| « Back to article | Print this article |

From default risk to booming economy: India's comeback tale

The post-1991 reforms have brought unrecognisable change.

However, there is a large unfinished agenda which, if neglected, could hobble India's progress to the next level.

Economic liberalisation, collectively a set of sweeping reforms covering industry, trade, investment and the financial sector, alongside rationalisation of the tax structure, was principally responsible for transforming India from an economy in a low-growth equilibrium trap as late as the late 1980s to the second fastest growing large economy in the world two decades later.

It was extreme crisis that drove change. India, in May 1991, faced a balance of payments crisis and was on the verge of defaulting on its external debt repayment obligations.

Click NEXT to read more...

From default risk to booming economy: India's comeback tale

India correctly chose to adopt a "gradualist" approach to reforms, eschewing the temptation to change everything at one go.

The strategy driving change was to pick areas where the probability of success was the highest and use that as a springboard to enact further change.

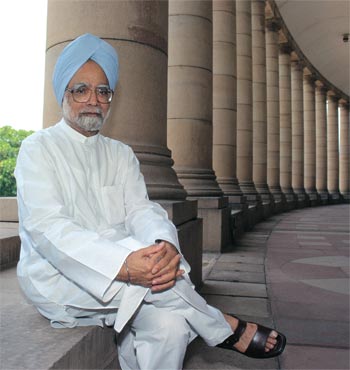

The budget speech of July 24, 1991, by the then Finance Minister Manmohan Singh, eliminated the industrial licensing regime in one sweep.

The list of industries reserved for the public sector was whittled down from 18 to three.

Click NEXT to read more...

From default risk to booming economy: India's comeback tale

The number of industries covered under small-scale sector reservation was also drastically reduced.

The most conspicuous contribution of industrial liberalisation was in promoting domestic entrepreneurship.

The change was twofold - existing firms rapidly scaled up, while several new first generation enterprises were started.

The rise of world-class Indian enterprises in areas ranging from information technology to manufacturing is a direct consequence of a more conducive environment to growth that industrial de-licensing engendered.

Click NEXT to read more...

From default risk to booming economy: India's comeback tale

This reform was also easier to push through, because the number of existing domestic producers was small to begin with.

However, the situation with final products was different because of the large number of domestic producers, mostly belonging to the small-scale sector.

Tariff reduction was slower and often unsteady.

While peak customs duties have come down from 150 per cent in 1991-92 to about 30 per cent today, they are still very high compared to China and Southeast Asia, where corresponding rates are around 10 per cent.

Click NEXT to read more...

From default risk to booming economy: India's comeback tale

In 2010-11 exports were $247 billion and imports $359 billion.

They collectively amount to about 30 per cent of GDP, a significant increase from the pre-liberalisation era.

While India still does not rank among the world's great trading nations like China, it is undeniably a more open economy today than two decades ago.

The change in investment regime and its impact is equally striking. Foreign direct investment in India increased from virtually nothing in 1990 to $25 billion in 2010 (it reached a peak of $36 billion in 2009).

Click NEXT to read more...

From default risk to booming economy: India's comeback tale

While FDI inflows have not spurred an export-oriented manufacturing revolution as in China, they have contributed in more subtle ways, such as exposure to global best practices.

In fact, in niche areas such as automobiles and auto components, they have raised the profile of India as a global manufacturing hub.

If this experience is not broader than it currently is, serious gaps in physical infrastructure and a debilitating regulatory process are to blame.

Click NEXT to read more...

From default risk to booming economy: India's comeback tale

The economic reforms of 1991 have changed India unrecognisably.

However, there is still a large unfinished agenda.

For example, there is considerable divergence between states in the quality of the investment environment - the states of southern and western India are in a different league compared to their northern and eastern counterparts.

India still ranks among the more difficult countries in the world to do business in.

While the progress to date needs to be rightly cherished, resting on laurels would hobble India's progress to the next level.