| « Back to article | Print this article |

RBI steps to curb Re volatility, not to impact interest rate: FM

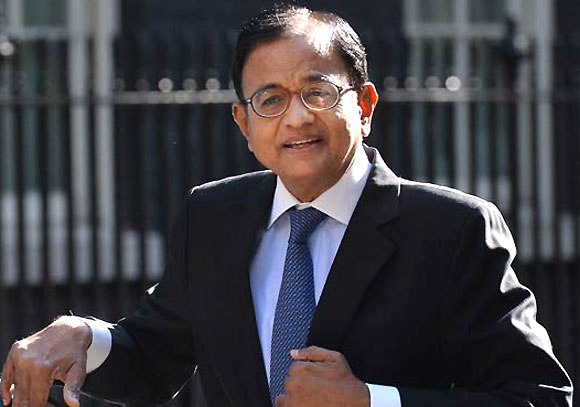

Asserting that rupee price will be market determined, Finance Minister P Chidambaram on Tuesday said Monday's measures by the Reserve Bank have nothing to do with the upcoming monetary policy review and may not impact interest rates of banks.

RBI's measures, he said, were aimed at checking excessive volatility and speculation in the forex market.

"These measures (RBI decisions) should not be read as prelude to any policy rate changes. This has nothing to do with upcoming policy review of RBI...I don't expect banks to increase interest rates as a result of yesterday's measures," Chidambaram said at a press conference.

Click on NEXT for more...

RBI steps to curb Re volatility, not to impact interest rate: FM

RBI on Monday announced a slew of measures like raising cost of borrowing by banks by 2 per cent to 10.25 per cent and announcing sale of bonds worth Rs 12,000 crore (Rs 120 billion) through open market operations to suck liquidity to check rupee slid, which had earlier in the month touched a all low of 61.21 to a dollar.

"Measures are taken to curb excessive speculation and reduce volatility and stabilise the rupee," Chidambaram added.

The value of rupee, he said, will depend upon "how much foreign exchange we earn and how much foreign exchange we spend".

Admitting that there will be some depreciation of rupee in view of high current account deficit and inflation, Chidambaram said the value of domestic currency will be market determined and it will find its price.

"We know that in forex market sometimes there is excessive speculation. Excessive speculation leads to volatility in market. So what any central bank or RBI and government can do or should do is ensure that volatility is reduced...and there is not too much speculation in forex market", the minister said.

Click on NEXT for more...

RBI steps to curb Re volatility, not to impact interest rate: FM

Chidambaram was in Jaipur to address media along with Health Minister Ghulam Nabi Azad as head of the Group of Ministers (GoM) on media.

The initiatives announced by the RBI, he elaborated, were "intended to quell excessive speculation in forex market and to reduce volatility in forex market. These measures should not be read as a prelude to any policy rate changes. This has nothing to do with policy rate changes".

RBI is scheduled to announce first quarter monetary review on July 30 amid demand from industry to cut interest rates to boost sagging growth.

Chidambaram said the measures were taken by the RBI in consultation with the government and "both are on board".

Click on NEXT for more...

RBI steps to curb Re volatility, not to impact interest rate: FM

Ruling out the possibility of ban on import of gold, the minister appealed to the people to reduce consumption of the precious metal which was costing nation $50 billion in foreign exchange.

Referring to growth, Chidambaram stressed that the measures taken by the RBI "will in no way affect our commitment to growth. We must increase credit delivery and must stimulate growth".

In the current fiscal, he said, growth rate would be over 6 per cent, higher than 5 per cent recorded in 2012-13.

"This year, by all estimates, it (growth rate) will be 6 per cent or slightly above. This is not satisfactory level of growth..."he said, attributing the moderate increase in growth to slowdown in advanced economies.