| « Back to article | Print this article |

Biggest deals in India: Diageo-United Spirits tops

Last updated on: November 9, 2012 18:30 IST

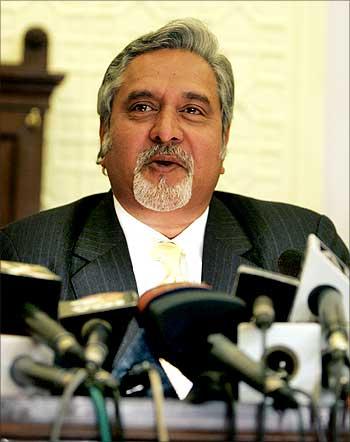

UK-based Diageo's acquisition of 53.4 per cent stake in Vijay Mallya-led United Spirits for Rs 11,166.5 crore ($2 billion) could be the biggest inbound M&A deal so far this year.Some of the major inbound deals - wherein a foreign company or its subsidiary had acquired an Indian entity - in the past, includes BP's $9 billion acquisition of Reliance Industries' oil & gas assets and the acquisition of Cairn India by NRI billionaire Anil Agarwal led-Vedanta Resources for over $8 billion.

Click NEXT to read more...

Biggest deals in India: Diageo-United Spirits tops

Last updated on: November 9, 2012 18:30 IST

The United Kingdom has been one of the top acquirers of Indian assets over the years as another most prominent inbound deal also involved a UK entity -- Vodafone Group. It acquired Essar's stake in Vodafone Essar for $5 billion.

Click NEXT to read more...

Biggest deals in India: Diageo-United Spirits tops

Last updated on: November 9, 2012 18:30 IST

Other key inbound transactions include Japanese drug major Daiichi Sankyo Company's acquisition of majority stake in Ranbaxy Laboratories Ltd for up to $4.6 billion and US-based Abbott's acquisition of Piramal Healthcare's domestic formulation business for $3.72 billion. Click NEXT to read more...

Biggest deals in India: Diageo-United Spirits tops

Last updated on: November 9, 2012 18:30 IST

Commenting on the deal Deloitte India Leader, Financial Advisory Avinash Gupta said, "This is most likely the largest inbound deal so far this year but it is not a trend and it does not signify that many more such inbound deals are likelyto happen. This is just a unique situation where a deal has happened." Click NEXT to read more...

Biggest deals in India: Diageo-United Spirits tops

Last updated on: November 9, 2012 18:30 IST

World's largest spirits maker Diageo Plc on Friday announced it will acquire 53.4 per cent stake in United Spirits for Rs 11,166.5 crore in a multi-structured deal, which may provide Vijay Mallya a breather from troubles emanating from thegrounded Kingfisher Airlines.