| « Back to article | Print this article |

After markets rally, BJP to face key investor tests

The BSE Sensex on Friday surged more than 6 percent to record highs while the rupee strengthened to an 11-month high against the dollar as the opposition Bharatiya Janata Party and its allies were set to sweep the country's elections with a clear majority.

Domestic-focused shares such as ICICI Bank Ltd and Ambuja Cements Ltd soared, reflecting hopes the BJP and its National Democratic Alliance are best placed to revive an economy growing at its slowest in a decade.

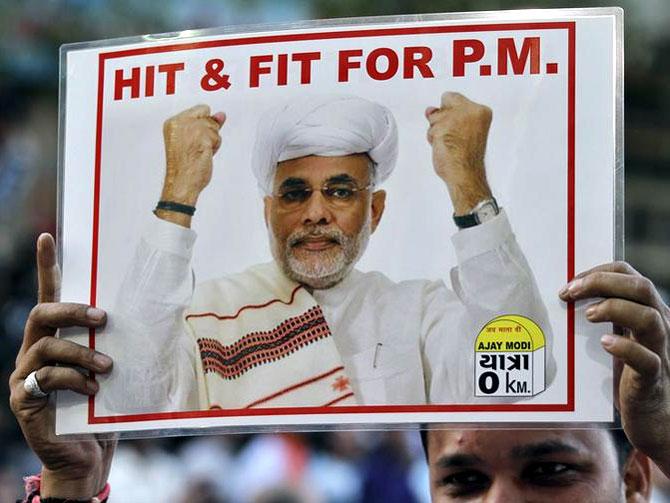

But analysts caution a series of key tests now loom for the new government that will likely be led by Narendra Modi, including most immediately, the selection of a cabinet.

Other critical areas for investors include the new government's relationship with a central bank focused on inflation and the need to deliver a budget that can reassure markets and credit agencies about the fiscal deficit.

(Reporting by Mumbai Markets Team; Writing by Rafael Nam)

Click NEXT to read more…

After markets rally, BJP to face key investor tests

"The to-do list is long and the ball is in the incoming government's court to walk the talk on reviving growth and addressing macro challenges," said Radhika Rao, an economist for DBS in Singapore.

"The new government is bound to face challenges on several fronts soon after taking office, foremost amongst which is the fiscal consolidation agenda."

The strong market gains come less than a year after the country was gripped by its worst currency crisis since the balance of payment crisis in 1991.

Although analysts credit measures taken by the ruling Congress party and the Reserve Bank of India for stabilising markets, gains have accelerated since the BJP named Modi as its prime minister candidate in mid-September.

As a result, India has gone from one of the most vulnerable emerging countries to one of the favourites among foreign investors: overseas funds have poured more than $16 billion into Indian stocks and bonds in the past six months.

Click NEXT to read more…

After markets rally, BJP to face key investor tests

The Sensex gained as much as much as 6.1 percent to a record high at 25,375,63 - a gain that makes it the third-best performer in Asia in dollar terms so far this year after Indonesia and Pakistan.

Gains have been driven by a surge in domestic-focused shares that investors say are primed to benefit from any recovery in the economy. ICICI Bank surged 9 percent while Ambuja Cements gained 6.5 percent.

Meanwhile the rupee strengthened to as much as 58.62 per dollar, its highest since late June 2013, marking a 17.5 percent gain since the record low hit in August.

The benchmark 10-year bond yield fell as much as 10 basis points to 8.68 percent, its lowest since Feb. 6.

Investors will now expect the BJP to deliver. Most immediately a Modi-led government is expected to soon name key cabinet posts such as the finance ministry, which is widely seen as going to Arun Jaitley, a senior BJP leader.

Click NEXT to read more…

After markets rally, BJP to face key investor tests

Meanwhile, as the BJP focuses on reviving growth, it will need to accommodate the Reserve Bank of India, whose Governor Raghuram Rajan has made fighting inflation a priority since taking the helm of the central bank in September.

The BJP will also need to deliver a budget that investors hope will be more realistic than the one unveiled by Congress party in February, which tips the fiscal deficit at 4.1 percent of gross domestic product for the year ending in March 2015.

"This is not an easy government to take over. Growth is still not there. You have a significant inflation to take care of. Interest rates cannot be brought down the next day. Revival of the investment cycle is not that easy," said Ajay Garg, managing director at Eqirus Capital in Mumbai.

© Copyright 2024 Reuters Limited. All rights reserved. Republication or redistribution of Reuters content, including by framing or similar means, is expressly prohibited without the prior written consent of Reuters. Reuters shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.