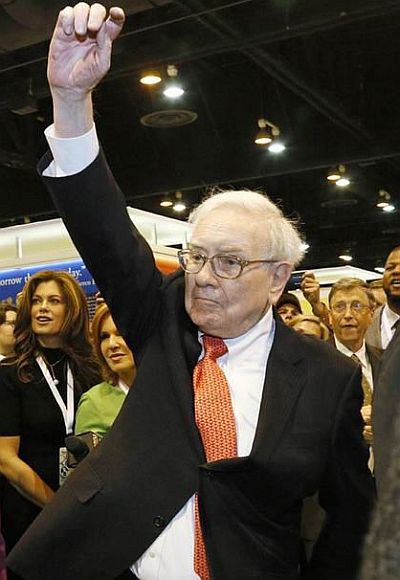

Photographs: Rick Wilking/Reuters Christopher Swann New York

With some $44 billion in cash on Berkshire's balance sheet , and 10-year Treasuries yielding just 2 per cent, Buffett is under pressure to put money to work.

Warren Buffett needs luck for his Las Vegas gamble to pay off. Berkshire Hathaway's $5.6 billion bet on NV Energy suggests the billionaire investor is coming up short on decent ways to deploy his cash.

With electrical utility mergers offering meagre synergies thanks to the pounds of flesh demanded by regulators, Berkshire will struggle even to cover its cost of capital.

True, the Nevada power company Buffett has just purchased is a steady cash cow. Earnings before interest and tax have rebounded a healthy 65 per cent since the gloom of 2008 to around $785 million in 2012.

...

Warren Buffett needs luck for Las Vegas gamble to pay off

Photographs: Rick Wilking/Reuters

The deal will also extend the geographical spread of Berkshire's MidAmerican Energy. In addition, NV has a strong base of solar production, which MidAmerican has used to generate strong returns in the past.

Yet barring an unexpected boom in the Nevada economy, the growth outlook for NV is bland. Operating profit is forecast to remain almost flat as far out as 2016, according to estimates compiled by Thomson Reuters. And Berkshire seems to expect only trivial synergies.

Merging utilities are often falsely modest about cost savings - fearing that regulators will demand they pass gains onto consumers in the form of cheaper electricity. In this case, with only modest overlap in operations, the humility appears justified.

While Duke Energy aimed for synergies of around 6 percent of revenue through its $13.7 billion purchase of Progress Energy in 2011, MidAmerican would be lucky to get 3 per cent.

...

Warren Buffett needs luck for Las Vegas gamble to pay off

Photographs: Rick Wilking/Reuters

Even this upbeat assumption would translate into just around $90 million of savings on forecast revenue of $3 billion in 2013.

Taxed at around 34 per cent, that would deliver a return on the acquisition of just 6 per cent - below the roughly 9 per cent cost of capital that Buffett would normally aim to clear.

MidAmerican could pile on debt to boost equity returns. The company has been deleveraging in recent years, trimming long-term debt from $5.3 billion to $4.7 billion since 2008 as well as adding over $200 million to cash. That leaves room for more borrowing.

But even with a little capital structure hocus-pocus, it's hard to see the deal vaulting MidAmerican's cost of capital.

With some $44 billion in cash on Berkshire's balance sheet, and 10-year Treasuries yielding just 2 per cent, Buffett is under pressure to put money to work. This deal just shows how big a challenge that is, even for investment sages.

The author is a Reuters Breakingviews columnist. The opinions expressed are his own.

article