| « Back to article | Print this article |

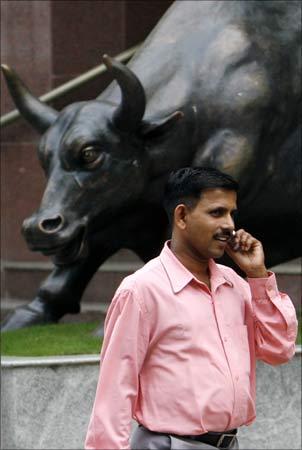

Modi magic: Markets end at record highs

Markets ended at record highs on Monday, amid aggressive institutional buying in cyclicals and policy-reform oriented sectors, with the BJP-led NDA keeping economic growth as its top priority.

The 30-share Sensex ended up 241 points at 24,363 and the 50-share Nifty ended up 61 points at 7,264.

Further, several brokerages have upped their Sensex targets. Nomura raised its 2014 target for the Sensex to 27,200 from 24,700, while Citigroup increased its target to 26,300.

Goldman Sachs also raised its 12-month target for the Nifty to 8,300 from 7,600, implying a 15.2% upside from current levels.

Market volatility has also seen a sharp decline today, with India VIX down 15% at 20.63.

A sharp rally in equities saw over 500 stocks hit the upper circuit on the Bombay Stock Exchange (BSE) on Monday. Of the 2,859 stocks that are traded on the BSE, as many as 532 hit upper circuit levels.

Foreign institutional investors were net buyers in Indian equities to the tune of Rs 3,634 crore on Friday, when the BJP-led NDA won the general elections by an absolute majority.

The rupee surged to its highest level in 11 months against the dollar on expectations of continued robust foreign buying in domestic shares and debt following the historic win by the BJP-led NDA in the general elections. The rupee was trading higher at Rs 58.56 against the US dollar compared to its previous close of Rs 58.79.

Click NEXT to read more...

Modi magic: Markets end at record highs

Asian markets ended lower with China's Shanghai Composite down over 1% amid growth concerns in the world's second largest economy. Japanese shares ended lower amid a stronger yen and tracking weakness in Chinese shares. The Nikkei ended down 0.6% at 14,006. Meanwhile, Hang Seng and Straits Times were trading flat with negative bias.

European markets were trading lower as investors booked profits after recent gains, adopting a wait-and-watch stance ahead of the European Central Bank's policy meet in June. Weakness in Asia also dampened market sentiment. The CAC-40, DAX and FTSE-100 were down 0.2-0.8% each.

The BSE Power index was the top gainer among the sectoral indices, up 10%, followed by Capital Goods, Bankex, Metal, Auto , Oil and Gas index up 2.5-8.3% each. IT, FMCG, Healthcare indices ended down 3.6-5% each.

Infrastructure stocks were among the top gainers on hopes that the government's top priority would be to resume large infrastructure projects that are currently stalled. L&T was up nearly 7% at Rs 1,525.

State-owned BHEL was up nearly 17% at Rs 268. The company today said it has signed an initial agreement with PT Star Vyobros, Indonesia for setting up a 200 MW coal fired plant in the island nation.

Among mid-cap infrastructure stocks, GVK Power and Infrastructure, GMR Infrastrucutre and IRB Infrastructure ended up 11-20% each.

Click NEXT to read more...

Modi magic: Markets end at record highs

In the oil and gas space, the upstream industry is hopeful that the new government would take a serious look at the subsidy sharing formula.

The industry also awaits clarity on E&P reforms and expects the government to stick to Kelkar committee recommendations of continuing with the cost recovery mechanism. ONGC ended up 8.2% and index heavyweight Reliance Ind ended up 3.7%.

Coal India ended up 12.7%. According to a report by a foreign brokerage, reform of Coal India would be on the agenda of the new government. The company will announce its results for the year ended March 31, 2014 on May 29, 2014.

Bank shares also witnessed buying on hopes that resumption of economic activity would lead to higher credit growth. HDFC Bank, Axis Bank and SBI ended up 1-6.5% each. ICICI Bank, which had seen sharp gains last week, ended marginally higher.

Click NEXT to read more...

Modi magic: Markets end at record highs

Meanwhile, shares of IT exporters such as TCS, Infosys and Wipro ended down 4-5.7% each after the rupee touched a 11-month high against the US dollar. Over 80% of their revenues come from exports to the US and an appreciation in the Indian rupee hurts revenues.

Defensive shares in the pharma and FMCG space witnesed profit-taking, with focus shifting to cyclicals. Dr Reddys Labs and Sun Pharma ended down 4.8-5.2% each. In the FMCG space, HIndustan Unilever ended down 4.1% and ITC lost 5.5%.

Among other shares, Rail stocks surged on hopes that Bhartiya Janta Party's Prime Minister designate, Narendra Modi will stand by his promise to improve the Indian Railways. Texmaco Rail, Kernex Microsystems (India), Kalindee Rail Nirman (Engineers), BEML,Titagarh Wagons , Nelco, Stone India, and Zicom Electronic Security Systems ended up 5% - 20% each.

Adani Enterprises gained 2% to end at Rs 541, its multi-year high on BSE, after reporting a massive six-fold increase in consolidated net profit at Rs 2,848 crore for the quarter ended March 31 2014 (Q4), boosted by gains from compensatory tariff for its arm Adani Power. The company had reported a profit of Rs 474 crore in the same quarter last fiscal.

Rashtriya Chemicals and Fertilisers Ltd (RCF) rallied 15% to close at Rs 46.45 after reporting 30% year on year (yoy) increase in net profit at Rs 152 crore for the fourth quarter ended on March 31, despite decrease in income. The state-owned company had profit of Rs 118 crore in the same quarter year ago.

Century Textiles and Industries has surged 9% to Rs 456 on reports that Kumar Mangalam Birla will acquire 16% stake in the company, which he is eventually set to inherit from grandfather Basant Kumar Birla.

In the broader market, the BSE Mid-cap and Small-cap indices touched 3-year highs in intra-day trades. The BSE Mid-cap index ended up 4.2% and the Small-cap index gained 5.8%. The CNX Mid-cap index also ended at record closing high of 9,908.

Market breadth ended strong with 2,003 gainers and 726 losers on the BSE.