending -- it could be personal spending or a cut in government expenditure -- leads to deflation. The decline in the supply of money and credit thus leads to deflation.

So, if money-supply decreases; supply of other goods increases, demand for money rises, and the demand for other goods slips, it is deflation.

So, if money-supply decreases; supply of other goods increases, demand for money rises, and the demand for other goods slips, it is deflation.

Why is it bad for the economy?

Deflation is a fall in the price of goods and services. Deflation occurs when the inflation rate falls below zero per cent. This is the opposite of inflation.

When the inflation rate is negative, the economy is in said to be in a deflationary period.

What are the effects of deflation?

Negative inflation: Is it good for India?

What are the consequences of deflation?

Deflation leads to a lower level of demand in the economy. It increases the real value of money. It also increases unemployment.

The main effect of deflation is that it gives people a huge incentive not to buy goods. This means that if something costs Rs 100 today, it will cost only Rs 95 next week, thus making people hold off their purchases. The good news is that gives people an incentive to save money.

But as fewer people buy, manufacturers are left with excess inventory. That means they need to reduce their supply, which means they can either stop manufacturing, which causes factory closures and layoffs, or they can reduce prices even further. But the latter causes even more deflation, leading to lower spending, leading to more deflation. Once an economy is caught in this deflationary spiral, it is very hard to climb out. That's why many economists are more worried about impending deflation rather than inflation.

Deflation also slows down business development as entrepreneurs are less likely to invest in new business plans if they see a trend towards lower profit margins. As noted in a earlier post, deflation is more of a hinder to a strong economy than inflation.

In a deflationary environment, those sectors with a high proportion of variable costs are likely to benefit from falling input prices, according to Goldman Sachs.

What if India slips into deflation?

Negative inflation: Is it good for India?

What could happen if India slips in deflation?

India would see deflation or reduction in general price level from next month due to slackening demand, according to financial services firm Goldman Sachs said.

"We expect yearly headline WPI inflation to fall rapidly below 1 per cent in March. And enter a period of deflation beginning in April, which could last till end-2009 due to not only continuing demand destruction but also a sharp step-up in the base," it said in a research report.

"There will be negative inflation for a few weeks in the first quarter of next fiscal, driven largely by higher base effect but we do not expect a pronounced deflationary trend in the economy," Dun and Bradstreet chief operating officer Kaushal Sampat said recently.

But prices may fall in deflation, so is it good?

Negative inflation: Is it good for India?

Is deflation good for you as prices may drop?

A fall in the prices may sound good for consumers. But it is not actually good. The lack in demand may push companies to further lower prices.

This can lead to a situation where the prices of product fall bellow the cost of manufacturing a product. This in turn forces the companies to cut production, slash jobs and shut down business till demand picks up. This worsens the situation.

Will the deflationary period last long in India?

Negative inflation: Is it good for India?

Will deflation dog India for long?

Deflation is not likely to last long. The monetary and fiscal stimulus measures of the government is likely to boost demand in the long run. In 2010, however, Goldman Sachs expects inflation to come back due to both a gradual pick-up in demand, and conversely, a low base from 2009.

It further said that the Reserve Bank could slash cash reserve ratio (CRR) for banks by 150 basis points by mid-2009 to provide liquidity into the system.