M R Venkatesh

Most pink papers have missed it. Most news portals (barring Rediff) have failed to cognize the importance of the news item. News Channels with their fixation with Salman Rushdie have failed to capture the significance of the event as it unfolded.

According to a report carried by an Israeli news website DEBKAfile, India has decided to pay Iran in gold - yes gold - for the oil it purchases.

As countries led by US are contemplating sanctions against Iran, this move to trade gold for oil by India has stumped geo-political observers.

India, after all, is never known to initiate any dramatic moves in the world of geo-politics or global finance.

Click on NEXT for more...

Iranian crude for gold - Beginning of the end of dollar?

Press reports had originally indicated that India may prefer to pay in Japanese yen or even in rupees for the Iranian Oil.

This was when an Indian delegation visited Tehran recently to discuss payment modalities in light of the proposed US sanctions. Naturally, this repositioning by India has set the cat amongst the pigeons.

It may be noted that while the proposed sanctions (though not backed by the UN) have a calculated effect of ostracizing Iran, it has an equally debilitating impact on other economies too.

Accordingly, any bank dealing with Iranians would be banned from transacting with American and European financial institutions.

It is given this paradigm that the Indian proposal to pay for gold for the Iranian crude assumes importance.

Click on NEXT for more...

Iranian crude for gold - Beginning of the end of dollar?

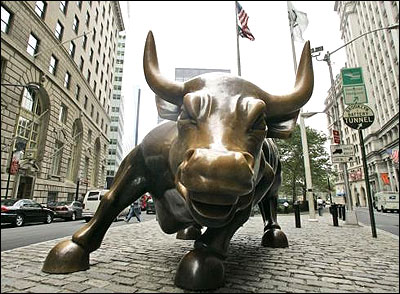

Photographs: Reuters

Non-dollar denominated oil trade - the new WMD?

To understand the implication of what has been stated above it is essential to understand the dynamics of oil trade.

What is bizarre to note here is that in spite of the fact that crude is produced by mostly in Middle East; officially it can be purchased in dollar terms only and that too from one of the two oil exchanges situated in New York or London.

Therefore, a potentially destabilising development for the dollar was reported as early as in mid-2004 announcing Iran's intentions to create an Iranian Oil Bourse as a competition to these two oil exchanges located on either side of the Atlantic.

Click on NEXT for more...

Iranian crude for gold - Beginning of the end of dollar?

Photographs: Reuters

The macroeconomic implications of successful Iranian Bourse selling oil denominated in non-dollar terms are in fact profound for the world of finance.

If Iran switches to the non-dollar terms for its oil payments from its buyers, it would usher in a new oil price that would well be denominated in euro, yen or for that matter, the INR (Indian rupee).

The domino effects of these proposals of an Iranian Oil exchange are unfathomable even after eight years.

While one is not sure the impact such a development would have on economics of Middle East, one can be near certain that if Iran's bourse becomes a successful alternative for oil trade, it would explicitly challenge the hegemony currently enjoyed by the existing two exchanges and implicitly, the USD.

Click on NEXT for more...

Iranian crude for gold - Beginning of the end of dollar?

Photographs: Reuters

This clearly explains the repeated American paranoia of Iran and accusing it of having WMD (weapons of mass destruction).

Put pithily, oil trade denominated in non-dollar terms and not nuclear weapon program are the weapons of mass destructions as far as the Americans are concerned. Why?

The reasons for the same are obvious. Given the fact that oil trade is denominated in dollars, it is pertinent to note that had Iran effectuated its threat to establish an Oil Exchange and commence oil trade in non-dollar terms, the dollar would come under tremendous selling pressure.

As a bargaining chip, it may be noted then, that the US had then allowed putting the matters relating to the WMD in the cold storage, as Iranians too, as a quid pro quo measure postponed their decision to commence this new oil exchange or trade their oil in non-dollar terms.

Click on NEXT for more...

Iranian crude for gold - Beginning of the end of dollar?

Photographs: Kind courtesy, Deesillustration.com

It would take no seer to say that the collapse of the dollar could well occur when even a small fraction of the existing traders exit the oil trade being denominated in dollars.

Given the state of affairs of the American economy, it could well be akin to the proverbial straw on the camel's back.

The late Iraqi leader Saddam Hussein was fully aware of this paradigm even a decade back.

He sought to exploit the inherent weakness of the present arrangement in the global financial architecture.

More particularly he understood the link between oil trade and dollars which in effect sustains the value of the dollar.

Consequently, Saddam sought to trade his crude in euros, which would have led to a lower demand for the USD and thereby trigger a dollar collapse. And that was his WMD!

Click on NEXT for more...

Iranian crude for gold - Beginning of the end of dollar?

Then Iraq, now Iran?

Taking a dim view of the events leading to the invasion of Iraq, William Clark from the Centre on Research on Globalisation states, "It is now obvious the invasion of Iraq had less to do with any threat from Saddam's long-gone WMD program and certainly less to do to do with fighting International terrorism than it has to do with gaining control over Iraq's hydrocarbon reserves and in doing so maintaining the US dollar as the monopoly currency for the critical international oil market."

He further adds, "Throughout 2004 statements by former administration insiders revealed that the Bush/Cheney administration entered into office with the intention of toppling Saddam Hussein.

Indeed, the neo-conservative strategy of installing a pro-US government in Baghdad along with multiple US military bases was partly designed to thwart further momentum within OPEC towards a petroeuro."

Surely, never in the history of mankind has an army supported a currency as much as the American army has done for the dollar!

Click on NEXT for more...

Iranian crude for gold - Beginning of the end of dollar?

Naturally, the proposed move by India, if effectuated, will have other unintended consequences: it will bring down the value of dollar and increase the value of gold - in short, dynamite the world of global finance and destabilise global economies. No wonder even this has incensed the Americans.

More to the point, press reports suggests that the Chinese have also shown their willingness to play ball with the Indians on this matter.

While it may be too early to predict the arrival of India-China-Iran axis, it is likely scenario that the world is increasingly facing in the immediate future.

Fascinatingly, analysts have already begun placing bets on a decisive American intervention in Iran based on these earth-shattering developments in the world of finance.

It is quite possible that the Arab world (as are some in India) is silently rejoicing the very idea of India (and possibly China Joining hands) dynamiting the extant global financial architecture where the dollar is enjoying even to this day the status of global currency.

Nevertheless, there is flip side to this arrangement – gold cannot be a permanent substitute for US dollar. Gold, after all is finite.

Consequently, limitations on availability of gold will translate into limitations on the world of trade. That will in turn choke global economy.

Click on NEXT for more...

Iranian crude for gold - Beginning of the end of dollar?

Photographs: Kind courtesy, Jafrianews.com

The only way out is by countries their Forex holding in diverse currencies and use those currencies for their bilateral trade.

For instance, the Iranians may sell their crude to India for yen, yuan, or the INR. In turn using the same, the Iranians may buy our wheat.

All this possibly signals the end of the dollar domination in the world of finance. As more countries worm their way to fight the sanctions imposed by the US, they may have to jettison the dollar. That in will result in fall in the value of the dollar!

And should the dollar fall, some of them may well have to face its debilitating consequences. After all several countries have billions of dollars worth of forex reserves, denominated in dollars.

China for instance is reported to have approximately fifty per cent of its 3 trillion forex reserves denominated in dollars.

Consequently, countries across continents are caught in a serious dilemma - should they not intervene, the collapse of the USD is imminent, and should they continue to intervene in the forex market to keep the value of their currency down, they would be a loser as the present arrangement has self-contained seeds of destruction.

Click on NEXT for more...

Iranian crude for gold - Beginning of the end of dollar?

Photographs: Kind courtesy, Jafrianews.com

While everyone is conscious of this fact and prefers to postpone the inevitable, no one (India included) may want to bite the bullet as yet.

It is apparent that all these countries would benefit if all of them would continue to hold USD, but paradoxically each of them has an incentive too to sell their holdings first.

The central bank of a country which sells before a potential currency holocaust could be the ultimate winner.

But even that would be a huge risk and a costly exercise for that central bank, its currency and its national economy. And that is a considerable deterrent.

The very idea of India trading gold for crude demonstrates that the world of finance is fast running out of choices.

Whatever be it, the Iran-American conflict may be well be fought, not in Hormuz strait, but across the financial capital of the world. And that is frightening.

The author is a Chennai based Chartered Accountant. He can be contacted at mrv@mrv.net.in

article