| « Back to article | Print this article |

Will the new FDI norms impact the Jet-Etihad deal?

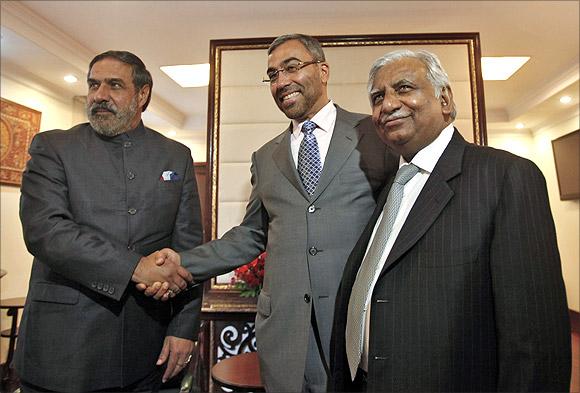

Clearing the air surrounding relaxation of foreign direct investment (FDI) norms on multi-brand retail, commerce and industry minister Anand Sharma said the mandatory 50 per cent investment in back-end infrastructure has to be put in creating new facilities.

In an interview with Nayanima Basu, he also said the Rs 2,060-crore (Rs 20.60 billion) Jet-Etihad deal falls in line with new 'control' definition.

Click NEXT to read more…

Will the new FDI norms impact the Jet-Etihad deal?

After Thursday's cabinet meeting, you said the new definition of 'control' in FDI policy will be somewhat different, although in line with the definition by Sebi (the capital markets regulator) and the Companies Bill, 2012.

We have aligned it to the maximum limit possible. We have looked at it from the FDI perspective, as well as Sebi regulations and the Companies Bill. The definitions by both the latter are identical. Our present definition did not have provisions on management rights, policy decisions and shareholders' rights.

So, the meaning of control was restricted. Now, based on the other two definitions, we have included things like management rights, voting rights and power to take decisions by virtue of a shareholders' agreement or voting rights.

I understand the civil aviation ministry has another definition of 'control and effective ownership', above all other definitions. What happens to that?

This is the new definition in FDI policy. Every ministry has to go by this definition for FDI. This is final.

Will the new definition not impact the Jet-Etihad deal?

Technically speaking, the Jet-Etihad deal got covered under old definition only. And it is covered by the new definition also. Actually, the scrutiny and approval has taken it well beyond that. Their shareholders' agreement and voting agreements were looked at and they were specifically asked to amend those (as per the new guidelines).

On multi-brand retail FDI, while the cabinet did clarify that 50 per cent investment in back-end infrastructure will have to be made in the first tranche of the initial amount of $100 million, it was unclear whether that money will go in creating new facilities or into existing ones.

This first tranche of 50 per cent has to be in new facilities. There is no question on that. The rest they (foreign retailers) can keep acquiring, depending on their business needs.

The philosophy of our policy is to create infrastructure through storage, cold chains and processing. This country needs that. Otherwise, how are we creating anything new through the FDI policy? We want them to bring the latest technologies, create an integrated cold chain.

Click NEXT to read more…

Will the new FDI norms impact the Jet-Etihad deal?

I doubt how happy retailers will be to hear this because they clearly want to acquire the existing ones.

We are very clear about it. They can keep buying the existing ones but the first tranche has to go towards fresh infrastructure.

On sourcing, the new policy says small scale industries which continue to supply to a particular retailer will keep enjoying the benefits, even if they outgrow the $2-mn cap on investment in plant and machinery. What if tomorrow it becomes a large entity; will it still get those sops?

Well, if a micro entity becomes small and the small becomes medium, we should encourage it. There is also a relationship that develops between the retailer and vendor. Take the case of single-brand retailing, where 95 per cent of the sourcing is done from India. We want the same thing to happen here.

Also, now multi-brand retailers can open their stores at any state which allows them to come in?

This is an enabling policy, so in any state which allows retail FDI, such retailers can open stores even if there are no cities of more than a million population. There is no harm. Eventually, what is manufactured and processed will find its way even to the small neighbourhood stores anyway because they will buy from cash and carry points.

Click NEXT to read more…

Will the new FDI norms impact the Jet-Etihad deal?

On single-brand retail now, a non-resident entity or entities which might not be the owner of the brand will be allowed. Can you explain this in the context of the problem surrounding the proposal of Zara and Marks & Spencer?

It is simple. Now at the time of filing for approval, they should file a list of lines of products they want to sell.

FDI in defence has taken an interesting stance. While the cap remains 26 per cent, the government will be ready to allow any limit, even 100 per cent, if the Cabinet Committee on Security is convinced of the proposal?

The 26 per cent is through the government route. The issue here is that if it is beyond 26 per cent but inducts modern state-of-art technology, such proposals would be considered on case-to-case basis, subject to CCS approval. Earlier, even this was not allowed. It is for CCS to decide whether they want to allow 26 per cent or more.