| « Back to article | Print this article |

India must take measures to arrest rupee fall, inflation

It could be argued that faster growth in Indian per capita income in the last 10 years compared to the United States' reflects a comparative rise in total factor productivity.

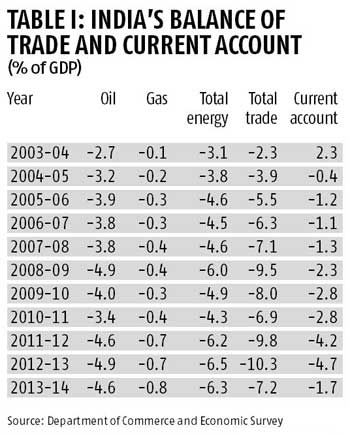

India has had an adverse balance of trade every year since 1949-50, except for the two marginally surplus years of 1972-73 and 1976-77.

The rupee sank to 63.8 to the dollar in September 2013 and was around 62 in January 2014. That bout of depreciation has been followed by a pick-up in exports.

According to some, this is a spurious correlation, and it is the multiple constraints in our real sectors that make it difficult for India to be globally competitive.

And even though inflation in India has been relatively high the rupee should not adjust downwards, because India's total factor productivity has been rising.

A third argument against rupee depreciation is that if the Reserve Bank of India (RBI) mops up incoming foreign exchange, the consequent increase in rupee liquidity would further complicate the tricky task of containing inflation.

At the risk of sounding like a stuck record, this article argues that India is taking a risky and sub-optimal approach by allowing the rupee to be overvalued against the dollar.

Please click NEXT for more...

India must take measures to arrest rupee fall, inflation

Take a step back in time: Britain's sterling quandary of the 1920s was somewhat similar to current questions about India's exchange-rate policies.

In 1925, Montagu Norman, the then governor of the Bank of England, and United Kingdom Treasury officials strenuously advocated lowering inflation by keeping interest rates high and the sterling strong.

Chancellor of the exchequer Winston Churchill reverted sterling to the gold standard at a high parity to maintain its exchange rate against the dollar.

This reduced British competitiveness and raised unemployment. Later, John Maynard Keynes lampooned these decisions in a publication titled the The Economic Consequences of Mr Churchill. Clearly, Britain's sterling policies were tilted in favour of those who had large savings.

Indian capital markets have been buoyant after the general elections in which a single party was able to form the government at the Centre in May 2014.

However, table I lists the grim numbers that detail India's trade imbalances and negative current account over the last 10 years.

The 2013-14 current account balance was better mainly due to a sharp decrease in imports. India's adverse trade balance is persistently driven by high net energy imports.

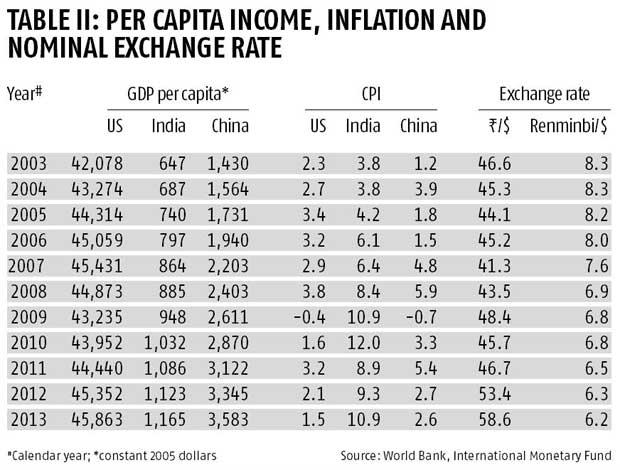

Table II provides rupee-dollar and renminbi-dollar nominal exchange rates, annual inflation, and Indian and Chinese per capita income numbers

Please click NEXT for more...

India must take measures to arrest rupee fall, inflation

The rupee was at 60.2 to the dollar on July 15, 2014 - that is, the rupee has appreciated nominally by 2.9 per cent in the last six months.

The sharp depreciation of the rupee in August-September 2013 was attributed to foreign-exchange outflows caused by the United States Federal Reserve's indication that it may reduce its purchase of government and mortgage-backed securities.

The RBI countered by providing an expensive exchange-rate guarantee for non-resident Indian deposits at higher-than-market rates of interest - and $34 billion was collected during September-November 2013.

Paragraph 6.32 (page 115) in the latest Economic Survey released on July 9 this year mentions that using the Consumer Price Index, or CPI, and 2004-05 as the base year, the rupee was overvalued by 12.3 per cent in real effective exchange rate (REER) terms in 2013-14.

The Survey also says that if 2012-13 is taken as the base year, the rupee was undervalued in 2013-14. A year's time horizon is too short to meaningfully assess movements in the rupee's REER.

It could be argued that faster growth in Indian per capita income in the last 10 years compared to the United States' reflects a comparative rise in total factor productivity..

Hence, although the rupee's REER confirms overvaluation, the currency should not be managed down to a lower value.

If the even sharper rise in Chinese per capita income is used as a benchmark to estimate the renminbi's exchange rate, it should have appreciated to 3.6 in 2013 from 8.3 in 2003.

Obviously, China does not accept the productivity logic since it has limited renminbi appreciation to 6.2 to a dollar.

Please click NEXT for more...

India must take measures to arrest rupee fall, inflation

If the Indian and United States' inflation numbers are used to calculate the rupee's interest rate-parity nominal exchange rate, the rupee should currently be 81 to the dollar.

Even after adjusting this number downwards by an assumed faster rise in Indian productivity, the rupee is substantially overvalued at 60.2.

One view in India is that we should not push the rupee down because China's trade competitiveness is based not on its exchange rate but improvements in infrastructure and other sectors that have made our neighbour a manufacturing hub.

In stark contrast, the United States and other countries have repeatedly complained about undervaluation of the renminbi.

Hopefully, we will improve the ease with which business is done in India.

In the interim, to reduce the risk of capital flight and disorderly rupee depreciation India should manage its currency to make it drift lower against the dollar predictably and consistent with higher Indian inflation.

If this means the RBI has to mop up foreign-exchange inflows, it should do so, and issue market stabilisation bonds - or sell government securities borrowed from Life Insurance Corporation or comparable institutions, if it does not have an adequate stock of such securities.

Please click NEXT for more...

India must take measures to arrest rupee fall, inflation