| « Back to article | Print this article |

Is Dhoni Aircel's success mantra?

For the last few weeks, India's cricket captain and youth icon Mahendra Singh Dhoni has been extolling the virtues of Aircel mobile services on television, billboards and newspapers across the country.

If media planners are to be believed, in the last few weeks, ever since it launched in Delhi, the mobile services company has forked out over Rs 35 crore (Rs 350 million) to newspapers, magazines and television channels to promote its products.

The company says that Dhoni's brand image fits in well with what Aircel stands for -- simplicity and the 'boy next door' image which underlines consumer trust.

Is Dhoni Aircel's success mantra?

The company feels there is no better way to connect with customers in India than cricket. It has sponsored the Chennai Super Kings team in the Indian Premier League and has now taken on board Dhoni as the brand ambassador.

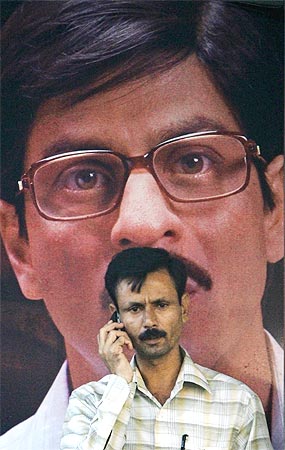

"We chose Dhoni very carefully. He is like us and reflects our unpretentious values in many ways, besides being the best symbol of modern emerging India," says Sandip Das, the CEO of Maxis Communications of Malaysia, which owns 74 per cent of Aircel. (It had bought the stake from NRI businessmen C Sivasankaran.)

At the moment, the trick seems to be working.

Media planners agree that the advertising blitz with Dhoni has worked.

Is Dhoni Aircel's success mantra?

"The recall value of the advertising to its intended users has gone up significantly, despite the fact that competitors like Vodafone and Airtel have spend nearly equal amounts on their brand with the IPL season in full swing now," says a senior executive of a media buying house.

But will Dhoni be able to catapult Aircel into a pan-India mobile service company of substance?

After all, in 10 years of its launch, Aircel has remained a relatively small player which depends for over 57 per cent of its subscribers on just one state -- Tamil Nadu (including Chennai).

With 18 million subscribers and a 6.41 per cent share (without including Reliance Communication) of the GSM mobile market, it is way behind big players like Bharti Airtel, Vodafone, BSNL and Idea Cellular in the pecking order.

Is Dhoni Aircel's success mantra?

Spreading wings

Aircel, on its part, is on overdrive these days.

The company in the last few weeks has rolled out services in Delhi and Mumbai as well as Uttar Pradesh. It plans to roll out in the whole of Maharashtra soon and hopes to hit the 30 million subscriber mark by the end of the year.

By that time, Aircel will be present in 17 circles across the country. And it means serious business.

It has committed almost $2 billion over the next 18 months to augment its network capacity. Das has on his target a double digit market share in the next one or two years.

Is Dhoni Aircel's success mantra?

For Maxis, India holds the key in its quest to become a dominant Asian mobile company. The company operates in three markets -- Malaysia, Indonesia and India -- and over half of its 34 million subscribers and 20 per cent of its revenue come from India.

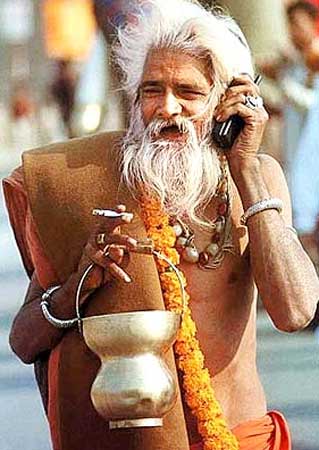

Das says Maxis has invested in India and Indonesia because it estimates that, in the next five years, over half a billion phone connections will be added in these two geographies.

But how will Aircel catch up with far bigger rivals in India?

Is Dhoni Aircel's success mantra?

Its market share is a quarter of market leader Bharti Airtel (32.5 per cent) and half of its nearest rival, Idea Cellular (14.92 per cent). Worse, in key markets like Delhi and Mumbai, where it recently launched, it will be the sixth or seventh mobile service operator.

At least one of these markets, Delhi, is known to be saturated -- mobile penetration has hit 100 per cent.

Says a senior executive of a leading mobile company: "Aircel does not have a unique selling proposition. It cannot play the tariff game as the rates are already very low. Its networks are not comparable to incumbents who through years of experience have plugged all the problems."

Is Dhoni Aircel's success mantra?

Keep it simple

Aircel, of course, is aware of some of the challenges. But it does not believe it doesn't have a USP.

Explaining the brand strategy, Das says: "Price as we all know is a perishable differentiator, unless you have a disproportionate operating cost model. Our fresh networks, simplified tariff plans, refreshing value additions and customer services are a powerful package in a market suffering from a lot of sameness, service fatigue and brand agnostic offerings."

Das says that increasingly customers will use Aircel as their second number, while youngsters will find it attractive as new-generation data users.

Its data offering includes easy-to-use services like doctor on call, music downloads and recitals from the Bible or Quran.

Is Dhoni Aircel's success mantra?

To ensure that the simplicity of the product gets communicated to the consumers, Das says Aircel has devised a very simple plan: "Our launch across the national media has been predicated on simple refreshing communication in a cluttered 'everyday low price' market. We continue to introduce commonsensical value-added services."

Aircel executives are confident they will get new subscribers as well as pick up customers from existing service operators.

They point out, for instance, that while the metros have nearly 100 per cent saturation figures according to the number of SIM cards sold, unique users are still 65-70 per cent of the population. So, there is still room for getting new subscribers.

At the same time, the churn rate of about 3 per cent will help the company grab some more subscribers.

Aircel is also hoping that number portability, which is expected to come by the end of the year, will help it get more numbers.

Is Dhoni Aircel's success mantra?

Target groups

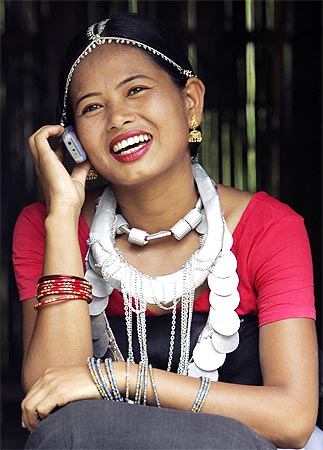

The company is also looking at segmenting the market. And the segments which it has already identified for growth include students, small and medium enterprises and migrant workers.

For instance, the company realised that young users are not looking at a cheap price but offerings which they can use -- group community calling, faster data transfer and downloads.

It also realised that these young users are much more ready to change their numbers -- they simply upload their number on Facebook for their large group of friends to know. The Dhoni campaign was thus clearly targeted at these consumers.

Aircel might also leverage its global footprint to gain numbers in India. Maxis is part of the Bridge Alliance (it includes service providers like Singtel, SK Telecom and Telekomsel) which offers facilities like a uniform roaming rate across its 11 partners.

Das says Aircel has ensured that there is no network problem, despite being on the 1,800 MHz band. The company has a tower strength of 1,000 to 1,400 towers in the new circles where it has started operation. This, he says, is very impressive for a new network.

Is Dhoni Aircel's success mantra?

But competitors say that it will be an uphill task for Aircel to reach even amongst the top four players in the new markets that it has entered.

"It has been in Kolkata for over a year but it doesn't even have a double digit market share. In Andhra Pradesh also, it got 33,000 subscribers in the second month, while in Karnataka it got 52,000 subscribers in the third month of operations. And it is increasingly under pressure in its strong markets like Tamil Nadu and Chennai," says a rival.

Despite the competitive pressure, Aircel has held out on its own in the markets in which it is the number one player -- Chennai and Tamil Nadu. The question is: Will it be able to repeat the same magic across the country?

Ishita Russell and Ashish Sinha contributed to this article.