| « Back to article | Print this article |

Fed surprises, sticks to stimulus as it cuts growth outlook

The US Federal Reserve defied investor expectations on Wednesday by postponing the start of the wind down of its massive monetary stimulus, saying it wanted to wait for more evidence of solid economic growth.

Investors responded by propelling US stocks to record highs and driving down bond yields.

Yields on U.S. Treasury debt had risen over the summer on expectations the Fed would cut back its $85 billion a month in bond purchases that have been the cornerstone of its efforts to spur the economy.

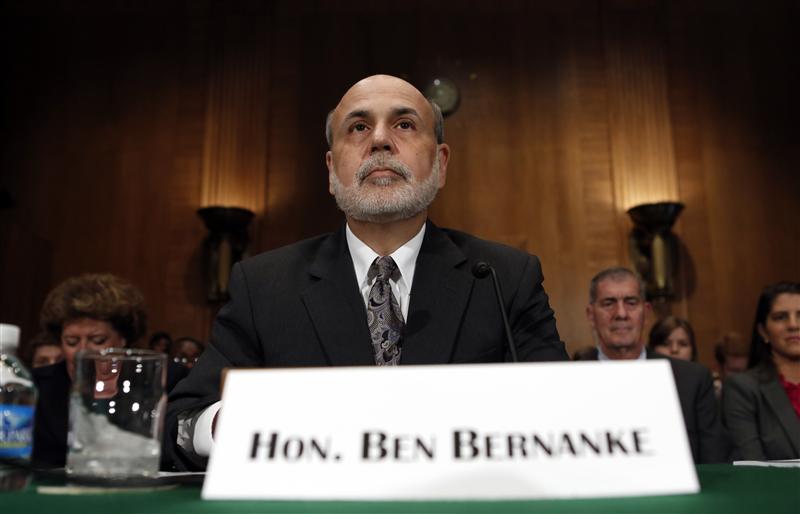

Furthermore, Fed Chairman Ben Bernanke refused to commit to reducing the bond purchases this year, and instead went out of his way to stress the program was "not on a preset course." In June he had said the Fed expected to cut back before year end.

"There is no fixed calendar schedule. I really have to emphasise that," he told a news conference. "If the data confirm our basic outlook, if we gain more confidence in that outlook ... then we could move later this year."

Click NEXT to read more…

Fed surprises, sticks to stimulus as it cuts growth outlook

The reaction in markets was swift and sharp. The US dollar fell to a seven-month low against major currencies and the price of gold, a traditional inflation hedge, soared more than 4 per cent.

"The Federal Reserve remains quite concerned about the overall sluggishness of the economy, preferring to take the risk of being too loose for too long as opposed to tighten prematurely," said Mohamed El-Erian, co-chief investment officer at Pimco, which manages the world's largest mutual fund.

Some economists said it was possible the Fed might not begin to wind down its bond buying until after Bernanke's term as Fed chairman expires in January.

That would leave the tricky task of unwinding the stimulus to his successor, quite likely Fed Vice Chair Janet Yellen, who was identified by a White House official on Wednesday as the front-runner for the job.

Bernanke declined to comment on his future, beyond saying he hoped to have more information soon.

Click NEXT to read more…

Fed surprises, sticks to stimulus as it cuts growth outlook

A Reuters poll of 17 top Wall Street bond dealers found that nine were now looking for the US central bank to trim its bond purchases at a meeting in December, but few held much confidence in their forecasts. One looked for a reduction in October, while two more said the Fed would wait until next year.

Earlier this month, 13 of 18 of these so-called primary dealers polled forecast a September tapering of the purchases.

Lowers Economic Growth Forecast

In fresh quarterly forecasts, the Fed cut its projection for 2013 economic growth to a 2 per cent to 2.3 per cent range from a June estimate of 2.3 per cent to 2.6 per cent. The downgrade for 2014 was even sharper.

It cited strains in the economy from tight fiscal policy and higher mortgage rates in explaining why it decided not to cut back on its asset purchases.

"The tightening of financial conditions observed in recent months, if sustained, could slow the pace of improvement in the economy and labour market," the Fed said in a statement.

Click NEXT to read more…

Fed surprises, sticks to stimulus as it cuts growth outlook

Nevertheless, it said the economy was still making progress despite higher tax hikes and the budget cuts in Washington that were part of the "sequester" implemented by Congress.

"Taking into account the extent of federal fiscal retrenchment, the committee sees the improvement in economic activity and labor market conditions since it began its asset purchase program a year ago as consistent with growing underlying strength in the broader economy," it said.

"The (policy-setting) committee decided to await more evidence that progress will be sustained before adjusting the pace of its purchases," the Fed added.

Bernanke had stated in June that officials expected to begin slowing the pace of bond purchases this year and would likely end the program by mid-2014, at which point the central bank forecast the unemployment rate would be around 7.0 per cent.

In his statement on Wednesday, he said a jobless rate of 7.0 per cent was not a "magic number" that would govern when the Fed would turn off the monetary spigot.

Click NEXT to read more…

Fed surprises, sticks to stimulus as it cuts growth outlook

"We could begin later this year. But even if we do that, the subsequent steps will be dependent on continued progress in the economy," Bernanke said. "We don't have a fixed calendar schedule. But we do have the same basic framework that I described in June."

Fed Sees First Rate Hike In 2015

The Fed has held overnight interest rates near zero since late 2008 and has more than tripled its balance sheet to more than $3.6 trillion through three rounds of bond buying aimed at holding borrowing costs down.

The decision not to taper bond purchases faced a single dissent. Kansas City Federal Reserve Bank President Esther George, who has dissented at every Fed policy meeting this year, repeated her concerns that the low-rate policy could lead to asset bubbles.

Fed Governor Sarah Raskin, who has been nominated to take a top job at the US Treasury, did not participate in the meeting.

Click NEXT to read more…

Fed surprises, sticks to stimulus as it cuts growth outlook

The central bank reiterated that it would not start to raise rates at least until the unemployment rate fell to 6.5 per cent, as long as inflation did not threaten to go above 2.5 per cent. The US jobless rate in August was 7.3 per cent.

Most policymakers, 12 out of 17, projected the first rate hike would not come until 2015, even though the forecasts suggested they could hit their threshold for considering a rate rise next year.

Following the unexpected decision, market participants pushed back their projections for the first rate hike by several months, to late January 2015, based on prices of interest rate contracts traded at the Chicago Board of Trade.

(Additional reporting by Jonathan Spicer and Jennnifer Ablan in New York, Jason Lange in Washington and Ann Saphir in San Francisco)

© Copyright 2024 Reuters Limited. All rights reserved. Republication or redistribution of Reuters content, including by framing or similar means, is expressly prohibited without the prior written consent of Reuters. Reuters shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.