| « Back to article | Print this article |

How RBI rate hike hits the common man

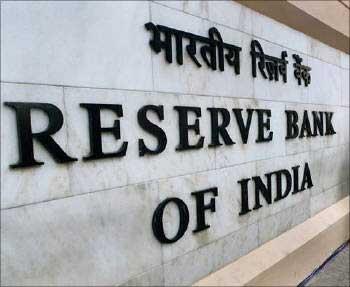

The Reserve Bank of India on Tuesday increased the cash reserve ratio (CRR) of scheduled banks by 25 basis points from 5.75 per cent to 6.0 per cent.

India's central bank also decided to increase the repo rate under the Liquidity Adjustment Facility (LAF) by 25 basis points from 5.0 per cent to 5.25 per cent with immediate effect.

The bank also increased reverse repo rate under the LAF by 25 basis points from 3.5 per cent to 3.75 per cent with immediate effect. Bank Rate however was left unchanged at 6.0 per cent.

As a result of the increase in the CRR, about Rs 12,500 crore of excess liquidity will be absorbed from the system.

Cash Reserve Ratio (CRR) is the amount of funds that the banks have to keep with the Reserve Bank of India. If RBI decides to increase the percent of this, the available amount with the banks comes down. RBI is using this method (increase of CRR rate), to drain out the excessive money from the banks.

So what will happen due to this hike? Click NEXT to read on. . .

How RBI rate hike hits the common man

Some of the expected outcomes of the hike in key rates by the Reserve Bank of India are:

(i) Inflation will be contained and inflationary expectations will be anchored.

(ii) The recovery process will be sustained.

(iii) The government's borrowing requirements and the private credit demand will be met.

(iv) Policy instruments will be further aligned in a manner consistent with the evolving state of the economy.

Impact on common man

Home, car and personal loans are likely to rise marginally with the Reserve Bank of India, under pressure to combat rising inflation, raising on Tuesday the mandatory cash reserves of banks to suck over Rs 12,500 crore (Rs 125 billion) out of the system.

With the RBI deciding that banks now need to increase the amount of cash they have to keep with the central bank (the cash reserves), the problem is that banks will not earn any interest on this amount.

So banks will be left with little option but to hike interest rates to make up for that loss of interest they would normally have earned had CRR been lower.

Click NEXT to read on what will happen to your EMIs. . .

How RBI rate hike hits the common man

Both lending and deposit rates are likely to go up, although by how much cannot immediately be said. The increase in interest rates, however, will depend on whether banks would want to absorb the CRR hike, until credit off-take increases meaningfully, before hiking lending rates.

Floating rate home loans

Floating rate home loan borrowers may have to brace up for another round of hike in their interest commitments, although not in the immediate future. In the long term, the CRR hike could lead to a general rise in interest rates in the economy, at times leading to resetting of equated monthly installments on flexible home and personal loans.

Effect on EMIs

In the long term, repayments may increase by over Rs 3.5-4 lakh (Rs 350,000-400,000) over a 20-year period on a Rs 20-lakh home loan, if the country's banks hike interest rates by up to 1 per cent following the tight monetary measures announced by RBI.

Consumers may have to fork out up to Rs 1,500 more every month for a home loan of Rs 20 lakh, as experts say that interest rates could go up by 0.75-1 per cent after RBI's hawkish policy aimed at containing inflation.

Click NEXT to read on. . .

How RBI rate hike hits the common man

Personal loans

The interest rates on personal loans too are likely to rise, for it is expected that banks will pass on the burden to the consumers.

Car loans

With RBI hiking rates, your dream car may have become more expensive. Car loan lenders have jacked up interest rates on loans by anything between 75 to 100 basis points, and as a double whammy to you, even car manufacturers are increasing prices due to heavy input costs.

What should one expect on the rate front going forward?

RBI has always been proactive and has worked towards tackling issues in a timely manner -- this time it being inflation.

The inflationary pressure is going to exist for some time going forward which means rate hike will be the name of the game (provided the economy doesn't take a turn for the worse).The interest rate cycle has turned and here on rates can only increase.

What should new buyers do?

This could be the best time to take a home loan or auto loan because rates will eventually rise. Fixed rate product may not be a bad idea at all.

Click NEXT to read on. . .

How RBI rate hike hits the common man

Why RBI was forced to hike rates

The RBI said that the Indian economy is firmly on the recovery path. Exports have been expanding since October 2009, a trend that is expected to continue.

On balance, under the assumption of a normal monsoon and sustenance of good performance of the industrial and services sectors on the back of rising domestic and external demand, for policy purposes the baseline projection of real GDP growth for 2010-11 is placed at 8.0 per cent with an upside bias.

The Reserve Bank's baseline projection of WPI inflation for March 2010 was 8.5 per cent. However, some subsequent developments on both supply and demand sides pushed up inflation. Enhancement of excise duty and restoration of the basic customs duty on crude petroleum and petroleum products and the increase in prices of iron ore and coal had a significant impact on WPI inflation.

In addition, demand side pressures also re-emerged as reflected in the sharp increase in non-food manufactured products inflation from 0.7 per cent to 4.7 per cent between December 2009 and March 2010, the bank said.

There have been significant changes in the drivers of inflation in recent months.

First, while there are some signs of seasonal moderation in food prices, overall food inflation continues at an elevated level. It is likely that structural shortage of certain agricultural commodities such as pulses, edible oils and milk could reduce the pace of food price moderation.

Second, the firming up of global commodity prices poses upside risks to inflation.

Third, the Reserve Bank's industrial outlook survey shows that corporates are increasingly regaining their pricing power in many sectors. As the recovery gains further momentum, the demand pressures are expected to accentuate. Fourth, the Reserve Bank's quarterly inflation expectations survey for households indicates that household inflation expectations have remained at an elevated level.

Click NEXT to read what RBI fears could affect inflation further. . .

How RBI rate hike hits the common man

Going forward, three major uncertainties cloud the outlook for inflation:

First, the prospects of the monsoon in 2010-11 are not yet clear.

Second, crude prices continue to be volatile.

Third, there is evidence of demand side pressures building up.

On balance, keeping in view domestic demand-supply balance and the global trend in commodity prices, the baseline projection for WPI inflation for March 2011 is placed at 5.5 per cent.

It would be the endeavour of the Reserve Bank to ensure price stability and anchor inflation expectations. In pursuit of these objectives, the Reserve Bank will continue to monitor an array of measures of inflation, both overall and disaggregated components, in the context of the evolving macroeconomic situation to assess the underlying inflationary pressures.