| « Back to article | Print this article |

Why govt showed the door to RBI Dy Governor

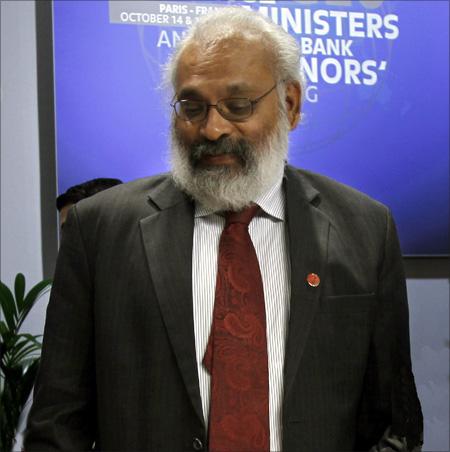

Subir Gokarn probably became the fall guy for resisting calls for interest rate cuts by the government and industry lobby groups, despite uncomfortably high inflation and/or for depreciation of rupee.

Being a central banker is a thankless job. This is especially true in developing economies, such as India, where the central bank is not legally independent.

This shortcoming makes the bank vulnerable to government interference at multiple levels, including the formulation of monetary policy.

The finance ministry's recent decision not to extend Subir Gokarn's three-year term as the Reserve Bank of India's deputy governor, which ended recently, is a good example.

The handling of the case also highlights the numerous gaps that exist in understanding India's macro challenges and policy making, and our inability to - or insecurity about - responding adequately to market-driven signals across various indicators.

A common fixture through the various gaps is a government with its head in the sand.

Technically, the government is within its rights to not extend Mr Gokarn's term after it ended. But that is not the issue.

The real issue is why, especially since a second term typically comes through in order to maintain continuity. Also, RBI Governor D Subbarao reportedly favoured an extension for his deputy.

But there is no clarity on the reasons for the government's action. Disappointingly, while newspapers and wire services widely reported on the decision, an overwhelming majority felt it was not important to raise an eyebrow. So much for India's free and fair press.

It is an unpleasant fact in countries where the central bank is not legally independent that any serious difference of opinion on monetary policy will, more often than not, result in the central bank compromising.

This often leads to sub-optimal outcomes since the government's political objectives may not match the economic objectives of an apolitical central bank.

Click NEXT to read more...

Why govt showed the door to RBI Dy Governor

The RBI is not legally independent, but selective independence is often conveyed by the personalities of the governor and his deputy governors.

Perhaps Mr Gokarn became the fall guy for resisting calls for interest rate cuts by the government and industry lobby groups, despite uncomfortably high inflation and/or for the handling of the rupee.

Under him, monetary policy guidance explicitly - correctly, in my view - identified the pressing need for fiscal correction to regain macro stability and to contain inflation.

The irony of his unfair fall is that the government, struggling for credibility and whose actions limited the degree of freedom of the RBI in dealing with massive rupee depreciation and stubbornly high inflation, decided who should pay the price.

It goes without saying that the government would have been far less responsive with its constructive measures since last September had it not been for the palpable public pressure from some sovereign credit rating agencies, the RBI and the several economists.

Finance Minister P Chidambaram and his predecessor, Pranab Mukherjee, publicly demanded interest rate cuts from the RBI despite consumer price inflation being off the charts.

Interestingly, Mr Mukherjee was promoted to become India's president despite the damage caused to the economy and investor confidence during his term as finance minister.

Depending on who you talk to, the RBI is criticised either for raising interest rates too much or for not raising them sufficiently. It cannot be guilty of both accusations.

Among Asian economies, India's inflation has the most complicated drivers and these cannot be fixed by monetary policy alone. It requires government actions that have been conspicuous by their absence.

Click NEXT to read more...

Why govt showed the door to RBI Dy Governor

The RBI cannot be absolved of its responsibility to deliver low inflation, but the complete story of failure has a significant role played by the government. Even the rupee debacle has the government's policy inconsistency as the key factor behind it.

There was no magic wand with the RBI for a quick fix to deal with an overvalued rupee that was a by-product of the government's own goals.

Differences of opinion are common in economic policy making and observers on the outside can have a different viewpoint from policy makers, and these views are revised often.

But there are no second chances in real-life economic policy making. Consequently, in hindsight, every policy maker can perhaps improve upon the initial policy response.

But the twist in India's macro management in recent years has been the government's policy incoherence and fiscal laxity - meaningful factors in crippling India's growth story and which made things difficult for the RBI's fight against inflation.

In some ways, the government's decision not to extend Mr Gokarn's term appears to be a censure of Governor Subbarao. His second term ends in September this year, so he could not be shown the door before without rattling investors.

Perhaps it was unfortunate that Mr Gokarn's term ended when it did; it appears to have made him an easy side target. After all, the current government has not been shy of messing around with institutions - the RBI is just the latest addition to that list.

Strangely, Mr Gokarn's successor, Urjit Patel, a level-headed economist who has wide-ranging public and private sector experience, has been given only a two-year term compared to the typical three-year term.

There will be a new RBI governor in September this year, and (hopefully) by next year we'll have a new government that is, finally, for the people and for the good of the people.

Click NEXT to read more...

Why govt showed the door to RBI Dy Governor

The government should revisit its opaque search criterion and the practice of appointing RBI governors and deputy governors for two to three years and then considering extensions (former RBI Governor Y V Reddy was an exception: he came in on a five-year term under a different government).

This practice might work in favour of the government (principally, the finance ministry) in keeping a tight leash on the RBI personnel so that they don't get too independent especially if that becomes counter to political goals, which are often myopic and self-serving.

But two to three years do not even qualify as half a business cycle. The initial appointments should be at least five to seven years, to offer stability and familiarity.

The last thing India needs is an RBI that caters to the government's whims. But there certainly is a price to be paid by the RBI personnel for disagreeing with the government to do the right thing.

This is hardly the recipe for enhancing the credibility of the RBI and boosting investor confidence, which is often used as a vacuum cleaner by the government.

It is worth asking how Governor Subbarao can undertake appropriate monetary policy for the economy (rather than for politicians) without the government's sign-off when he cannot even get the deputy he wants.

For all practical purposes, he has been reduced to being a sideshow for the remainder of his term. It remains to be seen if he, like a "good" bureaucrat, will silently accept the censure or salvage his legacy by standing up for the institution he represents.

The writer is senior economist at CLSA, Singapore. These views are personal.