| « Back to article | Print this article |

RBI on why inflation needs to be brought down to 5%

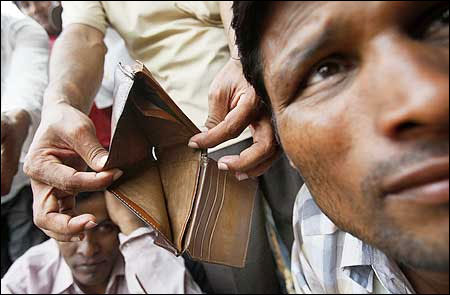

Reserve Bank of India Governor D Subbarao has said the battle against inflation has not ended yet and high prices were mostly hurting the poor people, who do not have a mechanism to get their voice heard.

The inflation continues to remain high and needs to be brought down to 'more acceptable' levels of five per cent or less, Subbarao said in New York, while noting that the challenge was to calibrate interest rates to control inflation and support economic growth at the same time.

Click NEXT to read further. . .

RBI on why inflation needs to be brought down to 5%

"People are hurt by inflation, largely the poor people. They don't have the mechanism to get their voice heard," he said while delivering a lecture at Cornell University on 'India in a Globalizing World: Some Policy Dilemmas'.

"I believe that the battle against inflation has not ended yet. . . We need to bring it down to more acceptable levels of 5 per cent or even less than 5 per cent," he said.

Click NEXT to read further. . .

RBI on why inflation needs to be brought down to 5%

Inflation as measured by the Wholesale Price Index stood at 6.87 per cent in July, down from 7.25 per cent in June.

It is still much above RBI's comfort level of 5-6 per cent.

Subbarao has maintained that inflation needs to remain the top priority for the Reserve Bank of India.

"To control inflation we need to keep interest rates high, but to support growth we need to keep interest rates low," he said.

Click NEXT to read further. . .

RBI on why inflation needs to be brought down to 5%

"The challenge is how do you calibrate interest rates," he added.

The RBI had cut its main interest rate in April by 50 basis points to 8 per cent, but the central bank did not reduce the benchmark interest rates in its first quarter credit policy review in July despite pressure from the industry, which wants reduction in interest rates to spur growth.

The Reserve Bank is scheduled to review its monetary policy on September 17.