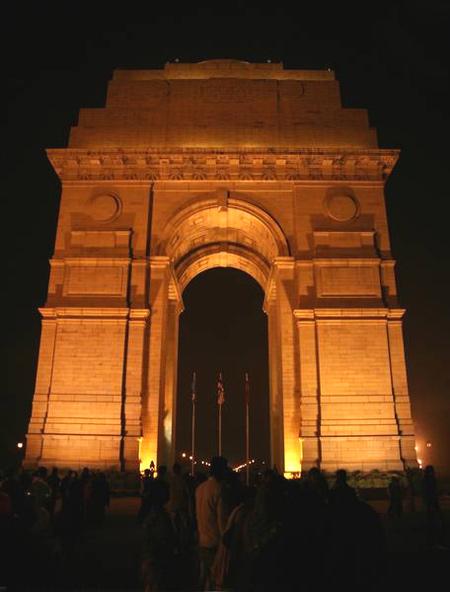

Photographs: Courtesy, Delhi Tourism.

While much attention has been devoted to interest rates and industrial revival, the bigger problem for the economy could be its external vulnerability, says T N Ninan.

This is especially after it became known last week that the current account deficit (on trade in goods and services) had soared to 5.4 per cent of GDP in the July-September quarter. That compared with a deficit of 4.2 per cent for all of last year, and 2.6 per cent the year before (2010-11).

The projection for this year, of 3.6 per cent, will almost certainly have to be raised, whereas the 12th Plan numbers are based on the opposite assumption - that the current account deficit will drop substantially.

The current account deficit so far this year has been fully funded by capital inflows: fresh foreign investment (direct and portfolio), companies borrowing more abroad, banks getting more deposits from non-resident Indians, and short-term loans.

...

The big problem Indian economy faces

Photographs: Reuters.

While equity inflows are fine, the total external debt has climbed. Foreign exchange reserves now cover only 80 per cent of the debt, whereas three years ago (in March 2010) the cover was over 110 per cent.

Since then, external debt has climbed by 40 per cent, to $365 billion, while the reserves have remained virtually unchanged.

We are not at crisis sta#8805 the external debt-to-GDP ratio is still quite modest, at under 20 per cent (it was close to 40 per cent in 1991), and the cost of servicing the debt is also manageable.

But if exports remain a lagging sector (remember that world markets are far from buoyant), and the current account deficit remains high through the next financial year, something will start to give.

...

The big problem Indian economy faces

Photographs: Reuters.

If the debt were to climb to around $450 billion, while the reserves stay where they are, the ratios will start to look dodgy.

Portfolio investors might then get skittish about the rupee holding its value, and the rating agencies may get back to thinking about downgrading India.

There is the school of thought that argues that none of this should be a problem. The world is awash with liquidity, interest rates are close to zero in the major markets, and borrowing at this time to keep the economy going is therefore a low-cost, low-risk opportunity to take advantage of global liquidity.

...

The big problem Indian economy faces

Photographs: Reuters.

This is fine on a short- to medium-term view, and if the money is used for investment that builds economic capacity. If not, what happens when the music stops, ie interest rates climb in the developed markets?

Some experts forecast that this is unlikely for the next decade at least, which is a long enough time to get the domestic economy into shape.

But if things go wrong, then we could be looking at a crisis much worse than what faced the country in 1991. Recall the havoc wrought on East Asian economies and societies in 1997.

...

The big problem Indian economy faces

Photographs: Reuters.

Indeed, if the country gets used to living on cheap external credit, it might be tempted to postpone the reform steps that are required to get the trade account into balance.

The difficult business of fiscal correction may not be pressed with, and the lack of competitiveness of the tradable sector (essentially manufacturing) will not be addressed.

Those two would guarantee a crisis further down the road. If policy makers are cautious, they will focus on getting the domestic house in order quickly.

article