| « Back to article | Print this article |

How to rewrite India's growth story

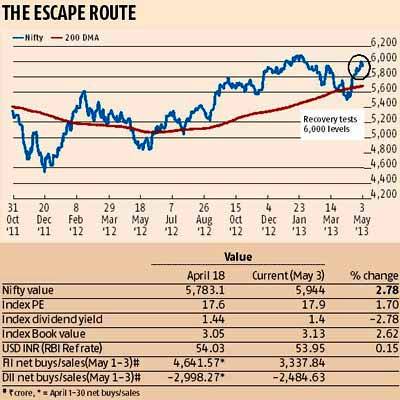

A bull run looks possible only if the Nifty breaks out above 6,111 -- and that's some distance away, notes Devangshu Datta

In the last two weeks, various institutions have released estimates for gross domestic product growth in 2013-14.

The projections are mostly distributed in a range between 5.7 per cent and 6.7 per cent.

The Reserve Bank of India guesses it will be about 5.7 per cent.

The International Monetary Fund projects it will be a little more with calendar 2013 registering 5.7 per cent and calendar 2014 improving to 6.2 per cent.

The World Bank and Moody's concur in equivalent guesses of about six per cent.

The finance ministry has suggested a range of somewhere between 6.1 per cent and 6.7 per cent, while the Prime Minister's Economic Advisory Council pegs growth at 6.4 per cent.

Click NEXT to read further. . .

How to rewrite India's growth story

Presumably, the underlying assumptions and the models used in all these estimates are different.

But PMEAC and the finance ministry have a record of consistent overestimation.

So the cynical would suggest growth will be less than 6.1 per cent, which is the lower bound of the finance ministry estimate.

The estimates by Citi, Morgan Stanley and HSBC are all also in the 5.7 to six per cent zone.

So that range is probably the conservative consensus.

Even this would be a modest to reasonable improvement over 2012-13 and signal a turnaround in trend after lower growth for many quarters in succession.

Click NEXT to read further. . .

How to rewrite India's growth story

Thus far, what we've seen of the fourth quarter of 2012-13 corporate results and macroeconomic numbers suggests that growth did see an uptick over the abysmal 4.5 per cent registered in the third quarter, 2012-13.

However, corporate profitability grew considerably faster than turnover in Q4.

Growth would have to strengthen considerably to achieve six per cent levels.

It would presumably have to be driven by higher consumption since there is unlikely to see a massive surge in investments in election year.

Higher consumption could indeed arrive on the back of falling interest rates and also be driven by election campaign spends.

Click NEXT to read further. . .

How to rewrite India's growth story

The RBI issued a fairly gloomy forecast in its monetary policy statement last Friday.

But it did cut the repurchase rate by 25 basis points.

In fact, the central bank started cutting rates as long ago as May 2012.

Despite the hawkish language it continues to employ, the actions indicate that it could loosen through this entire fiscal.

That has useful implications if it is true.

Campaign spending across multiple assembly elections and the Lok Sabha should also provide some sort of boost.

A general election means something over Rs 12,000 crore (Rs 120 billion) will be spent by various parties.

Click NEXT to read further. . .

How to rewrite India's growth story

A lot of that funding may consist of bagfuls of cash paid under the table. But whatever the provenance, it is still money in people's pockets.

Politics is liable to dominate the discourse until the next Lok Sabha is formed and the next government takes its oaths, at the very least.

The Saradha scam, Coalgate, Bansal's nephew, et al and the negative fallout from those events are more likely to influence investors than corporate earnings.

Even ostensibly economic decisions, such as gas pricing and coal pooling, will also be driven by political considerations and of course, legislation is likely to be stalled owing to Parliament being more or less non-functional.

Click NEXT to read further. . .

How to rewrite India's growth story

Big-ticket investments are likely to remain on hold until there is a new government and that government, whatever it is, looks reasonably stable.

Strains and stresses in the Indo-Chinese relationship and of course, the tense Indo-Pakistani relationship could also spook investors.

In contrast, the global scenario is looking somewhat easier.

North Korea hasn't attacked anybody despite its bellicose propaganda.

Crude prices have fallen.

Global markets may have discounted slower Chinese growth and been pleasantly surprised by strong US jobs data.

Click NEXT to read further. . .

How to rewrite India's growth story

Italy now has a government of sorts, and the European Union has survived Cyprus. Japan, thus far, is aggressively following through on its quantitative easing.

Indian exports rebounded in March to a 13-month high of $30 billion, even though the full year 2012-13 saw a drop of almost two per cent.

Given all this, the current account deficit is likely to reduce a fair amount and the fuel subsidy burden will also ease down.

The stock markets have made a fairly promising recovery.

After bottoming out at Nifty 5,477 on April 10, they tested 6,000-plus in early May.

The foreign institutional investors have reverted to being net equity buyers in the past two weeks although domestic institutions have remained net sellers.

Volumes are low however, and tending to the stock-specific.

Click NEXT to read further. . .

How to rewrite India's growth story

If the uptrend holds, banking and financials in general should do well owing to the falling rate regime.

Metals -- both ferrous and non-ferrous -- may be set for a rebound on the back of stronger US recovery.

If the crude rates stay low, public sector refiners as well as ONGC and Oil India should see a positive revaluation.

Auto stocks have also moved up with the promise of rate cuts outweighing lower April sales.

Real estate has seen some speculative buying, which will evaporate if there isn't a cut in mortgage rates.

Bharti Airtel delivered terrible results but the Qatar deal has kept the stock afloat. Reliance Communication has seen a fantastic turnaround, and so has Idea.

Click NEXT to read further. . .

How to rewrite India's growth story

So, despite the issues plaguing the telecom sector, stocks here could be worth watching.

Technically speaking, it's difficult to characterise the long-term trend.

A big bull market would only be confirmed if there was a breakout above 6,111, which was the 2013 high, registered in late January.

That is 150-odd points away and the Nifty has been unable to beat resistance above 6,020. Short-term corrections should find support above 5,850 and intermediate sell-offs should find support above 5,700, where the 200-Day Moving Average is now trending.

Results are still coming in and it will be interesting to see what the market makes of the next set.