| « Back to article | Print this article |

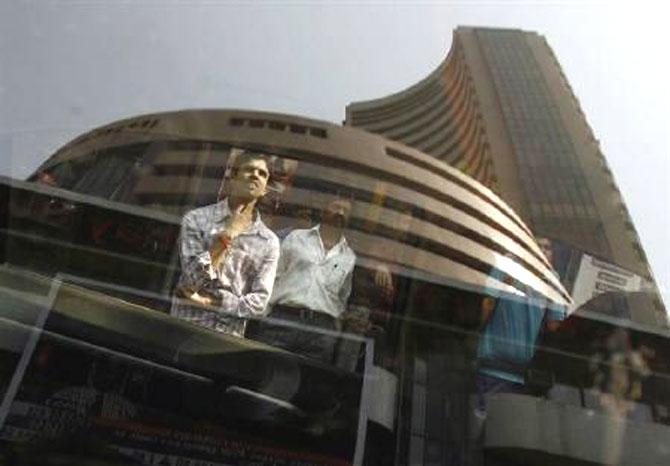

Weak China data wreaks havoc in domestic markets

Markets ended at their lowest level in 10 weeks on Monday as weak economic data from China, the world's second largest economy, raised worries that the global growth is still struggling. Further, the US Fed's decision to further taper its monetary stimulus measures has also dampened sentiment in emerging markets.

The 30-share Sensex ended down 305 points at 20,209 and the 50-share Nifty ended down 88 points at 6,002. On November 22, 2013, the 30-share Sensex had ended at 20,217 and on November 12, 2013 the 50-share Nifty had closed at 6,018.

Foreign Institutional Investors turned net sellers in Indian equities last week to the tune of Rs 3,216 crore.

The rupee turned marginally lower as state-run banks were seen buying dollars to likely to meet defence needs, foreign banks took cover ahead of RBI's reference rate setting.

The rupee is trading at 62.75 compared with its previous close of 62.68, after rising to 62.56 in early trades.

Stocks in Asia ended lower with trading holidays in some markets. Japan's benchmark share index the Nikkei dropped to a new 2-1/2 month low on Monday, extending losses for third straight day as investors remained cautious on weak economic data from China and ahead of the US jobs data. The Nikkei ended down 2% to 14,619. Singapore's Straits Times ended down 2.1% at 2,991. Stock markets in China, Hong Kong and Taiwan were closed on account of Lunar Year holidays.

BSE Metal index was the top loser among the sectoral indices down 3.3% at 8,849. The Metal Index ended below 9000 the lowest since October 28, 2013. Realty, Bankex, IT, AUto, Capital Goods, Oil and gas indices ended down 1-2% each. However, Healthcare index was the sole gainer up 1%.

Metal shares were down after official data released by China on Saturday showed that the country's factory growth in January eased to six-month low at 50.5 from 51 in December. Tata Steel, Hindalco, Sesa Sterlite, JSW Steel ended down 1.5-6% each. Further, even the services index witnessed a decline. The official non-manufacturing Purchasing Managers' Index (PMI) eased to 53.4 in January from 54.6 in December.

IT majors TCS and Infosys ended down 1.8% each on account of profit taking at higher levels.

Shares of mobile phone service providers such as Bharti Airtel, Reliance Comm and Idea ended down 1-3% each on worries that aggressive bidding for the 900-MHz bandwidth with the entry of Reliance Jio would lead to higher costs for retaining the spectrum.

Share of four-wheeler majors such as Tata Motors, Maruti Suzuki and Mahindra & Mahindra were down 0.5-3% each after they reported disappointing January sales on Saturday.

Other shares which contributed to the Sensex decline include ICICI Bank and FMCG major ITC.

In the oil and gas sector, Reliance Ind ended down 1.1% and ONGC fell 2.7%.

Lupin was up 0.3%. The pharma major today reported Q3 net profit of Rs 476 crore as compared to Rs 335 crore in the same period last year, a gain of 42%. Revenue came in at Rs 3,022 crore as compared to Rs 2,501 crore in the year ago period. Sun Pharma and Dr Reddys Labs were up 1-2% each.

Among other shares, TVS Motor ended up nearly 3% at Rs 79.50 after the company reported strong export growth in January. TVS Motor Company's total exports surged 39% to 28,875 units in January 2014 over January 2013.

Sobha Developers gained 2.2% to end at Rs 273 after net profit rose 10.46% to Rs 58.10 crore on 26.48% increase in total income to Rs 545.50 crore in Q3 December 2013 over Q3 December 2012.

Shares of United Spirits ended nearly 3% up at Rs 2,541 after Diageo through its Dutch arm Relay BV increased stake through a bulk deal on the Bombay Stock Exchange. Relay BV has purchased 35,00,000 shares of United Spirits at an average price of Rs 2,474.45 per share.

In the broader market, the BSE Mid-cap index ended down 0.9% while BSE Small-cap index eased 0.5%.

Market breadth ended weak with 1,437 losers and 1,095 gainers on the BSE.