| « Back to article | Print this article |

Foreign exchange reserves will not buy us immunity: Rajan

A day after the Reserve Bank of India’s monetary policy review, Governor Raghuram Rajan talked to journalists on related issues.

He noted, among other things, that foreign exchange reserves come at a cost and the country needs credible policies to fight external shocks.

And, on what can be done to make public sector banks more effective within the existing framework.

Please click NEXT to read the edited excerpts:

Foreign exchange reserves will not buy us immunity: Rajan

On preparedness to face further tapering by the US Federal Reserve of its earlier monetary expansion. . .

You have seen that every time the US sneezes, the markets around the world catch a cold and we hope they don’t catch pneumonia.

The stabilisation of the macro economy in the past year and half should sustain the initial bout of volatility.

Remember the so-called taper tantrums that started in May last year. . .the initial bout was not discriminating.

In fact, emerging markets that are stronger sometimes see more selling because one can get out without too much liquidity impact.

But over time, investors reassess what is a good market and what is bad.

I think relative to a number of countries, the perception of India is somewhat stronger. But are we immune? No.

Please click NEXT to read further. . .

Foreign exchange reserves will not buy us immunity: Rajan

Reserves will not buy immunity

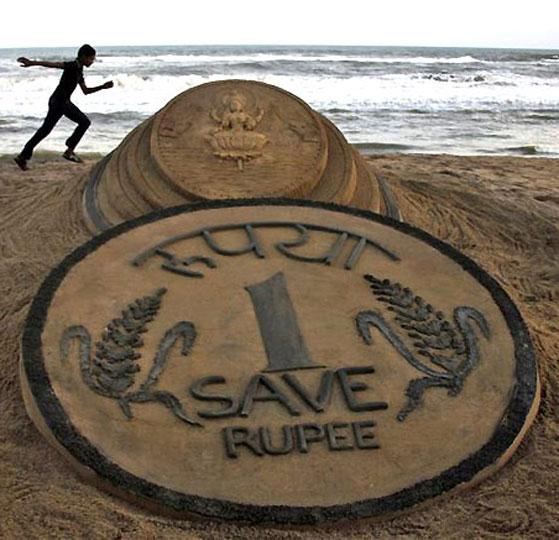

Foreign exchange reserves will not buy us immunity of their own.

What will buy immunity is strong and credible policies.

If we have a low fiscal deficit, a moderate current account deficit and low inflation, people will want to be here.

As the rupee becomes more international, debt markets become more vibrant, we will reach to developed country status.

That is when we will get immunity.

Reserves only make sure that volatility does not get converted into a deeper mini-crisis.

Please click NEXT to read further. . .

Foreign exchange reserves will not buy us immunity: Rajan

Focus on credible policies

Our focus has been to increase the policy and policy credibility.

Why do I emphasise on inflation so much?

I have no desire of being seen as an Indian (Paul) Volcker. . . the reason why we need to bring inflation under control is because it is also a part of our external defence.

Reserves are useful to have; I would rather prefer to have higher reserves than lower reserves.

But they come at a cost.

We earn next to nothing for the foreign reserves we hold.

We are financing another country when we have a significant financing need.

I am not thinking about an import cover target that I want to build. Our reserve accumulation happens as an incidental byproduct. We have neither a target exchange rate in mind nor a target level of reserves in mind.

Please click NEXT to read further. . .

Foreign exchange reserves will not buy us immunity: Rajan

Need for low inflation

Let me first say that inflation is a disease which we have to get rid of if we want sustainable growth.

Moderate inflation is fine.

High levels of inflation, like 10 per cent (a year) or above, is just completely detrimental.

The real interest rate might not be very high from the perspective of a business house, as it will invest at those high nominal interest rates thinking of the possibility that inflation might come down.

It creates a lot of fear about locking in long-term interest rates at that level. It has a dampening effect on investments.

It has an effect on the external accounts.

Please click NEXT to read further. . .

Foreign exchange reserves will not buy us immunity: Rajan

If inflation is high, there is a natural tendency for the currency to depreciate relative to the rest of the world.

It also puts off foreign investors.

They do not want to invest in a country in which inflation differentials are that high.

The problem in the past few fights against inflation has been that every time we look like we are succeeding, the clamour arises that we have had high interest rates and inflation is coming down, so why don’t you cut interest rates.

But we don’t want to keep fighting inflation every two years, which is what we have been doing over the past five-six years.

Please click NEXT to read further. . .

Foreign exchange reserves will not buy us immunity: Rajan

Banks will not cut rates even if RBI does

Are we being too tight relative to the growth situation? I don’t think so.

In fact, my sense is now that the industrial growth numbers are starting to pick up, I would very much doubt that the cost of capital is the primary factor keeping back investment.

Of course, lower cost of capital would help.

But as I have said repeatedly, if we cut policy rates, it is not clear that banks will follow suit, cutting the deposit rates until inflation comes down.

So, to continuously say that the policy rate is the problem is missing the overall picture of the current constraints on investment.

Please click NEXT to read further. . .

Foreign exchange reserves will not buy us immunity: Rajan

On markets’ misperception

For sure, at the back of our mind in crafting Tuesday’s policy statement, was also the view that some in the market had misinterpreted the June statement to suggest that there was a bias towards being more accommodative or, in your bird language, dovish.

I think that was misinterpreting the statement.

We were basically pointing to the fact that there was substantial uncertainty on both sides.

Please click NEXT to read further. . .

Foreign exchange reserves will not buy us immunity: Rajan

On governance in PSBs

To implement the P J Nayak committee report, privatisation of public sector banks are not required.

They have suggested that some governance issues might become easier if the (government) stake is brought below 51 per cent.

There are (other) recommendations which could be implemented without bringing the stake below this.

For example, appointing a bank board, putting the shares of banks in some kind of investment company structure, then manage by entities different from the government.

The whole point is, can we get the governance structure straight and can we distance the governance structure from succumbing to some of the political interests that are around.

For management, we have been recommending separating the chairman and managing director’s position into two.

We need MDs with longer terms, so a three to five-year term makes more sense.

Then, if you want more private sector talent to come in, then the differentials in the public sector with respect to the private sector has to narrow.

All this, put together, will change the quality of the public sector, without changing the ownership.

There are a number of suggestions in the report that can be implemented without necessarily changing the public service that the PSBs do or changing the ownership.

We have talked about some suggestions, which the government is considering seriously.

Please click NEXT to read further. . .

Foreign exchange reserves will not buy us immunity: Rajan

On foreign PE firms interested in entering the asset reconstruction company business

We have upped the requirement for the skin in the game for ARCs, so that it becomes costly only to participate.

The up-front investment requirement by ARCs have been increased.

In terms of bringing new capital, we are open to new players entering the ARC business, taking over existing ARCs and perhaps recapitalising those.

With some of these tools, ARCs will become more effective in terms of resolution and then, hopefully, new players will enter.

I understand some foreign private equity firms are very interested in participating here and we are open to hearing from them.

On legislative changes for wilful defaulters

We are trying to ensure wilful defaulters are prevented from accessing all kinds of funds and not only banking funds.

We are looking at some legislative changes on the powers of creditors in recovery.