Photographs: Reuters. Devangshu Datta

The possibility that high-frequency trading with its emphasis on speed and high volume could trigger some sort of systems failure has been recognised for months.

It happened on Friday and an instantaneous blip momentarily wiped out the gains of the entire year. The market recovered after a 15-minute halt but by then margin traders must have been on the verge of suicide.

A flash crash like this one, or worse, could happen again. And given the growing volumes of high-frequency trading, it is, in fact, bound to occur again. Sooner or later, somebody else will key in an absurd sequence of trades, which will be accepted by the system.

Something like a mandatory delay mechanism and/or manual confirmation for trades that are a certain percentage above or below the current price could make another flash crash a little less likely to happen.

...

The markets need a speed breaker

Photographs: Reuters.

Game players have long known that the simple act of waiting can have powerful positive consequences: it forces people to calm down and think rationally.

The great chess player Emmanuel Lasker once advised: "When you see a good move, don't play it. Sit on your hands. You might find a better one." Tournament bridge employs a mechanism known as a "stop-card" during auctions. When somebody displays a placard saying "stop!" it signifies that his next bid will be unusual and imposes a mandatory waiting period.

There could be a lesson here for financial regulators who might want to think of ways in which to incorporate waiting periods into trading mechanisms under certain circumstances.

The structural mechanics of financial trading normally rewards those who are faster on the trigger. But sometimes, speed can cause disastrous systemic consequences.

The only waits in the system consist of circuit filters and those are blunt instruments that can only be deployed post-facto.

...

The markets need a speed breaker

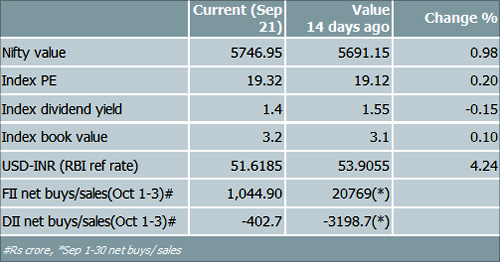

Flash crash apart, the market continued to do well through the week. It tested resistance around the Nifty 5800 levels and it finished comfortably in the black.

The government continued to send out positive policy signals with the raising of foreign direct investment (FDI) limits in insurance and the mood remained positive.

The dichotomy between foreign institutional investor (FII) and domestic institutional investor (DII) attitudes remains; FIIs continued to buy, while DIIs continued to sell into the rally.

Eventually, these changes will bring in more investments but it remains to be seen how much of the new measures will survive the winter session of Parliament unaltered. It will certainly make little difference on the ground in the next three to six months.

...

The markets need a speed breaker

Photographs: Reuters.

From this week onwards, the focus will be on Q2, 2012-13 results and projections and advisories for the rest of the fiscal. Nobody is expecting an extraordinary pick-up in Q2, so, poor results may be already discounted.

If advisories show signs of returning business confidence, the market could move up further.

The Reserve Bank of India's (RBI's) stance in its next credit policy could be crucial for animal spirits.

A rate cut now could energise personal consumption during the upcoming festive season and if it's passed on quickly, it could also help revive corporate investment plans. It's an open question however, if the central bank will actually cut.

Overseas, there are some situations that are worth watching.

...

The markets need a speed breaker

Europe will evolve slowly unless it's affected by external events. But the face-off between China and Japan could escalate in unpredictable ways with huge consequences for global trade.

As the US elections draw closer, Israel will also increase its attempts to get the US to pressure Iran or to take military action. And, of course, every twitch in the US opinion polls will be watched with bated breath.

All of the above will cause their own share of global financial volatility. One worst-case scenario would be a shooting war between China and Japan over those barren rocks.

Another worst-case scenario would be military action against Iran. Either of those events would cause market crashes. My best guess is that neither will happen. But we could come close and brinkmanship in itself might create volatility.

...

The markets need a speed breaker

Europe on its own will either see slow decline or slow recovery but it would be badly affected if the China-Japan conflict did escalate or Iran blew up.

Technically speaking, analysis is difficult at the moment. News-based events that may or may not occur have unpredictable consequences on pricelines.

The flash crash has caused a blip that makes normal analysis suspect. Plus, the Q2 results will naturally affect specific stocks and industries.

The market did gain through last week and it did have the strength to recover most of its losses after the crash. It has reasonable volumes. Positive RBI action could be a powerful factor. I'd tend to stay cautiously bullish.

...

The markets need a speed breaker

Photographs: Reuters.

The bounce-back in the rupee is one trend that seems worth following. Another good month of FII buying could take the USD below 50 and that would have a powerful psychological impact.

At the same time, there are huge technical resistances between 51 and 52 and a reversal to 53 could occur in a two-session trend.

The manner in which the Kingfisher situation is dealt with could also have interesting behavioural repercussions.

Here we have a company drowning in debt and hitting a point where it cannot safely sustain operations.

...

The markets need a speed breaker

Photographs: Reuters.

Shutting it down would set precedents for dealing with Air India, which has an even worse balance sheet.

Taking Kingfisher Airlines out of the equation should do interesting things to the share prices of other operators.

The market has room to advance till around the 5900-5950 levels in the next fortnight. It could also fall till 5500, ignoring the black swan possibility of flash crashes or escalations in the China-Japan situation or in Iran-Israel.

The guarantee of global brinkmanship might offer shorting opportunities or chances to enter at lower levels.

article