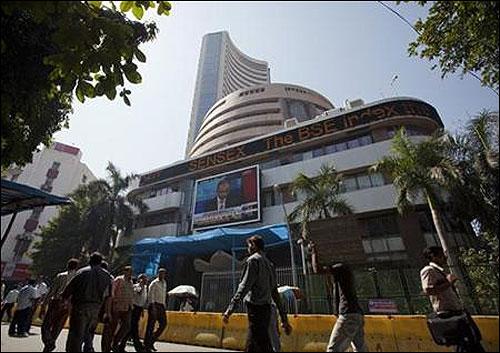

Market completed its hat-trick of weak closings this week; after a weak start key indices tumbled through the day with Bombay Stock Exchange Sensex slipping below the key psychological level of 21,000 only to regain it later.

Market participants remained jittery ahead of key economic data that is slated for release post market hours today. Benchmarks extended losses in the afternoon trades dragged down by heavyweight stocks.

The 30-share BSE Sensex ended almost 246 lower at 20,926 levels down 1.16% from its previous close while the broader 50-share Nifty index of the National Stock Exchange scrapped 71 points to close at 6,237 levels, down.

"The Nifty is testing support in the 6250-6275 zone. If that breaks, next support is at 6225," says technical analyst Devangshu Datta.

At 3:54 am, the rupee was trading at Rs 61.66 compared with previous close of Rs 61.57 per dollar.

Sentiment was also hit on account of a provisional budget deal in the US which removed one of the near-term reasons for the Fed to keep up its current pace of economic stimulus also known quantitative easing.

The budget agreement reached late on Tuesday, would end three years of political squabbling in US that climaxed in October with a two-week partial government shutdown. The U.S. House of Representatives could vote on the deal on Friday. U.S. markets posted their biggest drop in a month after the agreement was announced.

Asian shares ended lower on Thursday over fears that US Federal Reserve may taper its 85-billion-a-month bond buying program earlier than expected after a provisional budget deal in Washington eased some of the fiscal drag on the US economy.

The MSCI's Emerging Market Index which captures large and mid cap representation across 21 Emerging Markets (EM) was down 0.82% today. Liquidity flow from US Quantitative easing has largely pumped up equity markets in emerging markets.

Back home, the retail price index-based inflation for the month of November is slated to be released in the evening today, is keenly watched as it comes ahead of RBI monetary review next week and a few days after the Congress faced drubbing in assembly elections. It gains more significance because the drubbing was mainly on the issue of price rise among other factors. RBI is expected to take anti-inflationary stance as inflationary pressures have resurfaced.

In October, expensive vegetable prices had catapulted consumer price index (CPI)-based inflation to double digits after a gap of six months, even as normal monsoon is expected to yield a bumper crop this financial year.

Vegetable prices have abated a bit in November, but its exact impact on retail inflation would be known later in the day.

The inflation had risen to 10.09% in October from 9.84% in September as the rate of price rise surged to 45.67% against 34.93% over the period.

Tackling inflation will be a key priority, RBI Governor Raghuram Rajan said on Wednesday, raising expectations that the central bank could raise interest rates for a third time in four months if prices remained high.

Street expects consumer prices to rise on an annualised rate of 10%,in November a Reuters poll showed. It stood at 10.09 per cent clocked in October

Market participants are also on the lookout for Index of Industrial Production (IIP) data which will be released later today. Industrial activity may show a contraction in the factory output in October.

This may be a result of the high base in the same month last year and also due to sluggish performance by the eight infrastructure industries. The core sectors, which constitute around 38% of the IIP, contracted after eight months in October by 0.6% after growing at a high pace of 8% in the previous month.

In October last year, the IIP grew by a massive 8.4% -- a 16-month high at that time.

Auto, banks, oil& gas and Capital goods ended 1.3- 2.4% lower on the BSE sectoral indices which track various industrial sectors. Power index was the sole gainer, up 0.4% from its previos close.

Tata Motors, ONGC, Coal India ICICI Bank and Bajaj Auto were the top losers while Tata Power, HDFC, Gail India and NTPC were the top heavyweight gainers on the bourses today.

Market breath remained weak on the BSE as 1087 stocks advanced against a decline seen in 1456 stocks.

Other shares

Tata Motors slipped nearly 4.7% to Rs 360.10 on the NSE on reports that its UK subsidiary Jaguar Land Rover (JLR) expanded its capex guidance for the fiscal year ending March 2015 which is likely to strain the company's cash flows in near term.

State miner CIL ended 2.7% lower on the NSE at 280.85 after the company was slapped with a new probe a day after being fined Rs 1,773 crore by the Competition Commission of India (CCI), over allegations the state-run firm and its subsidiaries abused market dominance in their sale of fuel through e-auctions. Also, CIL chairman S Narsing Rao said that CIL is likely to fall short of its production target by 7 million tonnes (MT) this year.

GMR Infrastructure ended 1.6% higher at 22.25 on the NSE on reports that the company has hired four banks including Citigroup and JPMorgan to manage the listing of its airport business that is expected to raise $300-350 million.

Shares of SKS Microfinance were up over 4% at Rs 178 after the company late Wednesday announced that it has completed a second securitisation deal worth Rs 80.81 crore for the current fiscal.

Cadila Healthcare ended 2.4% higher at Rs 744 on the NSE after the pharmaceuticals company said it has settled a patent litigation with US-based Warner Chilcott Company LLC.